Region:Central and South America

Author(s):Shubham

Product Code:KRAB4471

Pages:81

Published On:October 2025

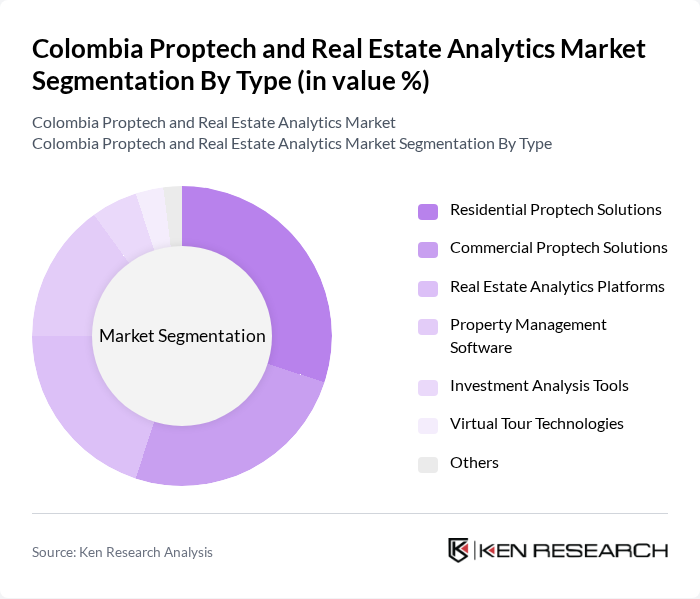

By Type:The market is segmented into various types, including Residential Proptech Solutions, Commercial Proptech Solutions, Real Estate Analytics Platforms, Property Management Software, Investment Analysis Tools, Virtual Tour Technologies, and Others. Each of these segments caters to different needs within the real estate sector, with specific technologies and solutions designed to enhance efficiency and user experience.

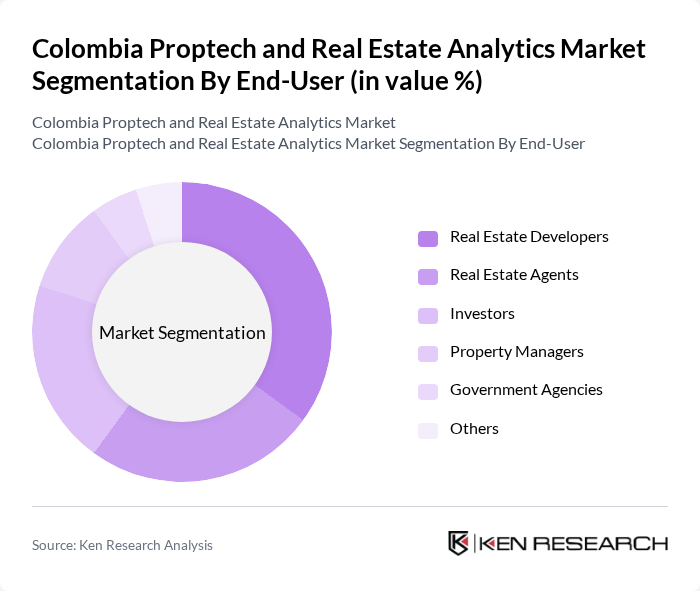

By End-User:The end-user segmentation includes Real Estate Developers, Real Estate Agents, Investors, Property Managers, Government Agencies, and Others. Each group utilizes Proptech solutions to streamline operations, enhance customer engagement, and improve decision-making processes in real estate transactions.

The Colombia Proptech and Real Estate Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Propy Inc., Habi, La Haus, Rappi, Homie, Urbania, Properati, Inmuebles24, Real Estate Analytics Group, Trovit, Cielo Property Group, Zukbox, Bimago, Rentberry, Kubo Financiero contribute to innovation, geographic expansion, and service delivery in this space.

The Colombia Proptech and Real Estate Analytics market is poised for significant transformation as urbanization continues to rise and technology adoption accelerates. In the future, the integration of advanced technologies such as AI and blockchain will reshape property transactions and management. Additionally, the increasing focus on sustainable practices will drive innovation in real estate solutions. As the market matures, collaboration between startups and established firms will be crucial in overcoming regulatory challenges and enhancing data security, paving the way for a more robust ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Proptech Solutions Commercial Proptech Solutions Real Estate Analytics Platforms Property Management Software Investment Analysis Tools Virtual Tour Technologies Others |

| By End-User | Real Estate Developers Real Estate Agents Investors Property Managers Government Agencies Others |

| By Application | Market Analysis Property Valuation Risk Assessment Investment Management Customer Relationship Management Others |

| By Sales Channel | Direct Sales Online Platforms Partnerships with Real Estate Firms Distributors Others |

| By Pricing Model | Subscription-Based One-Time Purchase Freemium Model Pay-Per-Use Others |

| By Customer Segment | Individual Home Buyers Small and Medium Enterprises Large Corporations Government Institutions Others |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Agents | 150 | Real Estate Agents, Brokers |

| Commercial Property Developers | 100 | Property Developers, Investment Managers |

| Proptech Startups | 80 | Founders, CTOs, Product Managers |

| Real Estate Investors | 70 | Institutional Investors, Private Equity Firms |

| Urban Planning Authorities | 60 | Urban Planners, Policy Makers |

The Colombia Proptech and Real Estate Analytics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by technological adoption, enhanced data analytics, and increasing demand for transparency in property management.