Region:Asia

Author(s):Rebecca

Product Code:KRAA2156

Pages:92

Published On:August 2025

By Type:The market is segmented into various types of automotive LED lighting, including headlights, taillights, interior lighting, daytime running lights, turn signal lights, fog lights, reverse lights, stop lights, and others. Each sub-segment plays a crucial role in enhancing vehicle safety and aesthetics, with headlights and taillights being the most prominent due to their essential functions in vehicle visibility and signaling. The adoption of adaptive headlights and daytime running lights is increasing, driven by regulatory requirements and consumer demand for advanced safety features .

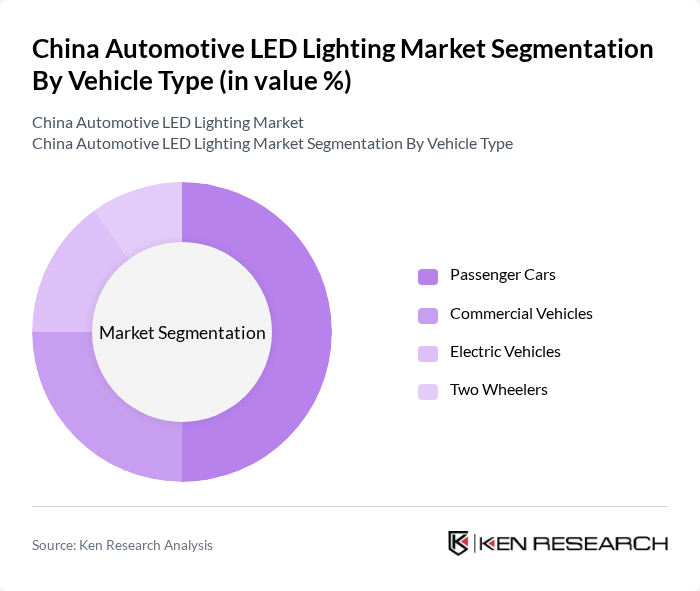

By Vehicle Type:The automotive LED lighting market is also segmented by vehicle type, including passenger cars, commercial vehicles, electric vehicles, and two-wheelers. Passenger cars dominate the market due to their high production volumes and consumer preference for advanced lighting technologies. The increasing popularity of electric vehicles is also contributing to the growth of LED lighting solutions tailored for these vehicles. Commercial vehicles and two-wheelers are steadily adopting LED technology, driven by regulatory standards and the need for improved safety and energy efficiency .

The China Automotive LED Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Osram Licht AG, Signify N.V. (formerly Philips Lighting), Cree LED (a SMART Global Holdings company), GE Lighting, a Savant company, Valeo SA, Koito Manufacturing Co., Ltd., Stanley Electric Co., Ltd., HELLA GmbH & Co., KGaA, ZKW Group GmbH, Marelli Automotive Lighting, LG Innotek Co., Ltd., Nichia Corporation, Samsung LED Co., Ltd., Shanghai Koito Automotive Lamp Co., Ltd., Hasco Vision Technology Co., Ltd., Changzhou Xingyu Automotive Lighting Systems Co., Ltd., Guangzhou Stanley Electric Co., Ltd., Shenzhen Refond Optoelectronics Co., Ltd., Zhejiang Crystal-Optech Co., Ltd., TYC Brother Industrial Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive LED lighting market in China appears promising, driven by increasing consumer demand for energy-efficient solutions and government support for sustainable technologies. As electric vehicle adoption accelerates, the integration of advanced LED systems is expected to become standard. Additionally, the rise of smart city initiatives will further enhance the need for innovative lighting solutions, positioning the automotive LED sector for significant growth in the coming years, despite existing challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Headlights Taillights Interior Lighting Daytime Running Lights Turn Signal Lights Fog Lights Reverse Lights Stop Lights Others |

| By Vehicle Type | Passenger Cars Commercial Vehicles Electric Vehicles Two Wheelers |

| By Application | OEM (Original Equipment Manufacturer) Aftermarket |

| By Distribution Channel | Direct Sales Online Retail Automotive Dealerships |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Standard LED Adaptive LED Smart LED |

| By Policy Support | Subsidies for LED Adoption Tax Incentives for Manufacturers Grants for Research and Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEMs in Passenger Vehicles | 120 | Product Development Managers, Lighting Engineers |

| Commercial Vehicle Manufacturers | 90 | Procurement Managers, Technical Directors |

| Aftermarket LED Lighting Suppliers | 60 | Sales Managers, Marketing Directors |

| Automotive Design Firms | 50 | Design Engineers, Innovation Managers |

| Regulatory Bodies and Standards Organizations | 40 | Policy Makers, Compliance Officers |

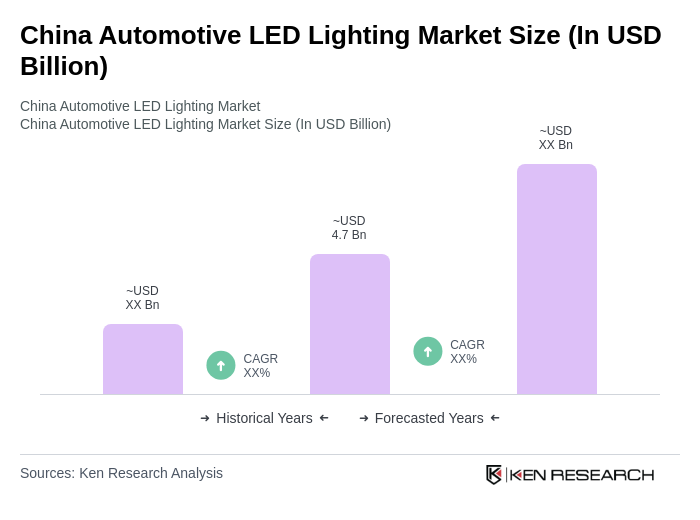

The China Automotive LED Lighting Market is valued at approximately USD 4.7 billion, reflecting significant growth driven by energy-efficient lighting solutions, advancements in automotive technology, and increasing consumer demand for enhanced vehicle aesthetics and safety features.