Region:Central and South America

Author(s):Dev

Product Code:KRAA0473

Pages:87

Published On:August 2025

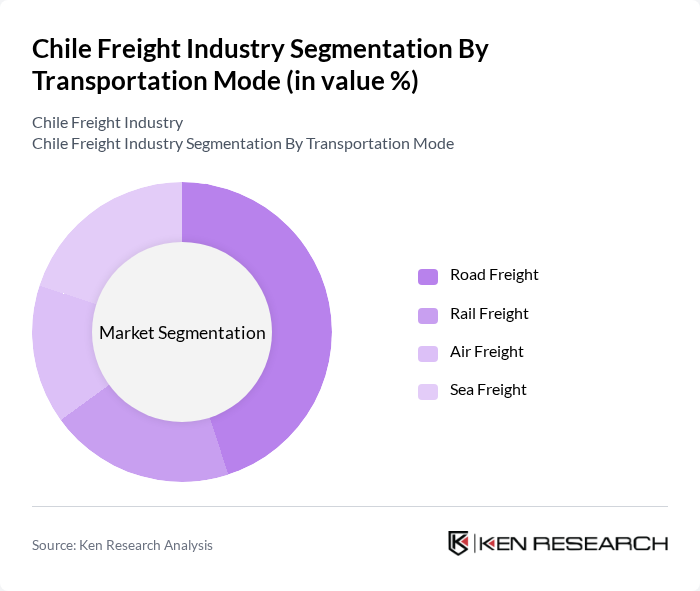

By Transportation Mode:The transportation mode segmentation includes road, rail, air, and sea freight. Road freight is widely used for its flexibility and reach, supporting domestic and cross-border transport. Rail freight is preferred for bulk commodities, especially minerals, over long distances. Air freight serves high-value and time-sensitive shipments, while sea freight is fundamental for international trade, particularly for exports of copper, agricultural products, and manufactured goods .

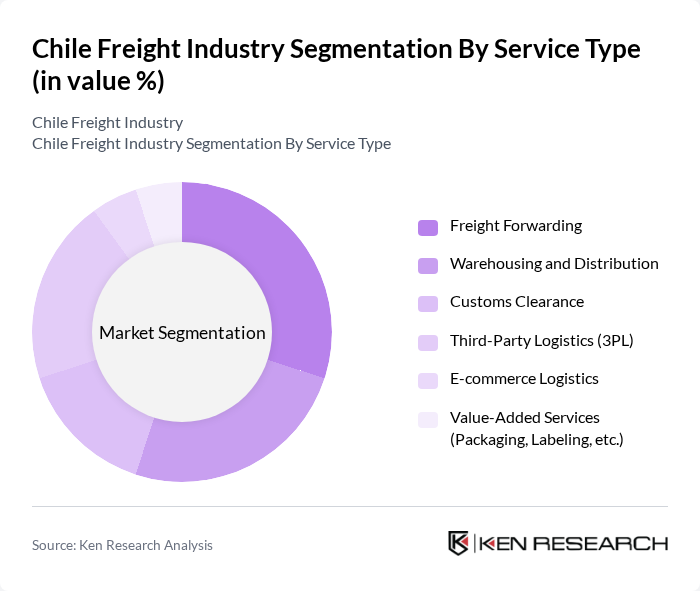

By Service Type:The service type segmentation includes freight forwarding, warehousing and distribution, customs clearance, third-party logistics (3PL), e-commerce logistics, and value-added services. Freight forwarding is essential for managing international and domestic shipments. Warehousing and distribution ensure efficient storage and delivery, while customs clearance is critical for cross-border trade. Third-party logistics providers offer integrated supply chain solutions. E-commerce logistics is rapidly expanding due to the growth of online retail, and value-added services such as packaging and labeling enhance supply chain efficiency .

The Chile Freight Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as LATAM Cargo, DHL Supply Chain Chile, Kuehne + Nagel Chile, DSV Chile, Agunsa Logistics, Andes Logistics de Chile, Starken, Blue Express, Transvip, Carga Chile, Cencosud Logistics, Transcomer, Grupo TCC Chile, FedEx Express Chile, and CorreosChile contribute to innovation, geographic expansion, and service delivery in this space .

The Chilean freight industry is poised for a transformative period, driven by increased trade volumes and infrastructure investments. As the government enhances port and road facilities, operational efficiencies are expected to improve significantly. Additionally, the integration of advanced technologies will streamline logistics processes, making them more efficient. However, companies must navigate regulatory challenges and environmental compliance to sustain growth. Overall, the industry is likely to experience robust development, positioning itself as a key player in regional trade dynamics.

| Segment | Sub-Segments |

|---|---|

| By Transportation Mode | Road Freight Rail Freight Air Freight Sea Freight |

| By Service Type | Freight Forwarding Warehousing and Distribution Customs Clearance Third-Party Logistics (3PL) E-commerce Logistics Value-Added Services (Packaging, Labeling, etc.) |

| By Industry Vertical | Mining and Minerals Agriculture and Food Manufacturing Automotive Retail and Consumer Goods Pharmaceuticals and Healthcare |

| By Region | Santiago Metropolitan Region Valparaíso Region Biobío Region (Concepción) Antofagasta Region Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 100 | Logistics Coordinators, Fleet Managers |

| Maritime Freight Services | 60 | Port Authorities, Shipping Line Executives |

| Air Cargo Management | 40 | Airline Cargo Managers, Freight Forwarders |

| Rail Freight Logistics | 40 | Railway Operations Managers, Supply Chain Analysts |

| Cold Chain Logistics | 40 | Cold Chain Managers, Quality Assurance Officers |

The Chile Freight Industry is valued at approximately USD 113 billion, driven by its strategic geographic location, increasing demand for logistics services due to e-commerce growth, and a rise in mining activities, particularly in copper and lithium.