Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB5123

Pages:89

Published On:October 2025

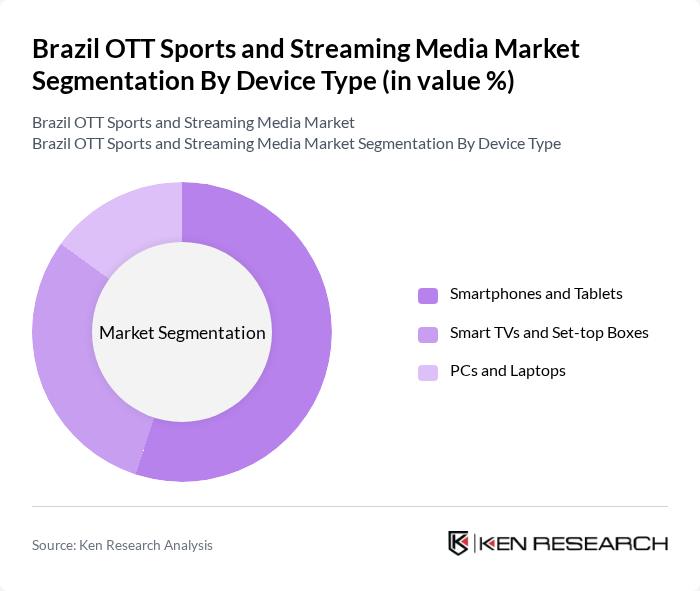

By Device Type:The market is segmented into three primary device types: Smartphones and Tablets, Smart TVs and Set-top Boxes, and PCs and Laptops. Among these, Smartphones and Tablets are the leading subsegment, driven by the increasing use of mobile devices for streaming sports content. The convenience and accessibility of mobile platforms have made them the preferred choice for consumers, especially younger demographics who favor on-the-go viewing experiences.

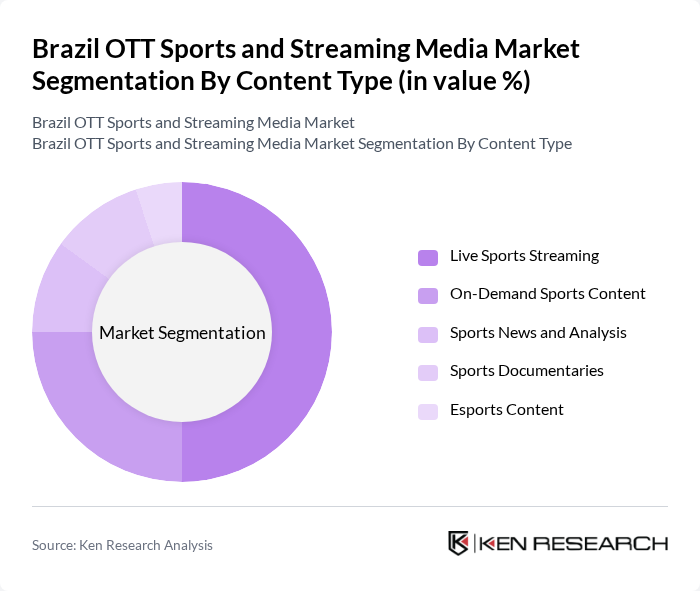

By Content Type:The content type segmentation includes Live Sports Streaming, On-Demand Sports Content, Sports News and Analysis, Sports Documentaries, and Esports Content. Live Sports Streaming is the dominant subsegment, as it caters to the real-time viewing preferences of sports fans. The excitement of watching live events, coupled with the ability to access various sports leagues and tournaments, has made this content type particularly appealing to consumers.

The Brazil OTT Sports and Streaming Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Globo Comunicação e Participações S.A., Netflix Inc., Amazon.com Inc. (Prime Video), Google LLC (YouTube), Spotify Technology S.A., WarnerMedia Direct LLC (Max), ESPN Brasil, DAZN Group Limited, Paramount Global (Paramount+), Fox Corporation (Fox Sports), Twitch Interactive Inc., Apple Inc. (Apple TV+), BuzzFeed Inc., Live Nation Worldwide Inc., Telecine contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's OTT sports and streaming media market appears promising, driven by technological advancements and evolving consumer preferences. As internet speeds improve and mobile penetration continues to rise, more viewers are expected to engage with streaming platforms. Additionally, the integration of interactive features and personalized content will enhance user experiences, fostering loyalty. Companies that adapt to these trends and invest in innovative content strategies will likely capture significant market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Smartphones and Tablets Smart TVs and Set-top Boxes PCs and Laptops |

| By Content Type | Live Sports Streaming On-Demand Sports Content Sports News and Analysis Sports Documentaries Esports Content |

| By Revenue Model | Subscription Advertisement Sponsorship Pay-Per-View |

| By Sports Category | Football (Soccer) Basketball Volleyball Formula 1 and Motorsports Mixed Martial Arts (MMA) Others |

| By End-User | Individual Consumers Sports Organizations Educational Institutions Commercial Establishments |

| By Geographic Region | São Paulo Rio de Janeiro Minas Gerais Bahia Rio Grande do Sul Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OTT Sports Streaming Subscribers | 120 | Sports Fans, OTT Platform Users |

| Content Producers and Distributors | 60 | Content Managers, Distribution Executives |

| Advertising Agencies Focused on Sports | 50 | Media Buyers, Account Managers |

| Sports Event Organizers | 40 | Event Managers, Marketing Directors |

| Regulatory Bodies and Industry Associations | 40 | Policy Makers, Industry Analysts |

The Brazil OTT Sports and Streaming Media Market is valued at approximately USD 1.0 billion, reflecting significant growth driven by increased smartphone adoption, internet penetration, and consumer demand for sports content.