Region:Asia

Author(s):Dev

Product Code:KRAA1658

Pages:81

Published On:August 2025

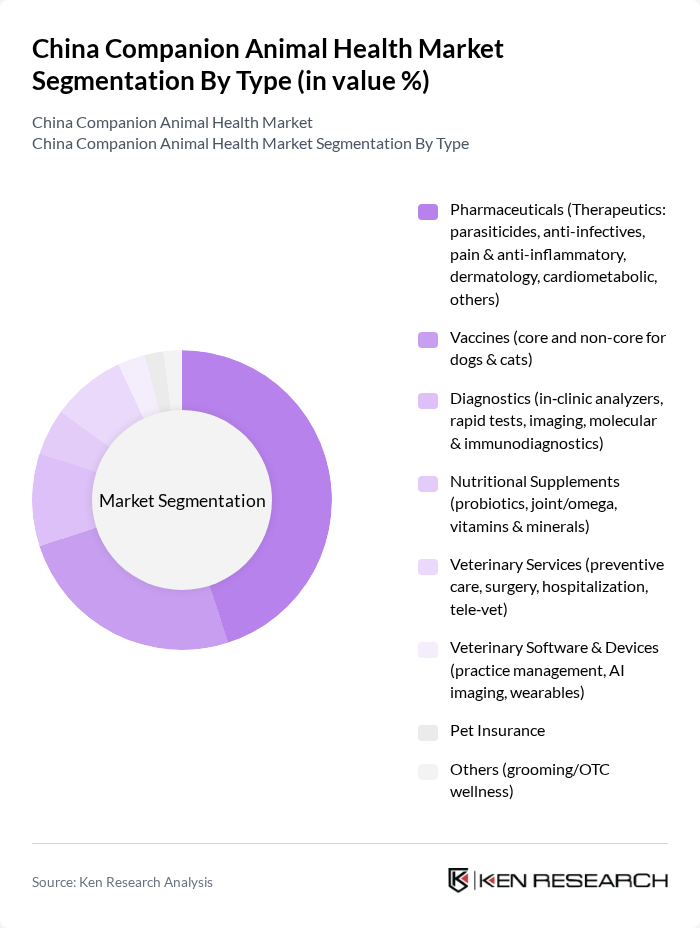

By Type:The market is segmented into various types, including pharmaceuticals, vaccines, diagnostics, nutritional supplements, veterinary services, veterinary software & devices, pet insurance, and others. Among these, pharmaceuticals, particularly therapeutics, dominate the market due to the increasing prevalence of pet diseases, rising urban pet populations, and a growing focus on preventive healthcare; demand for vaccines remains significant as dog and cat immunization adherence increases via clinics and organized hospital networks.

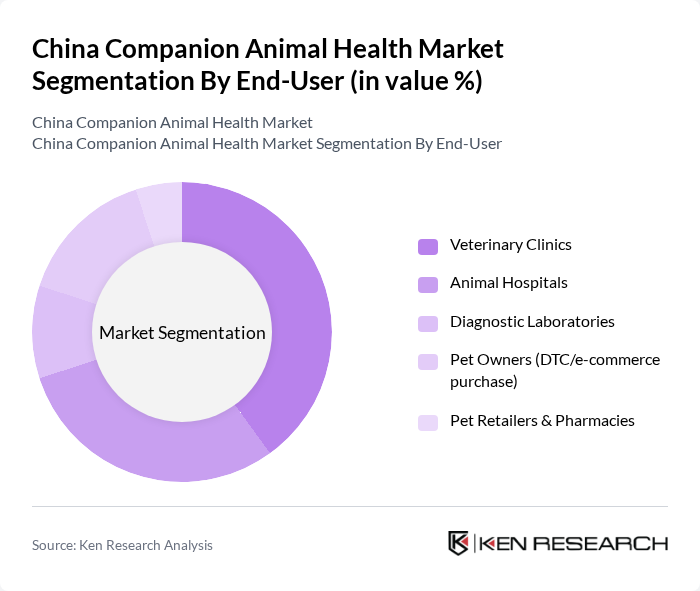

By End-User:The end-user segmentation includes veterinary clinics, animal hospitals, diagnostic laboratories, pet owners (DTC/e-commerce purchase), and pet retailers & pharmacies. Veterinary clinics and animal hospitals remain the primary end?users as they deliver core vaccination, anti-parasitic, surgical, and diagnostic services; e?commerce expansion (including brand flagship stores) enables direct purchase of OTC preventives, diets, and certain diagnostics by pet owners, supporting overall market growth.

The China Companion Animal Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health (MSD Animal Health), Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Virbac, IDEXX Laboratories, Mindray Animal Medical (Shenzhen Mindray Bio?Medical Electronics Co., Ltd.), Sinopharm Animal Health (China National Pharmaceutical Group), Jiangsu Ringpu Bio-Technology Co., Ltd. (Ringpu), JINYU Bio-Technology Co., Ltd. (China Animal Husbandry Group), Qilu Animal Health Products Co., Ltd., New Ruipeng Group (NRP Group) – Veterinary Services, Pidu Biotechnology Co., Ltd. (Shanghai Pidu Bio) – Companion Diagnostics/OTC, Thermo Fisher Scientific – Veterinary Diagnostics & Reagents contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China companion animal health market appears promising, driven by increasing pet ownership and a growing focus on pet wellness. As disposable incomes rise, consumers are expected to invest more in premium health products and services. Additionally, the integration of technology in veterinary practices, such as telemedicine and health monitoring apps, will enhance service delivery. These trends indicate a robust growth trajectory, with significant opportunities for innovation and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceuticals (Therapeutics: parasiticides, anti-infectives, pain & anti-inflammatory, dermatology, cardiometabolic, others) Vaccines (core and non-core for dogs & cats) Diagnostics (in?clinic analyzers, rapid tests, imaging, molecular & immunodiagnostics) Nutritional Supplements (probiotics, joint/omega, vitamins & minerals) Veterinary Services (preventive care, surgery, hospitalization, tele?vet) Veterinary Software & Devices (practice management, AI imaging, wearables) Pet Insurance Others (grooming/OTC wellness) |

| By End-User | Veterinary Clinics Animal Hospitals Diagnostic Laboratories Pet Owners (DTC/e-commerce purchase) Pet Retailers & Pharmacies |

| By Distribution Channel | Veterinary Channel (clinic/hospital dispensing) Online Retail & Marketplaces (Tmall, JD, WeChat mini?programs) Pet Specialty Stores & Pharmacies Supermarkets/Hypermarkets Company Direct & B2B Distributors |

| By Product Formulation | Tablets/Chews Liquids/Suspensions Injectables Topicals Powders/Granules |

| By Animal Type | Dogs Cats Small Mammals (rabbits, guinea pigs) Birds & Others |

| By Price Range | Premium Mid-range Economy |

| By Region | North China (Beijing, Tianjin, Hebei, Shanxi, Inner Mongolia) East China (Shanghai, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi, Shandong) South & Central China (Guangdong, Guangxi, Hainan, Hunan, Hubei, Henan) Southwest China (Sichuan, Chongqing, Yunnan, Guizhou, Tibet) Northwest China (Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 150 | Veterinarians, Clinic Managers |

| Pet Owners | 140 | Dog and Cat Owners, Pet Care Enthusiasts |

| Pet Product Retailers | 100 | Store Managers, Product Buyers |

| Pet Health Product Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Animal Health Researchers | 60 | Research Scientists, Academic Professionals |

The China Companion Animal Health Market is valued at approximately USD 1.3 billion, reflecting a significant increase in demand for veterinary services, pharmaceuticals, vaccines, and diagnostics due to rising pet ownership and disposable incomes in urban households.