Region:Central and South America

Author(s):Dev

Product Code:KRAD0493

Pages:80

Published On:August 2025

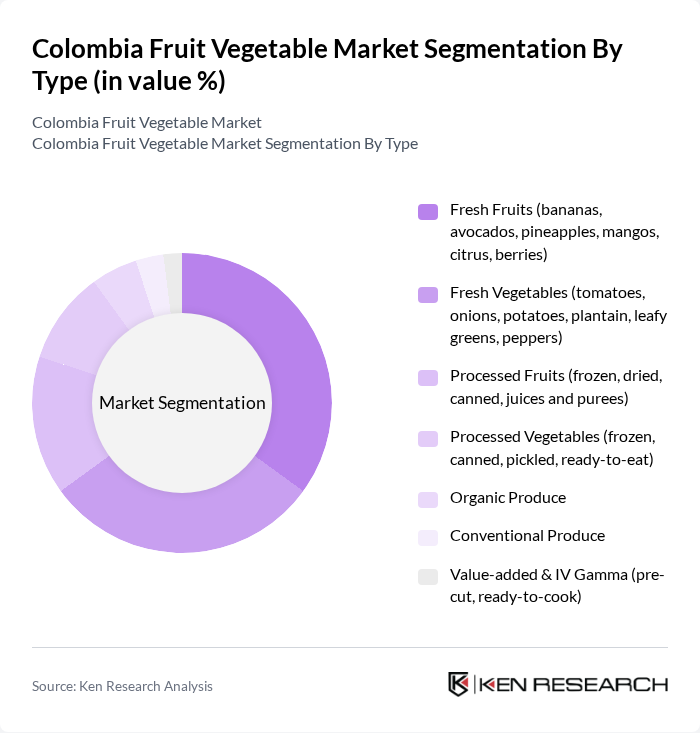

By Type:The market is segmented into various types, including fresh fruits, fresh vegetables, processed fruits, processed vegetables, organic produce, conventional produce, and value-added & IV Gamma products. Each sub-segment caters to different consumer preferences and market demands.

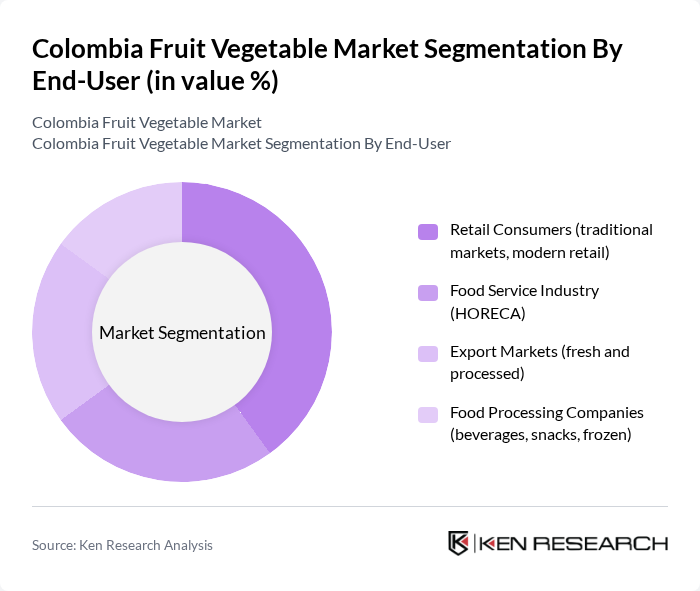

By End-User:The end-user segmentation includes retail consumers, the food service industry (HORECA), export markets, and food processing companies. Each segment plays a crucial role in the overall demand for fruits and vegetables in Colombia.

The Colombia Fruit Vegetable Market is characterized by a dynamic mix of regional and international players. Leading participants such as C.I. Unibán S.A., Banacol S.A.S., Grupo Nutresa S.A. (Colcafé/Comercial Nutresa Fresh Produce Channels), Grupo Éxito S.A., Carvajal Empaques (Packing for Produce), C.I. Tropical (C.I. Tropical Fresh S.A.S.), C.I. Pacific Fruits S.A.S., Cartama Group (Hass avocados), Westfalia Fruit Colombia S.A.S., Frutas Comerciales S.A. (Frutcom), C.I. Tecbaco S.A. (Tecnica Agricola de Banano de Colombia), Bavaria Fruits S.A.S. (fresh produce trading), Corabastos S.A. (Central de Abastos de Bogotá), Asohofrucol (Asociación Hortifrutícola de Colombia), Fruandes S.A.S. (organic dried fruits) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Colombian fruit and vegetable market appears promising, driven by increasing health awareness and a growing preference for organic products. As consumers continue to prioritize fresh produce, the market is likely to see innovations in sustainable farming practices and technology adoption. Additionally, the expansion of e-commerce platforms for fresh produce is expected to enhance accessibility, allowing consumers to purchase directly from local farmers. These trends will contribute to a more resilient and dynamic market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Fruits (bananas, avocados, pineapples, mangos, citrus, berries) Fresh Vegetables (tomatoes, onions, potatoes, plantain, leafy greens, peppers) Processed Fruits (frozen, dried, canned, juices and purees) Processed Vegetables (frozen, canned, pickled, ready-to-eat) Organic Produce Conventional Produce Value-added & IV Gamma (pre-cut, ready-to-cook) |

| By End-User | Retail Consumers (traditional markets, modern retail) Food Service Industry (HORECA) Export Markets (fresh and processed) Food Processing Companies (beverages, snacks, frozen) |

| By Distribution Channel | Supermarkets and Hypermarkets Wholesalers & Central de Abastos (Corabastos and regional) Local Markets Online Retail & Quick Commerce Direct Sales from Farmers & Cooperatives |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly & Recyclable Packaging |

| By Quality | Premium/Export Grade Standard/Domestic Grade Economy Grade |

| By Price Range | Low Price Mid Price High Price |

| By Region | Andean Region (Cundinamarca, Antioquia, Boyacá) Caribbean Region (Magdalena, Atlántico, Bolívar, La Guajira) Amazon Region Pacific Region (Valle del Cauca, Nariño, Chocó) Orinoquía (Meta, Casanare, Arauca) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fruit Sales | 150 | Store Managers, Category Buyers |

| Wholesale Vegetable Distribution | 100 | Wholesale Distributors, Supply Chain Managers |

| Local Farmer Insights | 80 | Farm Owners, Agricultural Cooperatives |

| Consumer Purchasing Behavior | 140 | Household Shoppers, Health-Conscious Consumers |

| Export Market Trends | 70 | Export Managers, Trade Analysts |

The Colombia Fruit Vegetable Market is valued at approximately USD 6.5 billion, reflecting significant growth driven by increasing consumer demand for fresh and healthy food options, as well as expanding export opportunities for Colombian produce.