Region:Asia

Author(s):Shubham

Product Code:KRAA1903

Pages:89

Published On:August 2025

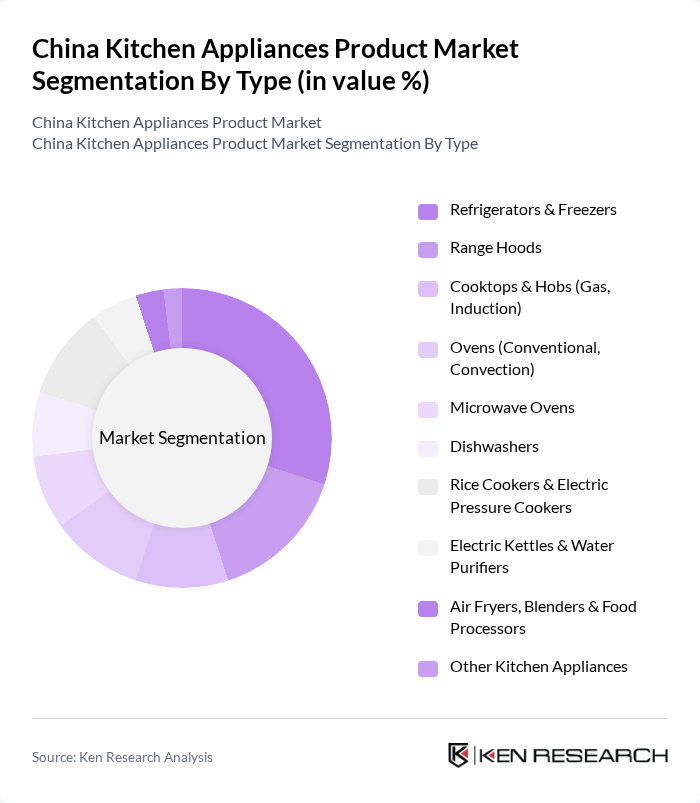

By Type:The kitchen appliances market can be segmented into various types, including Refrigerators & Freezers, Range Hoods, Cooktops & Hobs (Gas, Induction), Ovens (Conventional, Convection), Microwave Ovens, Dishwashers, Rice Cookers & Electric Pressure Cookers, Electric Kettles & Water Purifiers, Air Fryers, Blenders & Food Processors, and Other Kitchen Appliances. Among these,Refrigerators & Freezersare the most dominant segment due to their essential role in food preservation and the growing trend of energy-efficient models, with refrigerators cited as the top revenue category in China’s appliance market .

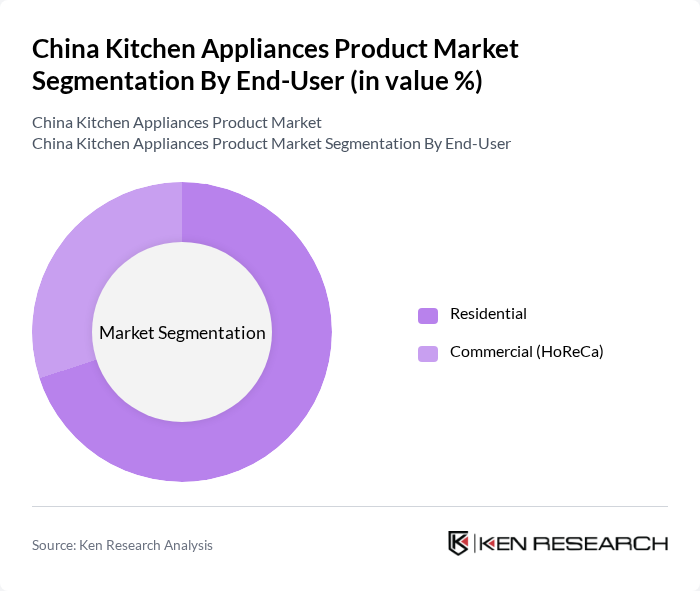

By End-User:The market can be segmented into Residential and Commercial (HoReCa) end-users. TheResidentialsegment is the largest, driven by the increasing number of households and the growing trend of home cooking, with strong online penetration in appliance purchases and ongoing replacement cycles supporting household demand . Consumers are investing in modern kitchen appliances to enhance their cooking experience, leading to a surge in demand for various kitchen products, particularly energy-efficient and smart-enabled models .

The China Kitchen Appliances Product Market is characterized by a dynamic mix of regional and international players. Leading participants such as Haier Group, Midea Group, Gree Electric Appliances, Inc. of Zhuhai, Hisense Group, TCL Electronics Holdings Limited, Robam Appliances Co., Ltd. (Hangzhou Robam), Fotile Group (Ningbo Fotile Kitchen Ware Co., Ltd.), Supor Co., Ltd. (SEB Group – China), Joyoung Co., Ltd., Galanz Group, Vatti Corporation Limited, Xiaomi Home Appliances (Mi Ecosystem), Panasonic Corporation, BSH Hausgeräte GmbH (Bosch & Siemens Home Appliances), Whirlpool Corporation, Electrolux AB, Samsung Electronics, LG Electronics, Sharp Corporation, Philips Domestic Appliances (Versuni) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the kitchen appliances market in China appears promising, driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for innovative and energy-efficient appliances is expected to rise. Additionally, the integration of smart technology will likely enhance user experience, making appliances more appealing. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capture market share and meet evolving consumer needs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators & Freezers Range Hoods Cooktops & Hobs (Gas, Induction) Ovens (Conventional, Convection) Microwave Ovens Dishwashers Rice Cookers & Electric Pressure Cookers Electric Kettles & Water Purifiers Air Fryers, Blenders & Food Processors Other Kitchen Appliances |

| By End-User | Residential Commercial (HoReCa) |

| By Distribution Channel | Online (E-commerce & Brand.com) Multi-brand Stores Exclusive Brand Stores Other Distribution Channels |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Domestic Brands International Brands Private Labels |

| By Features | Smart & Connected Features Energy Efficiency (China Energy Label Grades) Design & Aesthetics |

| By Application | Cooking Food Preservation Food Preparation Cleaning |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 150 | Homeowners, Renters |

| Product Development Feedback | 80 | Product Designers, Engineers |

| Market Trend Analysis | 60 | Market Analysts, Industry Experts |

| Distribution Channel Evaluation | 100 | Logistics Managers, Supply Chain Analysts |

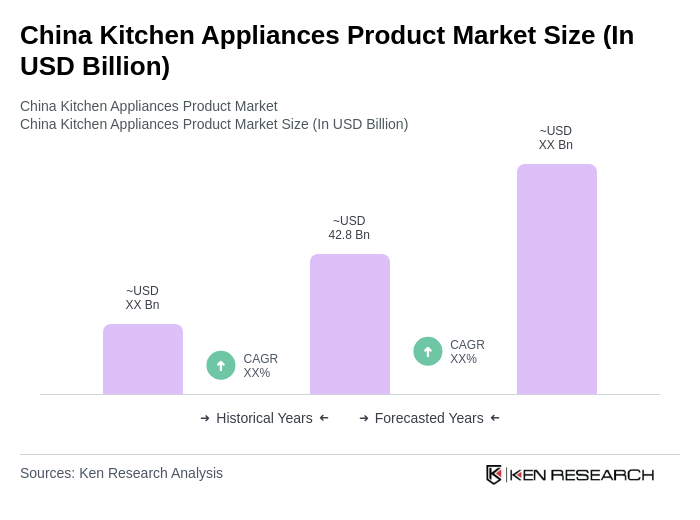

The China Kitchen Appliances Product Market is valued at approximately USD 42.8 billion, reflecting strong demand for household kitchen appliances driven by urbanization, rising disposable incomes, and a shift towards modern cooking solutions.