Region:North America

Author(s):Rebecca

Product Code:KRAD0270

Pages:97

Published On:August 2025

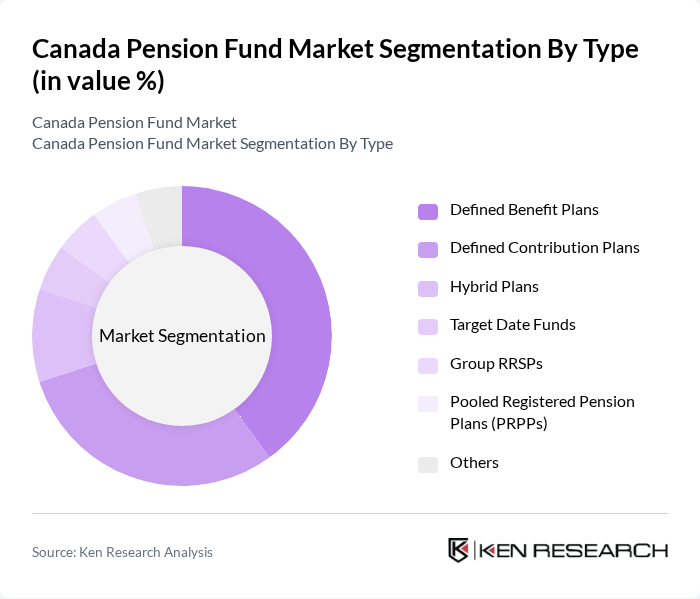

By Type:The market is segmented into various types of pension plans, each catering to different needs and preferences. The primary subsegments include Defined Benefit Plans, Defined Contribution Plans, Hybrid Plans, Target Date Funds, Group RRSPs, Pooled Registered Pension Plans (PRPPs), and Others. Defined Benefit Plans remain the largest segment due to their guaranteed payouts and prevalence among public sector employers, while Defined Contribution Plans are expanding rapidly as employers seek capital-light retirement solutions and employees value portability and investment flexibility .

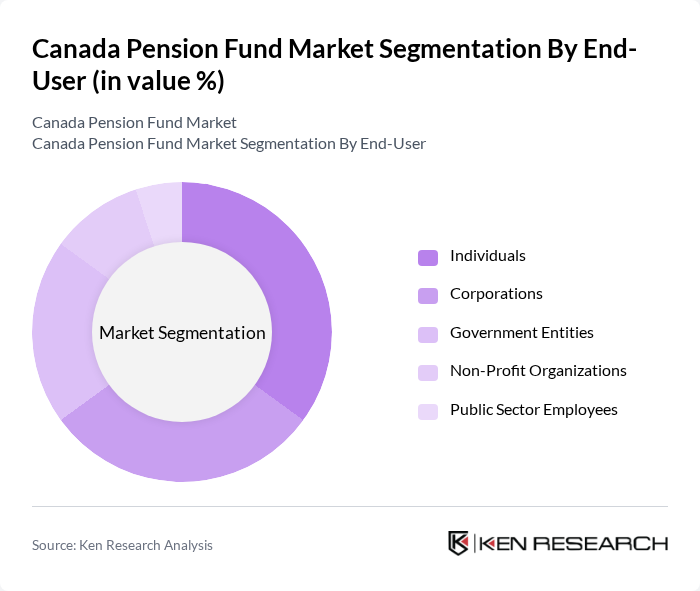

By End-User:The end-user segmentation includes Individuals, Corporations, Government Entities, Non-Profit Organizations, and Public Sector Employees. Each of these groups has distinct needs and preferences when it comes to pension plans. Individuals often seek plans that offer flexibility and control, while corporations may prefer plans that provide predictable costs and benefits for their employees. Public sector employees and government entities are typically covered by large, well-funded defined benefit plans, while non-profit organizations and smaller employers increasingly utilize group RRSPs and pooled plans for cost-effectiveness and administrative simplicity .

The Canada Pension Fund Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canada Pension Plan Investment Board, Ontario Teachers' Pension Plan, Caisse de dépôt et placement du Québec, British Columbia Investment Management Corporation, Alberta Investment Management Corporation, Healthcare of Ontario Pension Plan, Public Sector Pension Investment Board, Ontario Municipal Employees Retirement System, Saskatchewan Pension Plan, Manitoba Civil Service Superannuation Board, Nova Scotia Pension Services Corporation, Toronto Transit Commission Pension Fund Society, Vancouver City Savings Credit Union Pension Plan, New Brunswick Public Service Pension Plan, Newfoundland and Labrador Pooled Pension Fund contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada Pension Fund market appears promising, driven by increasing awareness of retirement planning and government support for pension initiatives. As the population ages, the demand for sustainable and diversified investment options will grow. Additionally, technological advancements in fund management are expected to enhance operational efficiency and improve customer engagement. The focus on personalized retirement solutions will likely reshape the market, catering to the unique needs of individual investors and fostering greater participation in pension funds.

| Segment | Sub-Segments |

|---|---|

| By Type | Defined Benefit Plans Defined Contribution Plans Hybrid Plans Target Date Funds Group RRSPs Pooled Registered Pension Plans (PRPPs) Others |

| By End-User | Individuals Corporations Government Entities Non-Profit Organizations Public Sector Employees |

| By Investment Strategy | Active Management Passive Management Tactical Asset Allocation Strategic Asset Allocation Alternative Investments (e.g., Infrastructure, Private Equity, Real Estate) |

| By Fund Size | Small Funds (< CAD 1 Billion) Medium Funds (CAD 1–10 Billion) Large Funds (> CAD 10 Billion) |

| By Risk Profile | Conservative Moderate Aggressive |

| By Geographic Focus | Domestic Investments International Investments Emerging Markets |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Sector Pension Funds | 100 | Pension Fund Managers, Investment Analysts |

| Private Sector Pension Funds | 80 | Chief Investment Officers, Asset Allocation Strategists |

| Alternative Investment Strategies | 50 | Portfolio Managers, Risk Management Officers |

| Regulatory Compliance and Governance | 40 | Compliance Officers, Legal Advisors |

| Investment Performance Analysis | 60 | Financial Analysts, Research Directors |

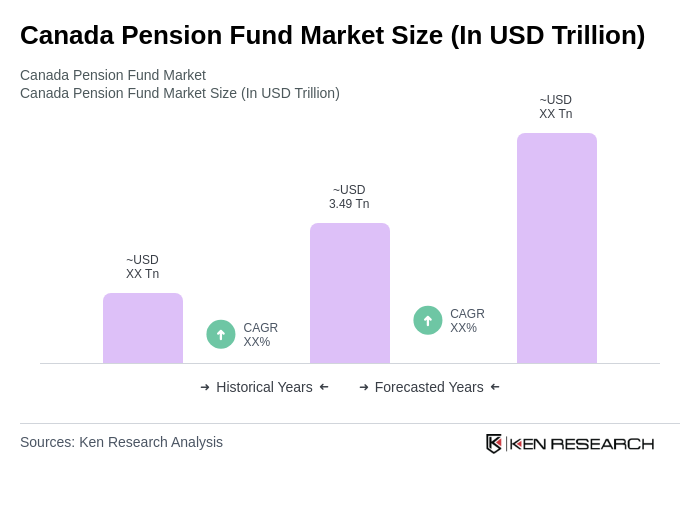

The Canada Pension Fund Market is valued at approximately USD 3.49 trillion, reflecting significant growth driven by increased contributions, strong investment returns, and a focus on alternative investments like infrastructure and private equity.