Region:North America

Author(s):Dev

Product Code:KRAA4928

Pages:97

Published On:September 2025

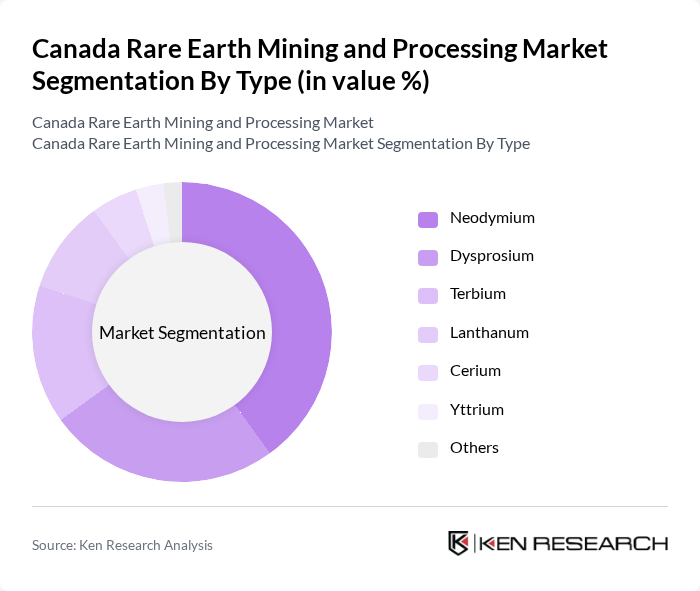

By Type:The market is segmented into various types of rare earth elements, including Neodymium, Dysprosium, Terbium, Lanthanum, Cerium, Yttrium, and Others. Neodymium is the most dominant sub-segment due to its extensive use in high-performance magnets, which are critical for electric vehicles and wind turbines. Dysprosium and Terbium follow closely, primarily used in high-temperature magnets and phosphors, respectively. The demand for these elements is driven by technological advancements and the growing emphasis on renewable energy solutions.

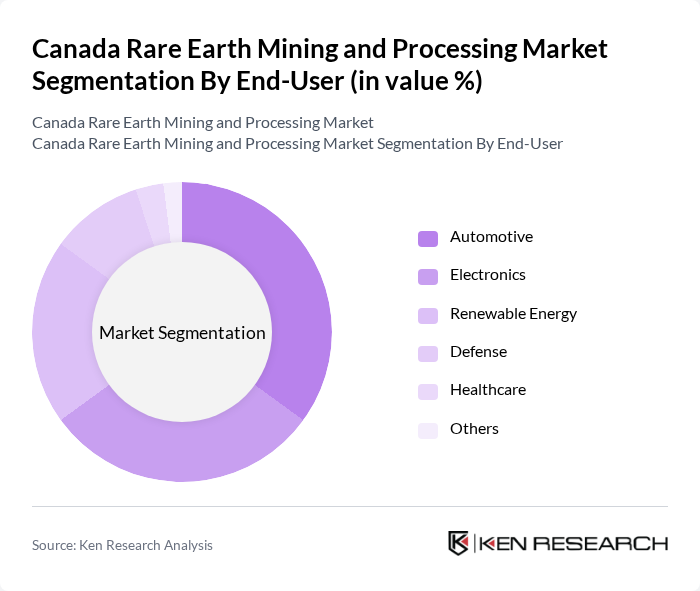

By End-User:The end-user segmentation includes Automotive, Electronics, Renewable Energy, Defense, Healthcare, and Others. The Automotive sector is the leading end-user, driven by the increasing adoption of electric vehicles that require rare earth magnets for their motors. The Electronics sector follows, with a high demand for rare earth elements in smartphones, computers, and other consumer electronics. The Renewable Energy sector is also growing rapidly, as wind and solar technologies increasingly rely on rare earth materials.

The Canada Rare Earth Mining and Processing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lynas Corporation Ltd., MP Materials Corp., Neo Performance Materials Inc., Canada Rare Earth Corporation, Arafura Resources Ltd., Northern Minerals Ltd., Ucore Rare Metals Inc., Avalon Advanced Materials Inc., Rare Element Resources Ltd., Greenland Minerals Ltd., Tasman Metals Ltd., Search Minerals Inc., American Rare Earths Ltd., Heavy Rare Earths Ltd., Rare Earth Salts LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada rare earth mining and processing market appears promising, driven by increasing global demand for clean energy technologies and electric vehicles. As the government continues to invest in critical mineral projects, the sector is likely to see enhanced production capabilities. Furthermore, advancements in sustainable mining practices and recycling technologies will play a crucial role in addressing environmental concerns while meeting market needs, positioning Canada as a key player in the global rare earth supply chain.

| Segment | Sub-Segments |

|---|---|

| By Type | Neodymium Dysprosium Terbium Lanthanum Cerium Yttrium Others |

| By End-User | Automotive Electronics Renewable Energy Defense Healthcare Others |

| By Application | Magnets Catalysts Phosphors Glass and Ceramics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Processing Method | Hydrometallurgical Pyrometallurgical Biotechnological Others |

| By Source | Primary Mining Secondary Recycling Others |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mining Operations Management | 100 | Site Managers, Operations Directors |

| Environmental Compliance and Regulation | 80 | Environmental Officers, Compliance Managers |

| Supply Chain and Logistics | 70 | Supply Chain Managers, Logistics Coordinators |

| Research and Development in Processing Technologies | 60 | R&D Managers, Process Engineers |

| Market Analysis and Strategic Planning | 90 | Market Analysts, Business Development Managers |

The Canada Rare Earth Mining and Processing Market is valued at approximately USD 1.5 billion, reflecting a significant growth driven by the increasing demand for rare earth elements in high-tech applications such as electronics, renewable energy, and defense systems.