Region:Asia

Author(s):Dev

Product Code:KRAC0445

Pages:99

Published On:August 2025

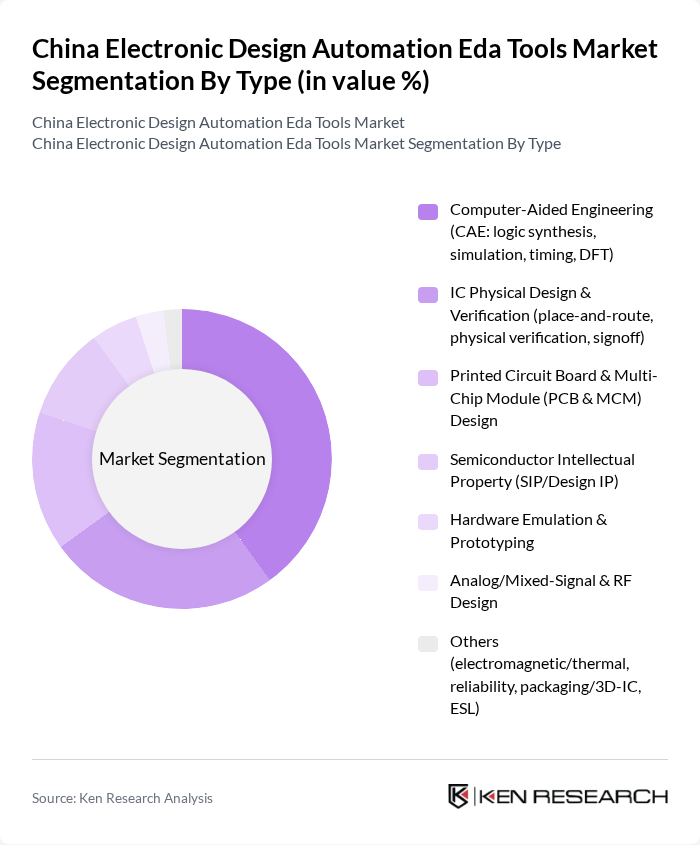

By Type:The EDA tools market can be segmented into various types, including Computer-Aided Engineering (CAE), IC Physical Design & Verification, Printed Circuit Board & Multi-Chip Module Design, Semiconductor Intellectual Property, Hardware Emulation & Prototyping, Analog/Mixed-Signal & RF Design, and Others. Among these, Computer-Aided Engineering (CAE) is the leading sub-segment, driven by the increasing complexity of electronic designs and the need for efficient simulation and verification processes. The demand for CAE tools is fueled by advancements in technology and the growing need for high-performance computing solutions.

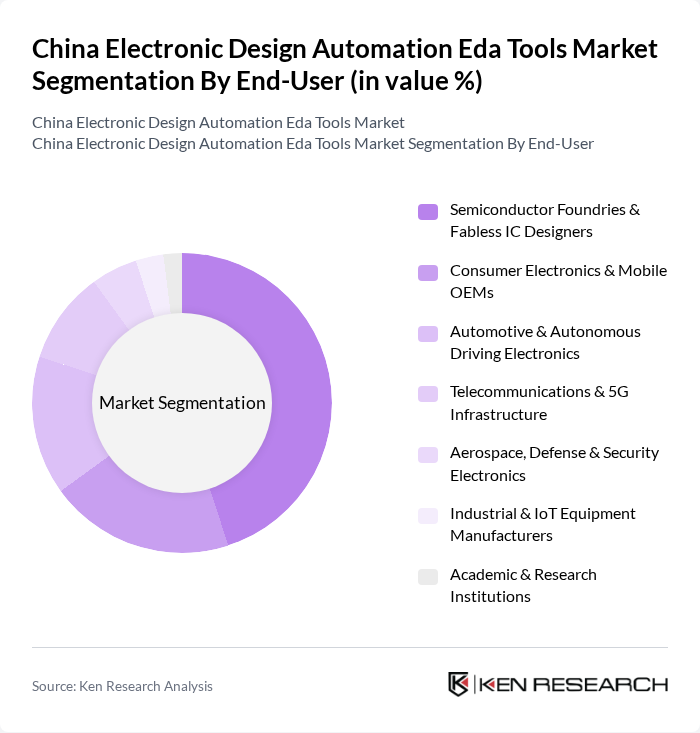

By End-User:The end-user segmentation of the EDA tools market includes Semiconductor Foundries & Fabless IC Designers, Consumer Electronics & Mobile OEMs, Automotive & Autonomous Driving Electronics, Telecommunications & 5G Infrastructure, Aerospace, Defense & Security Electronics, Industrial & IoT Equipment Manufacturers, and Academic & Research Institutions. The Semiconductor Foundries & Fabless IC Designers segment is the most significant, driven by the increasing demand for advanced semiconductor manufacturing and the need for efficient design processes to meet the growing consumer electronics market.

The China Electronic Design Automation Eda Tools Market is characterized by a dynamic mix of regional and international players. Leading participants such as Synopsys, Inc., Cadence Design Systems, Inc., Siemens EDA (Mentor Graphics), Ansys, Inc., Keysight Technologies, Inc., Altium Limited, Zuken Inc., Silvaco Group, Inc., AWR (Cadence AWR Design Environment), NI (National Instruments Corporation), Xilinx (AMD Adaptive Computing), Infineon Technologies AG, NXP Semiconductors N.V., Texas Instruments Incorporated, STMicroelectronics N.V., Empyrean Technology Co., Ltd. (????), Primarius Technologies Co., Ltd. (????), Xpeedic Technology, Inc. (?????), GigaDevice Semiconductor Inc. (????), VeriSilicon Holdings Co., Ltd. (????) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China Electronic Design Automation (EDA) tools market appears promising, driven by technological advancements and government support. As the demand for advanced semiconductor technologies and IoT applications continues to rise, EDA tools will play a pivotal role in facilitating complex designs. Additionally, the integration of AI and machine learning into EDA processes is expected to enhance efficiency and innovation. However, addressing workforce shortages and high costs will be crucial for sustaining growth in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Computer-Aided Engineering (CAE: logic synthesis, simulation, timing, DFT) IC Physical Design & Verification (place-and-route, physical verification, signoff) Printed Circuit Board & Multi-Chip Module (PCB & MCM) Design Semiconductor Intellectual Property (SIP/Design IP) Hardware Emulation & Prototyping Analog/Mixed-Signal & RF Design Others (electromagnetic/thermal, reliability, packaging/3D-IC, ESL) |

| By End-User | Semiconductor Foundries & Fabless IC Designers Consumer Electronics & Mobile OEMs Automotive & Autonomous Driving Electronics Telecommunications & 5G Infrastructure Aerospace, Defense & Security Electronics Industrial & IoT Equipment Manufacturers Academic & Research Institutions |

| By Application | Integrated Circuit (IC) Design System-on-Chip (SoC) Design FPGA Design & Verification ASIC Design & Tape-out Signoff PCB/Package Co-Design & System Integration D/3D-IC & Advanced Packaging |

| By Distribution Channel | Direct Sales (global principals and China subsidiaries) Value-Added Resellers/Distributors Cloud Marketplaces & Online Subscriptions System Integrators & Design Service Partners Others |

| By Pricing Model | Term/Subscription License (on-prem or cloud) Perpetual License with Maintenance Pay-Per-Use/On-Demand Cloud EDA Enterprise/Wide-Use Agreements Academic & Startup Programs |

| By Company Size | Large Enterprises (Tier-1 fabs/fabless, >1,000 employees) Medium Enterprises (200–1,000 employees) Small Enterprises (<200 employees) Startups Others |

| By Region | North China (Beijing, Tianjin, Hebei) East China (Shanghai, Jiangsu, Zhejiang) South China (Guangdong, Shenzhen, Hong Kong) West China (Chengdu/Chongqing, Shaanxi) Others (Hubei/Wuhan, Anhui/Hefei, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive EDA Tool Usage | 120 | Design Engineers, Project Managers |

| Consumer Electronics Design Practices | 90 | Product Development Engineers, R&D Managers |

| Telecommunications EDA Tool Adoption | 80 | Network Engineers, Technical Directors |

| EDA Tool Integration in Startups | 60 | Founders, CTOs |

| Academic Research on EDA Tools | 50 | Professors, Graduate Researchers |

The China Electronic Design Automation (EDA) Tools Market is valued at approximately USD 4.0 billion, driven by the increasing demand for advanced semiconductor technologies and the growth of artificial intelligence and the Internet of Things (IoT).