Region:Central and South America

Author(s):Shubham

Product Code:KRAB4397

Pages:84

Published On:October 2025

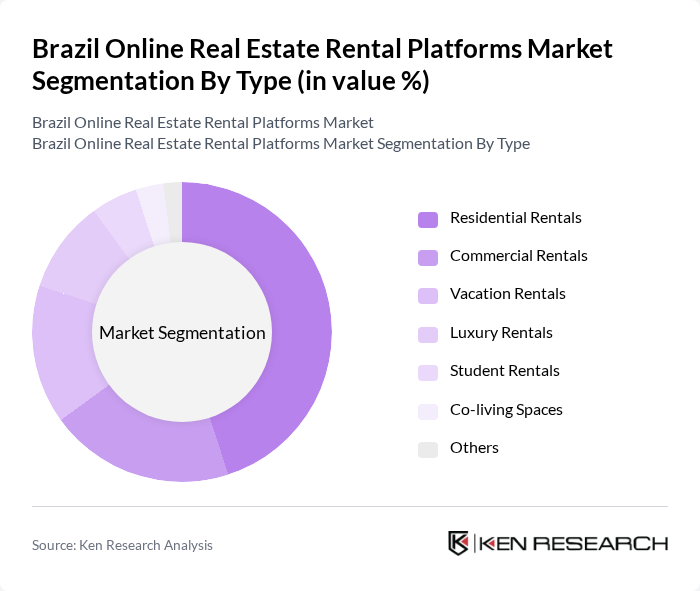

By Type:The market is segmented into various types, including Residential Rentals, Commercial Rentals, Vacation Rentals, Luxury Rentals, Student Rentals, Co-living Spaces, and Others. Among these, Residential Rentals dominate the market due to the high demand for housing solutions in urban areas. The trend towards urban living and the increasing number of young professionals seeking rental accommodations contribute significantly to this segment's growth.

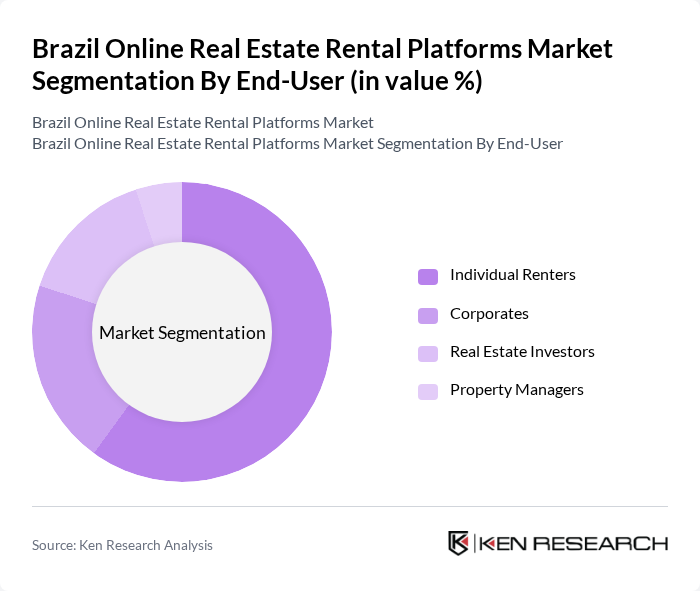

By End-User:The end-user segmentation includes Individual Renters, Corporates, Real Estate Investors, and Property Managers. Individual Renters represent the largest segment, driven by the increasing number of young professionals and families seeking flexible housing options. The trend towards remote work has also led to a rise in demand for rental properties that cater to diverse lifestyles.

The Brazil Online Real Estate Rental Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX Brasil, QuintoAndar, VivaReal, Imovelweb, Zap Imoveis, Airbnb, Booking.com, 123i, RentBrasil, Trovit, LAR Imoveis, Agente Imovel, Imovel Aki, AlugueTemporada, Homify contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's online real estate rental platforms appears promising, driven by ongoing urbanization and technological advancements. As more consumers embrace digital solutions, platforms that prioritize user experience and integrate innovative technologies will likely thrive. Additionally, the increasing demand for rental properties, particularly in urban areas, will create opportunities for growth. However, companies must navigate regulatory complexities and intense competition to capitalize on these trends effectively, ensuring sustainable development in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Rentals Commercial Rentals Vacation Rentals Luxury Rentals Student Rentals Co-living Spaces Others |

| By End-User | Individual Renters Corporates Real Estate Investors Property Managers |

| By Sales Channel | Direct Online Sales Third-Party Platforms Mobile Applications Real Estate Agencies |

| By Pricing Model | Fixed Pricing Dynamic Pricing Subscription-Based Pricing |

| By Geographic Presence | Major Cities Suburban Areas Rural Areas |

| By Property Type | Apartments Houses Commercial Spaces |

| By User Demographics | Age Groups Income Levels Family Size |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Rental Platforms | 150 | Property Managers, Landlords |

| Commercial Rental Platforms | 100 | Business Owners, Commercial Real Estate Agents |

| Tenant Experience Insights | 120 | Current Tenants, Prospective Renters |

| Market Trends Analysis | 80 | Real Estate Analysts, Market Researchers |

| Regulatory Impact Assessment | 70 | Legal Advisors, Policy Makers |

The Brazil Online Real Estate Rental Platforms Market is valued at approximately USD 5 billion, reflecting significant growth driven by urbanization, a rising middle class, and increased demand for rental properties, particularly in metropolitan areas.