Canada Mattress & Sleep Economy Market Overview

- The Canada Mattress & Sleep Economy Market is valued at USD 2.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding sleep health, rising disposable incomes, and the growing trend of online shopping for home goods. The market has seen a significant shift towards premium and specialty mattresses, reflecting changing consumer preferences for comfort and quality.

- Key cities dominating the market include Toronto, Vancouver, and Montreal. These urban centers are characterized by a high population density, a strong economy, and a growing trend towards home improvement and wellness. The presence of major retailers and a diverse consumer base further contribute to their dominance in the mattress and sleep economy market.

- In 2023, the Canadian government implemented regulations aimed at improving the sustainability of mattress production. This includes guidelines for manufacturers to use eco-friendly materials and ensure proper recycling of old mattresses. The initiative is part of a broader strategy to reduce waste and promote environmental responsibility within the furniture industry.

Canada Mattress & Sleep Economy Market Segmentation

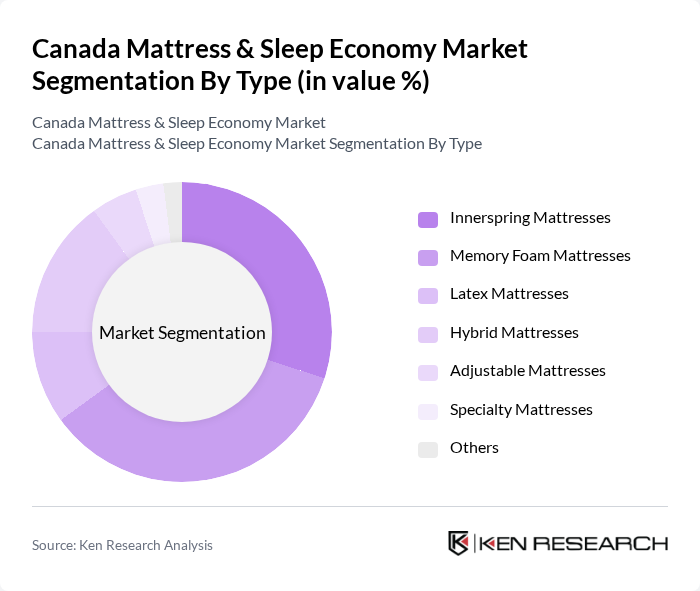

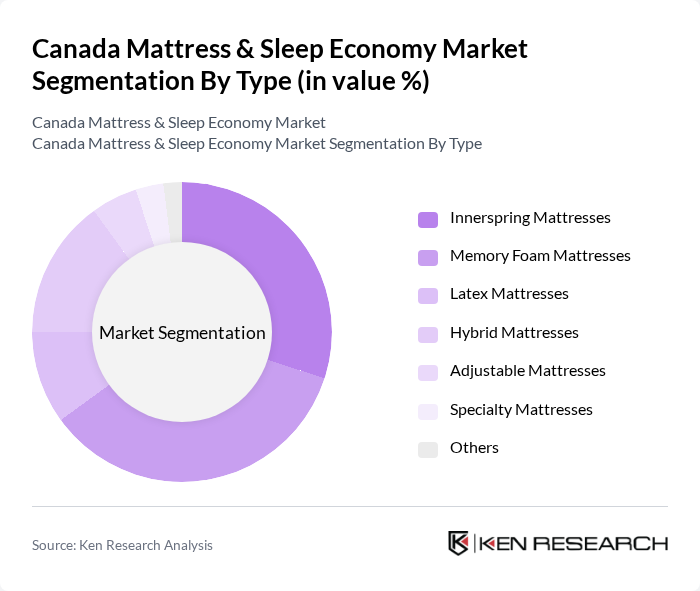

By Type:The mattress market is segmented into various types, including innerspring, memory foam, latex, hybrid, adjustable, specialty, and others. Among these, memory foam mattresses have gained significant popularity due to their comfort and support features, appealing to a wide range of consumers. Innerspring mattresses remain a staple due to their affordability and traditional appeal. The hybrid segment is also growing as it combines the benefits of both innerspring and foam technologies, catering to diverse consumer preferences.

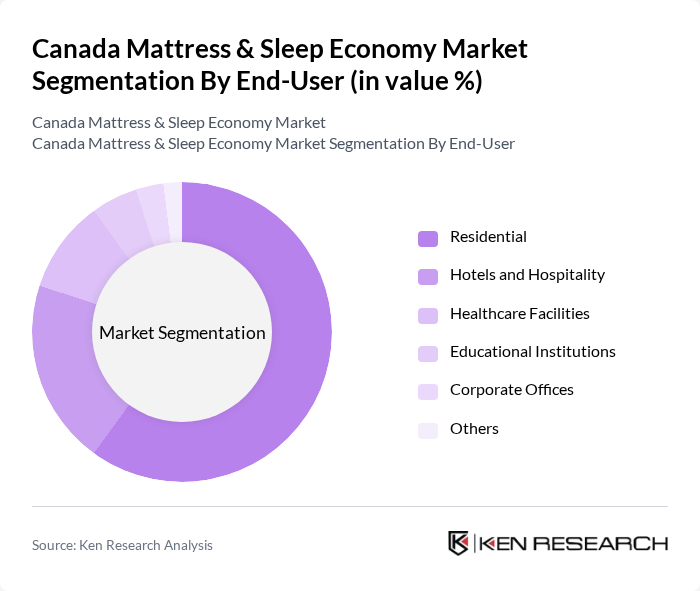

By End-User:The end-user segmentation includes residential, hotels and hospitality, healthcare facilities, educational institutions, corporate offices, and others. The residential segment dominates the market, driven by the increasing focus on home comfort and wellness. Hotels and hospitality also represent a significant portion, as establishments seek to enhance guest experiences through quality bedding. The healthcare segment is growing due to the rising demand for specialized mattresses that cater to patient comfort and recovery.

Canada Mattress & Sleep Economy Market Competitive Landscape

The Canada Mattress & Sleep Economy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., Sleep Country Canada Holdings Inc., Serta Simmons Bedding, LLC, Purple Innovation, LLC, IKEA Canada, Endy Sleep Inc., Leesa Sleep, Inc., Saatva, Inc., Kingsdown, Inc., Sealy Canada, Tempur-Pedic Canada, Zinus, Inc., Tuft & Needle, Avocado Green Mattress, DreamCloud contribute to innovation, geographic expansion, and service delivery in this space.

Canada Mattress & Sleep Economy Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Sleep Health:The growing recognition of sleep's impact on overall health is driving mattress sales. In Canada, 70% of adults report sleep issues, prompting a surge in demand for quality sleep products. The Canadian Sleep Society indicates that sleep disorders affect approximately 3.5 million Canadians, leading to increased consumer investment in sleep health solutions, including premium mattresses. This trend is expected to continue as awareness campaigns proliferate, emphasizing the importance of quality sleep for physical and mental well-being.

- Rise in Disposable Income:Canada's disposable income per capita is projected to reach CAD 54,000 in future, reflecting a 4% increase from previous estimates. This rise enables consumers to allocate more funds toward premium sleep products. As disposable income increases, consumers are more likely to invest in higher-quality mattresses, which are often associated with better sleep health. This trend is particularly evident among millennials and Gen Z, who prioritize wellness and are willing to spend on products that enhance their quality of life.

- Growth in E-commerce and Online Sales:E-commerce sales in Canada are expected to exceed CAD 55 billion in future, with the mattress segment experiencing significant growth. Online mattress sales have surged by 30% annually, driven by convenience and competitive pricing. The COVID-19 pandemic accelerated this trend, as consumers increasingly prefer online shopping for home goods. This shift allows brands to reach a broader audience, enhancing market penetration and driving overall sales growth in the mattress sector.

Market Challenges

- Intense Competition Among Brands:The Canadian mattress market is highly competitive, with over 120 brands vying for consumer attention. Major players like Tempur-Pedic and Sleep Country Canada dominate, but numerous startups are entering the market, offering innovative products. This saturation leads to aggressive pricing strategies, which can erode profit margins. Companies must differentiate themselves through unique selling propositions, such as advanced technology or superior customer service, to maintain market share in this challenging environment.

- Fluctuating Raw Material Prices:The mattress industry is significantly affected by the volatility of raw material prices, particularly foam and latex. In future, the price of polyurethane foam is projected to rise by 12% due to supply chain disruptions and increased demand. This fluctuation can lead to higher production costs, which may be passed on to consumers, potentially impacting sales. Manufacturers must develop strategies to mitigate these costs, such as sourcing alternative materials or optimizing production processes to maintain profitability.

Canada Mattress & Sleep Economy Market Future Outlook

The Canada mattress market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As awareness of sleep health increases, consumers are likely to invest more in high-quality sleep products. Additionally, the rise of smart mattresses and subscription services will reshape the market landscape. Companies that embrace sustainability and innovation will be well-positioned to capture emerging opportunities, particularly among environmentally conscious consumers seeking eco-friendly options in their purchasing decisions.

Market Opportunities

- Expansion into Underserved Regions:There is significant potential for mattress brands to expand into underserved regions in Canada, particularly rural areas where access to quality sleep products is limited. By establishing distribution channels and local partnerships, companies can tap into new customer bases, driving sales growth and brand loyalty in these markets.

- Development of Eco-Friendly Products:The demand for sustainable and eco-friendly mattresses is on the rise, with consumers increasingly prioritizing environmentally responsible products. Companies that invest in developing organic materials and sustainable manufacturing processes can differentiate themselves in the market, appealing to a growing segment of eco-conscious consumers and enhancing their brand reputation.