Region:Asia

Author(s):Rebecca

Product Code:KRAB0199

Pages:87

Published On:August 2025

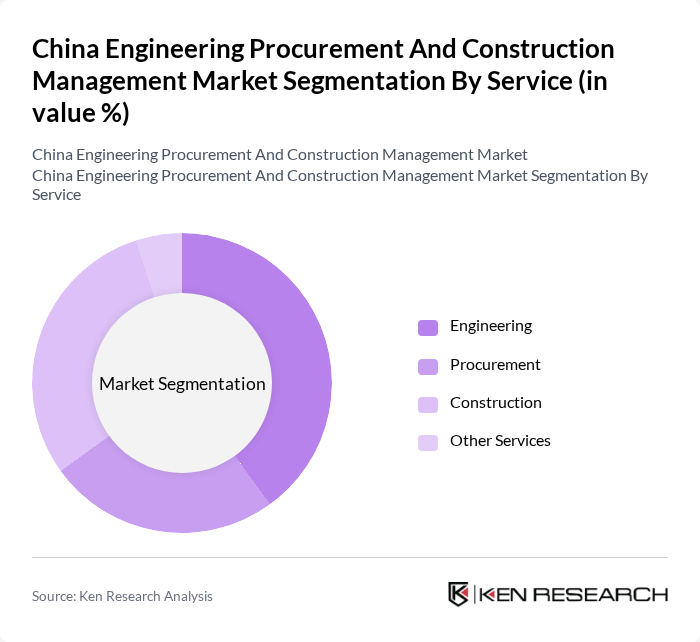

By Service:The services offered in the engineering procurement and construction management market include Engineering, Procurement, Construction, and Other Services. Engineering services encompass design and planning, while Procurement involves sourcing materials and equipment. Construction services cover the actual building process, and Other Services may include project management and consulting. The Engineering segment is currently leading the market due to the increasing complexity of projects requiring specialized design and planning expertise.

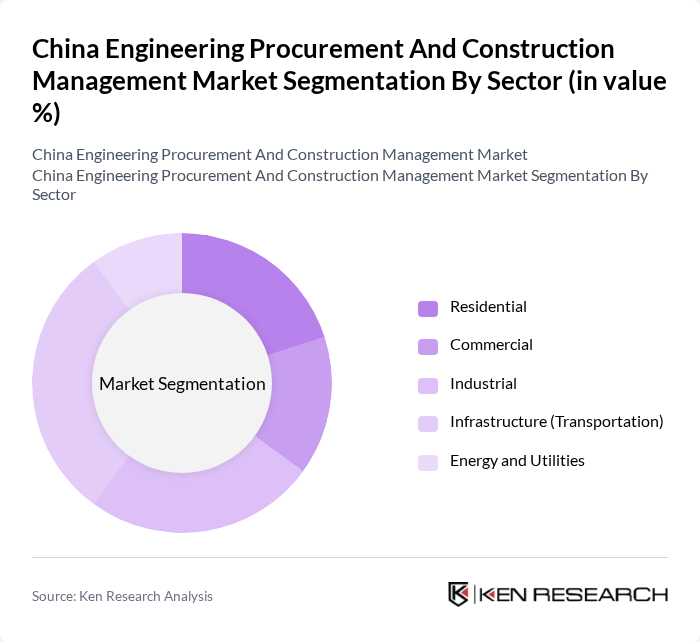

By Sector:The market is segmented into Residential, Commercial, Industrial, Infrastructure (Transportation), and Energy and Utilities sectors. The Infrastructure sector is currently the dominant segment, driven by significant government investments in transportation networks, including roads, railways, and airports. The growing urban population and the need for sustainable energy solutions are also contributing to the expansion of the Energy and Utilities sector.

The China Engineering Procurement and Construction Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as China State Construction Engineering Corporation (CSCEC), China Railway Group Limited (CREC), China Communications Construction Company (CCCC), China National Petroleum Corporation (CNPC), China Metallurgical Group Corporation (MCC), China Gezhouba Group Company Limited, China National Chemical Engineering Group Corporation (CNCEC), Shanghai Construction Group (SCG), China Harbour Engineering Company (CHEC), China Energy Engineering Corporation (CEEC), China National Offshore Oil Corporation (CNOOC), China Railway Construction Corporation (CRCC), China State Shipbuilding Corporation (CSSC), China National Building Material Group Corporation (CNBM), Power Construction Corporation of China (PowerChina) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China engineering procurement and construction management market appears promising, driven by ongoing infrastructure investments and urbanization trends. As the government continues to prioritize public projects and sustainable development, firms will need to adapt to evolving regulations and labor market dynamics. Emphasis on digital transformation and smart construction technologies will likely reshape operational efficiencies, while the integration of sustainability practices will become increasingly vital in meeting regulatory requirements and public expectations.

| Segment | Sub-Segments |

|---|---|

| By Service | Engineering Procurement Construction Other Services |

| By Sector | Residential Commercial Industrial Infrastructure (Transportation) Energy and Utilities |

| By Project Size | Small Projects Medium Projects Large Projects |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time and Materials Contracts |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infrastructure Projects | 120 | Project Managers, Procurement Directors |

| Energy Sector EPC Contracts | 90 | Operations Managers, Engineering Leads |

| Transportation Infrastructure | 60 | Supply Chain Managers, Contract Administrators |

| Urban Development Projects | 50 | City Planners, Construction Supervisors |

| Industrial Facility Construction | 45 | Facility Managers, Procurement Specialists |

The China Engineering Procurement and Construction Management Market is valued at approximately USD 520 billion, driven by rapid urbanization, government infrastructure initiatives, and increased foreign investments in construction projects.