Region:Asia

Author(s):Dev

Product Code:KRAB0377

Pages:82

Published On:August 2025

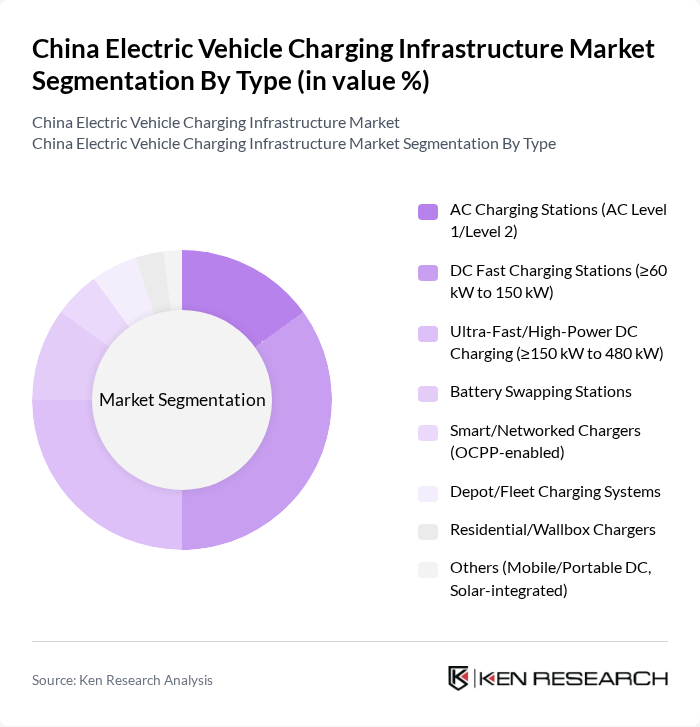

By Type:The market is segmented into various types of charging infrastructure, including AC Charging Stations, DC Fast Charging Stations, Ultra-Fast/High-Power DC Charging, Battery Swapping Stations, Smart/Networked Chargers, Depot/Fleet Charging Systems, Residential/Wallbox Chargers, and Others. Among these, DC Fast Charging Stations are gaining significant traction due to their ability to charge vehicles quickly, catering to the growing demand for efficient charging solutions.

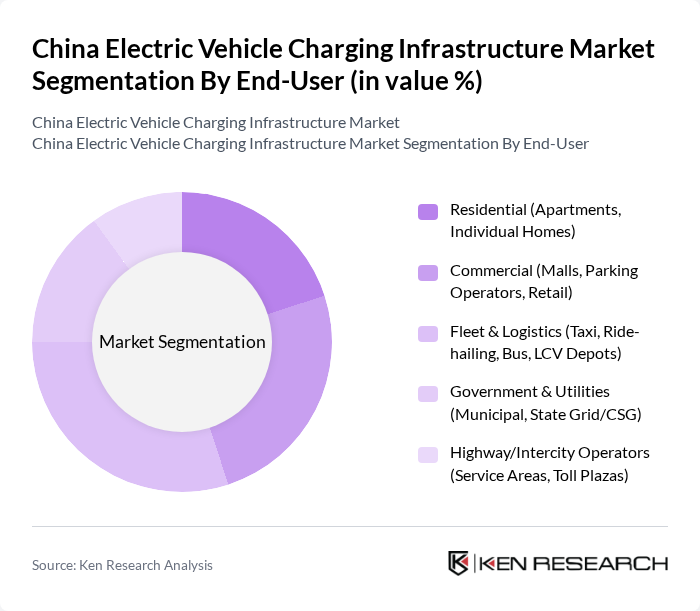

By End-User:The end-user segmentation includes Residential, Commercial, Fleet & Logistics, Government & Utilities, and Highway/Intercity Operators. The Fleet & Logistics segment is particularly prominent, driven by the increasing adoption of electric vehicles in public transport and logistics, which require efficient and reliable charging solutions to maintain operational efficiency.

The China Electric Vehicle Charging Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as State Grid Corporation of China (SGCC), China Southern Power Grid (CSG), Teld New Energy (???, TGOOD Group), Star Charge (????, Wanbang Digital Energy), Xiaoju Charging (????, Didi), China Tower Corporation, NIO Power (Battery Swap & Charging), Aulton New Energy (?????, Battery Swapping), State Grid EV Service Co., Ltd. (????????), BAIC BJEV Charging (??????????), BYD Electric Power/FinDreams Charging Solutions, Huawei Digital Power (FusionCharge), CATL (EVOGO Battery Swap & Charging Solutions), XPeng (XNGP-enabled Supercharging Network), Tesla Supercharger China contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric vehicle charging infrastructure market in China appears promising, driven by ongoing technological advancements and supportive government policies. In the future, the integration of smart charging solutions and vehicle-to-grid technology is expected to enhance energy efficiency and grid stability. Additionally, the focus on sustainability will likely lead to increased investments in renewable energy sources for charging stations, further aligning with national emission reduction targets and fostering a more robust infrastructure ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Charging Stations (AC Level 1/Level 2) DC Fast Charging Stations (?60 kW to 150 kW) Ultra-Fast/High-Power DC Charging (?150 kW to 480 kW) Battery Swapping Stations Smart/Networked Chargers (OCPP-enabled) Depot/Fleet Charging Systems Residential/Wallbox Chargers Others (Mobile/Portable DC, Solar-integrated) |

| By End-User | Residential (Apartments, Individual Homes) Commercial (Malls, Parking Operators, Retail) Fleet & Logistics (Taxi, Ride-hailing, Bus, LCV Depots) Government & Utilities (Municipal, State Grid/CSG) Highway/Intercity Operators (Service Areas, Toll Plazas) |

| By Application | Public Charging (On-street, Destination, Highway) Private Charging (Home, Workplace) Semi-public Charging (Communities, Campuses) Fleet Depot & Bus Terminal Charging Vehicle-to-Grid/Smart Charging Pilots |

| By Investment Source | State-Owned Utilities (State Grid, China Southern Power Grid) Private Operators (CPOs, OEM-backed) Public-Private Partnerships (PPP) Central & Provincial Government Programs Foreign Direct Investment (FDI)/Joint Ventures |

| By Charging Speed | Slow/Normal Charging (?7 kW) Fast AC/Moderate DC (7.1–60 kW) Fast DC (60.1–150 kW) Ultra-Fast DC (?150 kW) |

| By Distribution Mode | Direct Sales (B2B/B2G) Online/Platform Sales Distributors/Installers & EPC |

| By Policy/Standard | National Standard GB/T (AC/DC) ChaoJi/Next-Gen High-Power Standard (CHAdeMO-GB/T joint) OCPP/ISO 15118 & Smart Charging Compliance Renewable Integration & Demand Response Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Charging Infrastructure Providers | 100 | Business Development Managers, Operations Directors |

| Private Charging Station Operators | 80 | Facility Managers, Investment Analysts |

| Government Policy Makers | 60 | Urban Planners, Environmental Policy Advisors |

| EV Manufacturers | 70 | Product Managers, Marketing Directors |

| EV Users and Consumers | 120 | General Public, EV Owners, Fleet Managers |

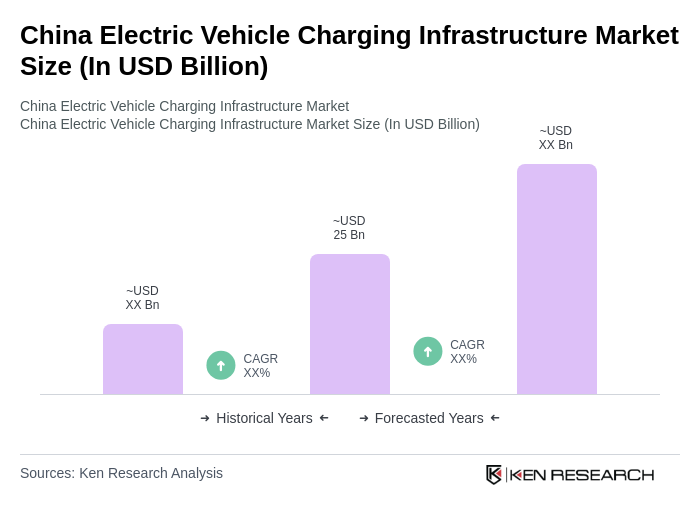

The China Electric Vehicle Charging Infrastructure Market is valued at approximately USD 25 billion, reflecting significant growth driven by increased electric vehicle adoption and government support for charging infrastructure development.