Region:North America

Author(s):Geetanshi

Product Code:KRAD0143

Pages:95

Published On:August 2025

By Type:The market is segmented into liquefaction plants, regasification terminals, storage facilities, transportation vessels, and floating LNG terminals. Liquefaction plants remain the dominant subsegment, reflecting the country’s focus on export capacity expansion and large-scale projects such as LNG Canada and Woodfibre LNG. Regasification terminals, storage, and transportation vessels are also essential to the supply chain, supporting both domestic and export operations .

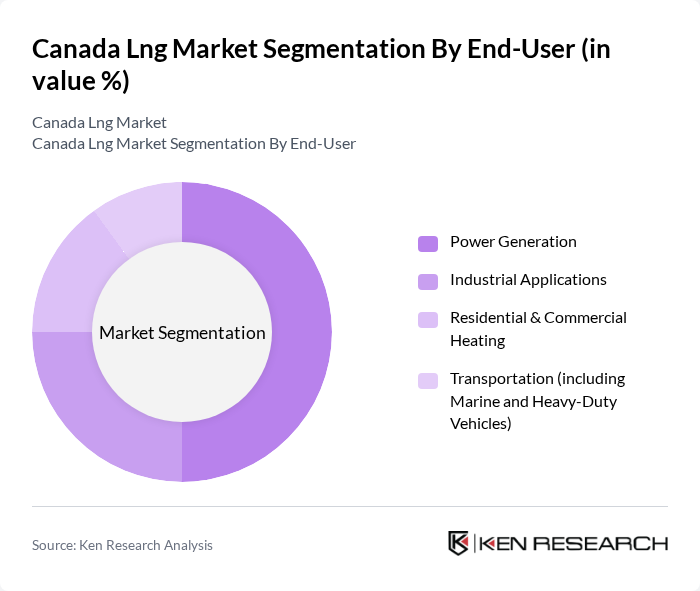

By End-User:The end-user segmentation includes power generation, industrial applications, residential and commercial heating, and transportation (including marine and heavy-duty vehicles). Power generation is the leading end-user segment, driven by the shift towards cleaner energy sources and the increasing demand for electricity in various sectors. Industrial applications and transportation are also experiencing growth as LNG adoption expands for process energy and as a lower-emission marine and heavy-duty vehicle fuel .

The Canada LNG market is characterized by a dynamic mix of regional and international players. Leading participants such as Shell plc, LNG Canada Development Inc., TC Energy Corporation, Enbridge Inc., Pembina Pipeline Corporation, FortisBC Energy Inc., Woodfibre LNG Limited, Cedar LNG Partners LP, Canadian Natural Resources Limited, Petronas Canada (Progress Energy Canada Ltd.), AltaGas Ltd., Imperial Oil Limited, Sempra Infrastructure, Chevron Canada Limited, Ksi Lisims LNG Limited Partnership contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada LNG market appears promising, driven by increasing global energy demands and a strong push for cleaner energy solutions. As countries transition away from coal, Canada is poised to become a key player in the LNG sector. The anticipated growth in small-scale LNG projects and innovations in transportation will further enhance market dynamics. However, addressing environmental regulations and infrastructure challenges will be crucial for sustaining this growth trajectory and ensuring competitiveness in the global market.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquefaction Plants Regasification Terminals Storage Facilities Transportation Vessels Floating LNG Terminals |

| By End-User | Power Generation Industrial Applications Residential & Commercial Heating Transportation (including Marine and Heavy-Duty Vehicles) |

| By Application | Power Plants Industrial Processes Marine Fuel Transportation Fuel Others |

| By Distribution Channel | Direct Sales Utilities & Energy Companies Distributors Online Platforms Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Technology | APCI Liquefaction Technology Cascade Liquefaction Technology Other Liquefaction Technologies |

| By Region | Western Canada Central Canada Atlantic Canada Northern Canada |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| LNG Export Market Analysis | 120 | Export Managers, Trade Analysts |

| Domestic LNG Consumption Trends | 100 | Energy Policy Makers, Utility Executives |

| Environmental Impact Assessments | 80 | Environmental Consultants, Regulatory Affairs Specialists |

| Investment Opportunities in LNG Infrastructure | 70 | Investment Analysts, Project Managers |

| Community Perspectives on LNG Projects | 50 | Local Government Officials, Community Leaders |

The Canada LNG market is valued at approximately USD 8 billion, driven by increasing global demand for cleaner energy sources and Canada's abundant natural gas reserves. Significant investments in infrastructure, including liquefaction plants and export terminals, support this market growth.