Region:North America

Author(s):Shubham

Product Code:KRAB4445

Pages:84

Published On:October 2025

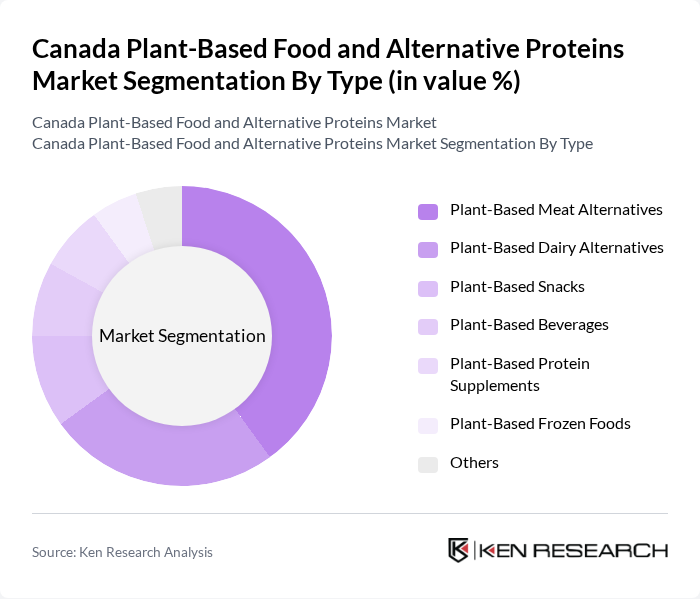

By Type:The market is segmented into various types, including Plant-Based Meat Alternatives, Plant-Based Dairy Alternatives, Plant-Based Snacks, Plant-Based Beverages, Plant-Based Protein Supplements, Plant-Based Frozen Foods, and Others. Among these, Plant-Based Meat Alternatives dominate the market due to the increasing consumer preference for meat substitutes that offer similar taste and texture to traditional meat products. This segment has seen significant innovation, with brands continuously improving their offerings to cater to the growing demand for plant-based diets.

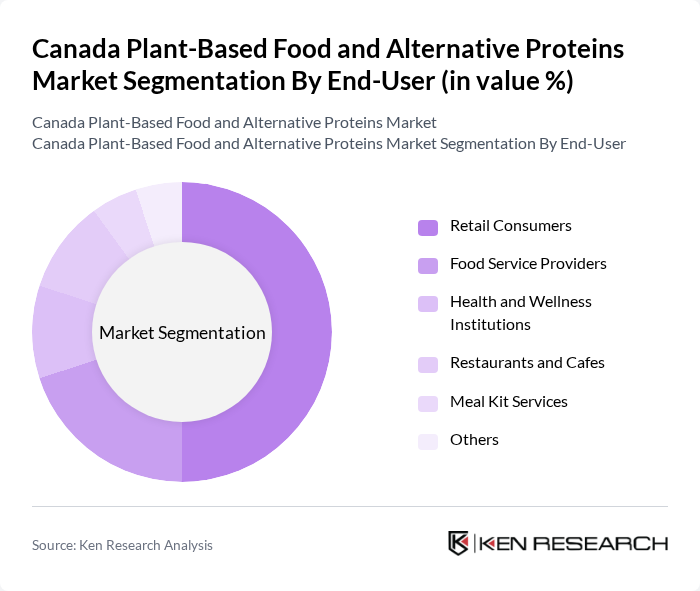

By End-User:The market is segmented by end-users, including Retail Consumers, Food Service Providers, Health and Wellness Institutions, Restaurants and Cafes, Meal Kit Services, and Others. Retail Consumers represent the largest segment, driven by the increasing availability of plant-based products in supermarkets and health food stores. The growing trend of health-conscious eating among consumers has led to a surge in demand for plant-based options, making this segment a key driver of market growth.

The Canada Plant-Based Food and Alternative Proteins Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beyond Meat, Impossible Foods, Daiya Foods, Tofurky, Lightlife Foods, Gardein, Oatly, Silk, Field Roast, MorningStar Farms, Earth Balance, So Delicious, Follow Your Heart, NutraBlast, Ripple Foods contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian plant-based food and alternative proteins market appears promising, driven by evolving consumer preferences and technological advancements. As more Canadians adopt flexitarian diets, the demand for innovative plant-based products is expected to rise. Additionally, the government's commitment to sustainability will likely foster a favorable regulatory environment, encouraging investment in this sector. Companies that adapt to these trends and focus on product quality and accessibility will be well-positioned for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Plant-Based Meat Alternatives Plant-Based Dairy Alternatives Plant-Based Snacks Plant-Based Beverages Plant-Based Protein Supplements Plant-Based Frozen Foods Others |

| By End-User | Retail Consumers Food Service Providers Health and Wellness Institutions Restaurants and Cafes Meal Kit Services Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Specialty Stores Convenience Stores Direct-to-Consumer Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| By Nutritional Profile | High Protein Low Carb Gluten-Free Others |

| By Product Form | Frozen Chilled Shelf-Stable Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Plant-Based Food Retailers | 150 | Store Managers, Category Buyers |

| Food Service Providers | 100 | Restaurant Owners, Menu Developers |

| Health and Wellness Influencers | 80 | Nutritionists, Fitness Coaches |

| Consumer Insights on Plant-Based Products | 200 | General Consumers, Health-Conscious Shoppers |

| Manufacturers of Alternative Proteins | 70 | Product Managers, R&D Specialists |

The Canada Plant-Based Food and Alternative Proteins Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by consumer demand for healthier and sustainable food options.