Region:Central and South America

Author(s):Shubham

Product Code:KRAA4709

Pages:85

Published On:September 2025

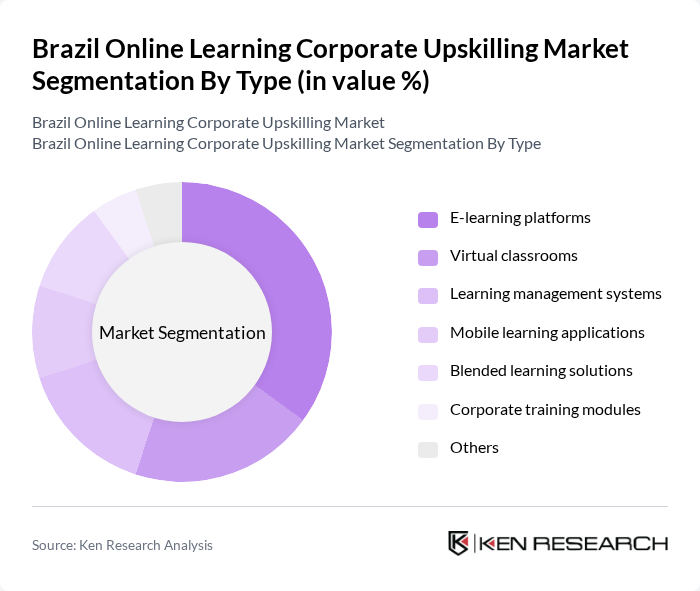

By Type:The market is segmented into various types, including E-learning platforms, Virtual classrooms, Learning management systems, Mobile learning applications, Blended learning solutions, Corporate training modules, and Others. Each of these sub-segments caters to different learning needs and preferences, with E-learning platforms being particularly popular due to their flexibility and accessibility.

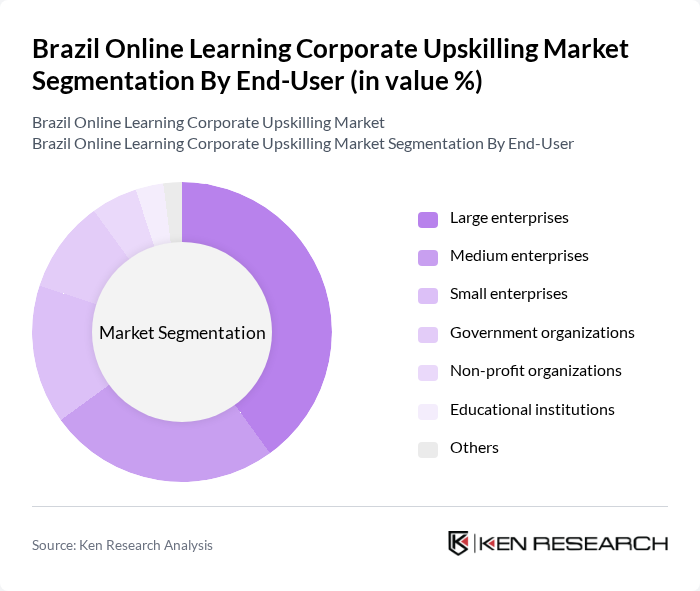

By End-User:The end-user segmentation includes Large enterprises, Medium enterprises, Small enterprises, Government organizations, Non-profit organizations, Educational institutions, and Others. Large enterprises dominate the market due to their substantial budgets for employee training and development, as well as their need for scalable learning solutions.

The Brazil Online Learning Corporate Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Udemy, Coursera, LinkedIn Learning, Skillshare, Pluralsight, edX, Alura, D2L Corporation, TalentLMS, Hotmart, Veduca, Escola Virtual, Senai, FGV Online, Sebrae contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's online learning corporate upskilling market appears promising, driven by technological advancements and a growing emphasis on employee development. As companies increasingly recognize the importance of continuous learning, investments in e-learning platforms are expected to rise. Additionally, the integration of AI and personalized learning experiences will enhance training effectiveness. However, addressing challenges such as internet accessibility and resistance to change will be crucial for maximizing the potential of online learning in the corporate sector.

| Segment | Sub-Segments |

|---|---|

| By Type | E-learning platforms Virtual classrooms Learning management systems Mobile learning applications Blended learning solutions Corporate training modules Others |

| By End-User | Large enterprises Medium enterprises Small enterprises Government organizations Non-profit organizations Educational institutions Others |

| By Industry | Information Technology Healthcare Finance Manufacturing Retail Telecommunications Others |

| By Learning Format | Synchronous learning Asynchronous learning Hybrid learning Self-paced learning Instructor-led training Others |

| By Delivery Mode | Online delivery Offline delivery Blended delivery Mobile delivery Others |

| By Certification Type | Professional certifications Skill-based certifications Compliance certifications Others |

| By Pricing Model | Subscription-based Pay-per-course Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | HR Managers, Learning & Development Directors |

| Employee Upskilling Initiatives | 100 | Training Coordinators, Program Managers |

| Online Learning Platform Utilization | 80 | IT Managers, E-learning Specialists |

| Industry-Specific Training Needs | 70 | Sector Analysts, Business Development Managers |

| Impact of Upskilling on Employee Performance | 90 | Performance Analysts, Employee Engagement Officers |

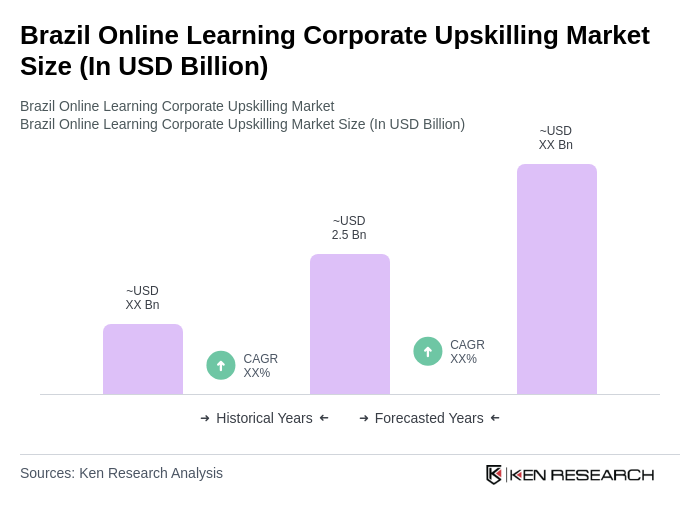

The Brazil Online Learning Corporate Upskilling Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by the demand for digital skills and the shift towards remote learning solutions, particularly accelerated by the COVID-19 pandemic.