Region:Asia

Author(s):Shubham

Product Code:KRAB0719

Pages:84

Published On:August 2025

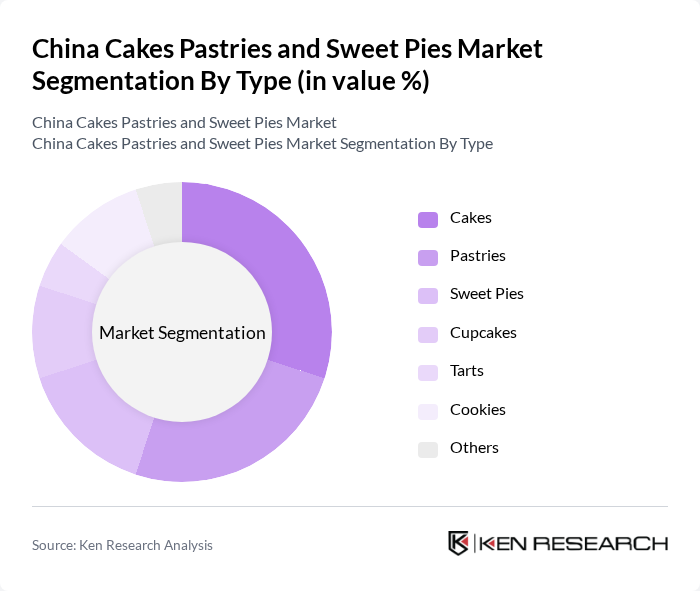

By Type:The market is segmented into cakes, pastries, sweet pies, cupcakes, tarts, cookies, and others, including traditional Chinese pastries. Cakes remain especially popular for celebrations such as birthdays and weddings, while pastries and sweet pies cater to daily snacking and gifting. Cupcakes and tarts have seen increased demand, fueled by social media trends and consumer interest in visually appealing, innovative desserts. Cookies are a staple snack across age groups, and traditional pastries like mooncakes and wife cakes are essential during major Chinese festivals and holidays .

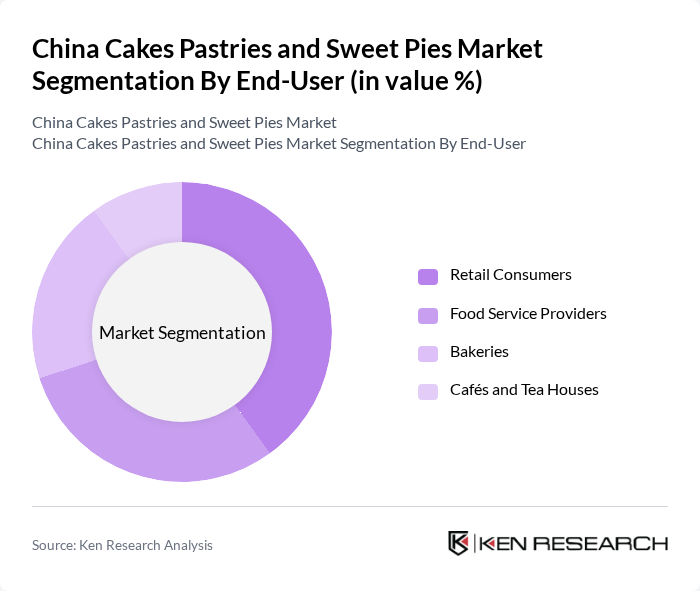

By End-User:The market is segmented by end-users: retail consumers, food service providers, bakeries, and cafés/tea houses. Retail consumers represent the largest segment, driven by the popularity of home consumption, gifting, and festive purchases. Food service providers, such as restaurants and catering services, contribute significantly due to their need for a consistent supply of baked goods for menu offerings and events. Bakeries, both chain and independent, are at the forefront of product innovation and distribution, while cafés and tea houses play a growing role in urban markets, offering premium and specialty bakery items alongside beverages .

The China Cakes Pastries and Sweet Pies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fujian Dali Food Co., Ltd., Beijing Daoxiangcun Foodstuff Co., Ltd., Holiland (Beijing Holiland Enterprise Management Co., Ltd.), Jiahua Food Co., Ltd., BreadTalk Group Limited (China operations), Paris Baguette (SPC Group China), 85°C Bakery Cafe (Gourmet Master Co., Ltd. China), Ganso Co., Ltd., Shanghai Christine Foodstuff Co., Ltd., Maxim’s Caterers Limited (China bakery division), MOMO DIM SUMS, Shenzhen Le Cake Food Co., Ltd., BreadTalk (China), Panpan Foods Group Co., Ltd., Taoli Bread (Taoli Foods Group Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cakes and pastries market in China appears promising, driven by evolving consumer preferences and technological advancements. As health-conscious trends gain momentum, manufacturers are likely to innovate with healthier options, including low-sugar and gluten-free products. Additionally, the integration of digital marketing strategies will enhance brand visibility and consumer engagement, particularly among younger demographics. The expansion into tier 2 and tier 3 cities will also present new growth avenues, as these regions experience rising disposable incomes and changing lifestyles.

| Segment | Sub-Segments |

|---|---|

| By Type | Cakes Pastries Sweet Pies Cupcakes Tarts Cookies Others (including traditional Chinese pastries such as mooncakes, wife cakes, egg tarts, and other region-specific specialties) |

| By End-User | Retail Consumers Food Service Providers (including hotels, restaurants, and catering services) Bakeries (chain and independent) Cafés and Tea Houses |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Platforms Specialty Stores (including bakery chains and boutique pastry shops) Direct Sales (including in-store and event-based sales) |

| By Occasion | Birthdays Weddings Festivals (e.g., Mid-Autumn Festival, Chinese New Year) Corporate Events |

| By Flavor Profile | Chocolate Vanilla Fruit-Based Nut-Based Traditional Chinese Flavors (e.g., red bean, lotus seed, matcha, taro) |

| By Packaging Type | Boxed Wrapped (individual and multipack) Bulk |

| By Price Range | Premium Mid-Range Economy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Bakery Consumers | 100 | Frequent buyers of cakes and pastries, aged 18-45 |

| Pastry Chefs and Bakers | 60 | Professional bakers and pastry chefs working in bakeries and restaurants |

| Retail Bakery Managers | 40 | Managers of retail outlets specializing in baked goods |

| Food Industry Experts | 40 | Consultants and analysts in the food and beverage sector |

| Health-Conscious Consumers | 50 | Consumers interested in low-sugar and gluten-free options |

The China Cakes, Pastries, and Sweet Pies Market is valued at approximately USD 20 billion, driven by rising disposable incomes, urbanization, and a growing demand for convenience and indulgence foods.