India Air Purifier Market

India Air Purifier Market: Growth Driven by Pollution and Health Awareness 2019–2030

Region:Asia

Author(s):Aashima Mendiratta

Product Code:KR983

May 2020

82

About the Report

```html

India Air Purifier Market Overview

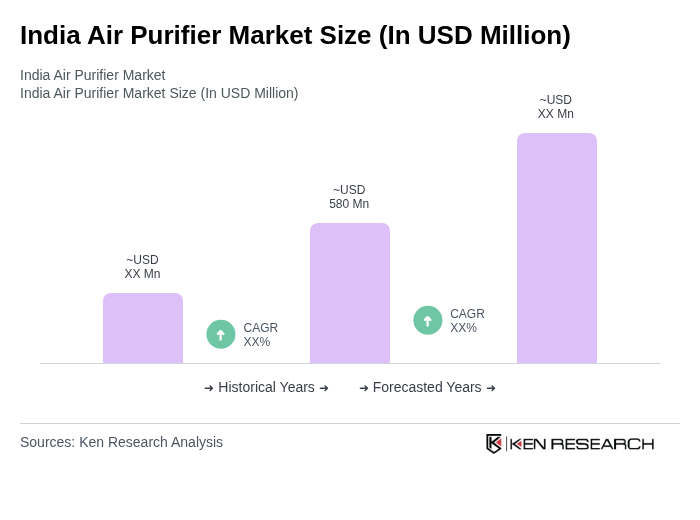

- The India Air Purifier Market is valued at USD 580 million, based on a five-year historical analysis. This growth is primarily driven by increasing air pollution levels, rising health awareness among consumers, a growing middle-class population seeking improved indoor air quality, rapid urbanization, and technological advancements integrating smart features such as IoT connectivity and AI-enabled air quality monitoring. The demand for air purifiers has surged, particularly in urban areas, as individuals and businesses prioritize health and wellness.(source)(source)

- Key cities dominating the market include Delhi, Mumbai, and Bangalore. These cities experience high levels of air pollution due to industrial emissions, vehicular traffic, and construction activities. The increasing number of health-conscious consumers in these urban centers is propelling the demand for air purifiers, making them significant contributors to market growth, with Delhi-NCR leading national demand.(source)(source)

- The National Clean Air Programme (NCAP), 2019 launched by the Ministry of Environment, Forest and Climate Change (MoEFCC), sets binding targets to reduce PM10 and PM2.5 concentrations by 20-30% in 131 non-attainment cities through 2024, with compliance requiring city action plans that include monitoring, source apportionment, and promotion of clean technologies such as air quality improvement devices in public and institutional buildings.(source)

India Air Purifier Market Segmentation

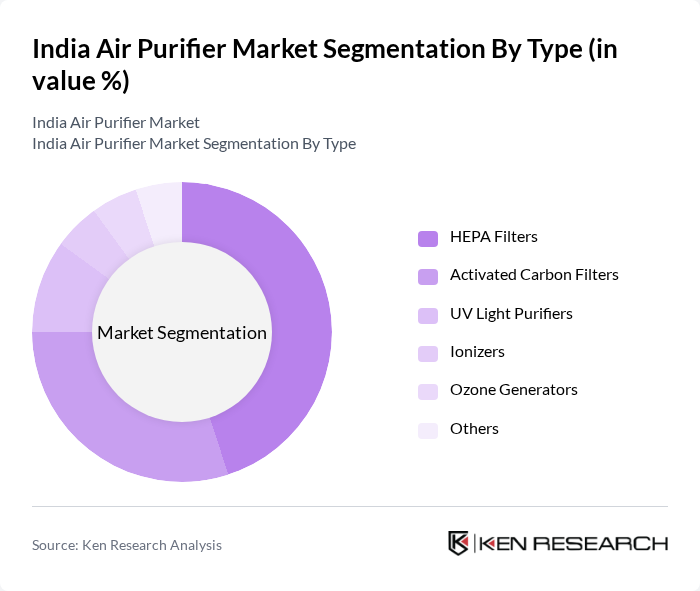

By Type: The air purifier market can be segmented into various types, including HEPA Filters, Activated Carbon Filters, UV Light Purifiers, Ionizers, Ozone Generators, and Others. Among these, HEPA filters are the most popular due to their efficiency in capturing particulate matter, making them a preferred choice for consumers concerned about air quality. Activated Carbon Filters also hold a significant share, particularly for their ability to remove odors and volatile organic compounds (VOCs). The demand for UV Light Purifiers is growing as consumers become more aware of the need for sterilization in addition to filtration.(source)

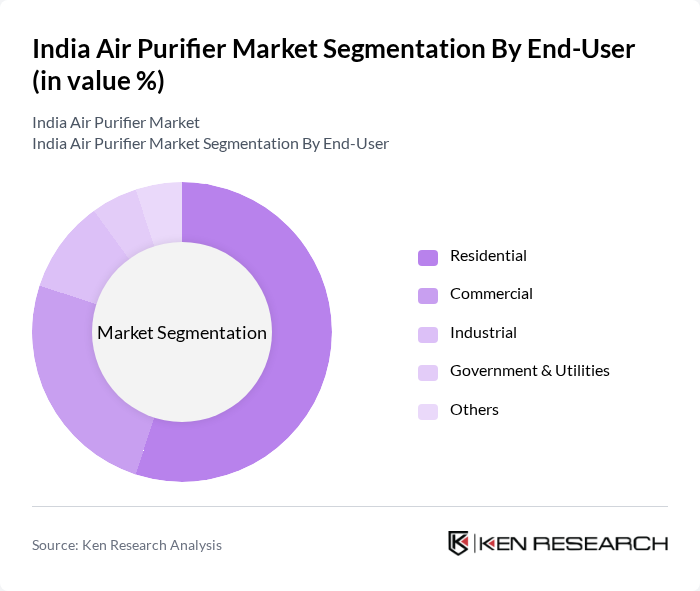

By End-User: The market can be segmented based on end-users, including Residential, Commercial, Industrial, Government & Utilities, and Others. The residential segment dominates the market, driven by increasing consumer awareness regarding health and air quality. The commercial segment is also significant, as businesses invest in air purifiers to ensure a healthy work environment for employees. The industrial segment is growing, particularly in manufacturing and processing industries, where air quality is critical for operational efficiency.(source)(source)

India Air Purifier Market Competitive Landscape

The India Air Purifier Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips India, Dyson Technology India, Honeywell India, Xiaomi India, Eureka Forbes, Kent RO Systems, Sharp India, Panasonic India, Blueair India, Livpure, LG Electronics India, Godrej Appliances, Whirlpool India, Daikin India, Syska LED contribute to innovation, geographic expansion, and service delivery in this space.

| Philips India | 1954 | Mumbai, India | – | – | – | – | – | – |

| Dyson Technology India | 2012 | Singapore | – | – | – | – | – | – |

| Honeywell India | 1958 | Pune, India | – | – | – | – | – | – |

| Xiaomi India | 2014 | Bengaluru, India | – | – | – | – | – | – |

| Eureka Forbes | 1982 | Mumbai, India | – | – | – | – | – | – |

| Company | Establishment Year | Headquarters | Group Size (Large, Medium, or Small as per industry convention) | Revenue Growth Rate | Market Penetration Rate | Customer Retention Rate | Product Diversification Index | Distribution Channel Efficiency |

|---|

``````html

India Air Purifier Market Industry Analysis

Growth Drivers

- Increasing Air Pollution Levels: The alarming rise in air pollution levels in India, particularly in urban areas, is a significant growth driver for the air purifier market. According to the World Health Organization, approximately 1.6 million deaths in India were attributed to air pollution recently. The average PM2.5 concentration in major cities like Delhi reached 126 µg/m³, far exceeding the safe limit of 10 µg/m³. This dire situation has led consumers to seek effective air purification solutions to safeguard their health.

- Rising Health Awareness Among Consumers: Growing health consciousness among Indian consumers is propelling the demand for air purifiers. A survey by the Indian Council of Medical Research indicated that 75% of urban residents are increasingly concerned about indoor air quality. This awareness is further fueled by rising respiratory diseases, with asthma cases in India estimated at 35 million. Consequently, consumers are investing in air purifiers to mitigate health risks associated with poor air quality.

- Government Initiatives for Clean Air: The Indian government has launched several initiatives aimed at improving air quality, which positively impacts the air purifier market. The National Clean Air Programme (NCAP) aims to reduce particulate matter levels by 20-30% in future. Additionally, the government has allocated ?4,500 crore (approximately $600 million) for air quality management recently. These initiatives not only raise awareness but also encourage consumers to invest in air purification technologies.

Market Challenges

- High Initial Costs of Air Purifiers: One of the primary challenges facing the air purifier market in India is the high initial cost of these devices. Quality air purifiers can range from ?10,500 to ?52,000 (approximately $140 to $670), which can be prohibitive for many consumers. This financial barrier limits market penetration, especially in lower-income segments, where affordability is a significant concern. As a result, many potential customers opt for cheaper, less effective alternatives.

- Lack of Consumer Awareness: Despite the growing health concerns, a significant challenge remains the lack of consumer awareness regarding the benefits of air purifiers. A study by the Consumer Electronics and Appliances Manufacturers Association revealed that only 32% of consumers are aware of the advantages of using air purifiers. This knowledge gap hinders market growth, as many consumers remain unaware of how air purifiers can improve indoor air quality and overall health.

India Air Purifier Market Future Outlook

The future of the air purifier market in India appears promising, driven by increasing urbanization and a heightened focus on health and wellness. As air quality continues to deteriorate, consumers are likely to prioritize air purification solutions. Additionally, advancements in technology, such as smart air purifiers equipped with IoT capabilities, are expected to enhance user experience and drive adoption. The market is poised for growth as manufacturers innovate and address consumer needs for effective air quality management.

Market Opportunities

- Expansion into Tier 2 and Tier 3 Cities: There is a significant opportunity for air purifier manufacturers to expand into Tier 2 and Tier 3 cities, where air pollution levels are rising. With urbanization increasing in these regions, the demand for air purifiers is expected to grow. Targeting these markets can lead to increased sales and brand loyalty as consumers become more health-conscious.

- Development of Smart Air Purifiers: The integration of smart technology in air purifiers presents a lucrative opportunity. Consumers are increasingly seeking devices that offer connectivity and automation. Smart air purifiers that can be controlled via mobile apps or integrated with home automation systems are likely to attract tech-savvy consumers, enhancing market growth and product differentiation.

```

Scope of the Report

| By Type |

HEPA Filters Activated Carbon Filters UV Light Purifiers Ionizers Ozone Generators Others |

| By End-User |

Residential Commercial Industrial Government & Utilities Others |

| By Region |

North India South India East India West India |

| By Technology |

Mechanical Filters Chemical Filters Biological Filters Hybrid Systems Others |

| By Application |

Home Use Office Use Healthcare Facilities Educational Institutions Others |

| By Investment Source |

Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support |

Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

Products

Key Target Audience

Air purifier Companies

Component Manufacturing Companies

Consumer Appliance Companies

Air Purifier OEMs/Assemblers

Air Purifier Importers/Exporters

Modern Trade Chains

Consultancy Companies

Time Period Captured in the Report:-

Historical Period: FY’2014 - FY’2020

Forecast Period: FY’2020 - FY’2025

Companies

Players Mentioned in the Report:

Philips India

Dyson Technology India

Honeywell India

Xiaomi India

Eureka Forbes

Kent RO Systems

Sharp India

Panasonic India

Blueair India

Livpure

LG Electronics India

Godrej Appliances

Whirlpool India

Daikin India

Syska LED

Table of Contents

Market Assessment Phase

1. Executive Summary and Approach

2. India Air Purifier Market Overview

2.1 Key Insights and Strategic Recommendations

2.2 India Air Purifier Market Overview

2.3 Definition and Scope

2.4 Evolution of Market Ecosystem

2.5 Timeline of Key Regulatory Milestones

2.6 Value Chain & Stakeholder Mapping

2.7 Business Cycle Analysis

2.8 Policy & Incentive Landscape

3. India Air Purifier Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Air Pollution Levels

3.1.2 Rising Health Awareness Among Consumers

3.1.3 Government Initiatives for Clean Air

3.1.4 Technological Advancements in Air Purification

3.2 Market Challenges

3.2.1 High Initial Costs of Air Purifiers

3.2.2 Lack of Consumer Awareness

3.2.3 Competition from Low-Cost Alternatives

3.2.4 Regulatory Compliance Issues

3.3 Market Opportunities

3.3.1 Expansion into Tier 2 and Tier 3 Cities

3.3.2 Development of Smart Air Purifiers

3.3.3 Collaborations with Health Institutions

3.3.4 Increasing Demand for Portable Air Purifiers

3.4 Market Trends

3.4.1 Growing Popularity of HEPA Filters

3.4.2 Integration of IoT in Air Purifiers

3.4.3 Shift Towards Eco-Friendly Products

3.4.4 Customization and Personalization of Products

3.5 Government Regulation

3.5.1 Standards for Indoor Air Quality

3.5.2 Energy Efficiency Regulations

3.5.3 Import Tariffs on Air Purifiers

3.5.4 Incentives for Green Technology Adoption

4. SWOT Analysis

5. Stakeholder Analysis

6. Porter's Five Forces Analysis

7. India Air Purifier Market Market Size, 2019-2024

7.1 By Value

7.2 By Volume

7.3 By Average Selling Price

8. India Air Purifier Market Segmentation

8.1 By Type

8.1.1 HEPA Filters

8.1.2 Activated Carbon Filters

8.1.3 UV Light Purifiers

8.1.4 Ionizers

8.1.5 Ozone Generators

8.1.6 Others

8.2 By End-User

8.2.1 Residential

8.2.2 Commercial

8.2.3 Industrial

8.2.4 Government & Utilities

8.2.5 Others

8.3 By Region

8.3.1 North India

8.3.2 South India

8.3.3 East India

8.3.4 West India

8.4 By Technology

8.4.1 Mechanical Filters

8.4.2 Chemical Filters

8.4.3 Biological Filters

8.4.4 Hybrid Systems

8.4.5 Others

8.5 By Application

8.5.1 Home Use

8.5.2 Office Use

8.5.3 Healthcare Facilities

8.5.4 Educational Institutions

8.5.5 Others

8.6 By Investment Source

8.6.1 Domestic Investment

8.6.2 Foreign Direct Investment (FDI)

8.6.3 Public-Private Partnerships (PPP)

8.6.4 Government Schemes

8.6.5 Others

8.7 By Policy Support

8.7.1 Subsidies

8.7.2 Tax Exemptions

8.7.3 Renewable Energy Certificates (RECs)

8.7.4 Others

9. India Air Purifier Market Competitive Analysis

9.1 Market Share of Key Players

9.2 Cross Comparison of Key Players

9.2.1 Company Name

9.2.2 Group Size (Large, Medium, or Small as per industry convention)

9.2.3 Revenue Growth Rate

9.2.4 Market Penetration Rate

9.2.5 Customer Retention Rate

9.2.6 Product Diversification Index

9.2.7 Distribution Channel Efficiency

9.2.8 Pricing Strategy

9.2.9 Brand Recognition Score

9.2.10 Customer Satisfaction Index

9.3 SWOT Analysis of Top Players

9.4 Pricing Analysis

9.5 Detailed Profile of Major Companies

9.5.1 Philips India

9.5.2 Dyson Technology India

9.5.3 Honeywell India

9.5.4 Xiaomi India

9.5.5 Eureka Forbes

9.5.6 Kent RO Systems

9.5.7 Sharp India

9.5.8 Panasonic India

9.5.9 Blueair India

9.5.10 Livpure

9.5.11 LG Electronics India

9.5.12 Godrej Appliances

9.5.13 Whirlpool India

9.5.14 Daikin India

9.5.15 Syska LED

10. India Air Purifier Market End-User Analysis

10.1 Procurement Behavior of Key Ministries

10.1.1 Government Procurement Policies

10.1.2 Budget Allocations for Air Quality Improvement

10.1.3 Collaboration with Private Sector

10.1.4 Evaluation Criteria for Suppliers

10.2 Corporate Spend on Infrastructure & Energy

10.2.1 Investment Trends in Air Quality Solutions

10.2.2 Budgeting for Sustainability Initiatives

10.2.3 Corporate Social Responsibility (CSR) Spending

10.2.4 Partnerships with Environmental Organizations

10.3 Pain Point Analysis by End-User Category

10.3.1 Residential Concerns

10.3.2 Commercial Sector Challenges

10.3.3 Industrial Air Quality Issues

10.3.4 Government Facility Requirements

10.4 User Readiness for Adoption

10.4.1 Awareness Levels Among Consumers

10.4.2 Willingness to Invest in Air Purification

10.4.3 Adoption of Smart Technologies

10.4.4 Feedback Mechanisms for Improvement

10.5 Post-Deployment ROI and Use Case Expansion

10.5.1 Measurement of Air Quality Improvement

10.5.2 Cost Savings from Health Benefits

10.5.3 Expansion into New Use Cases

10.5.4 Long-term Sustainability Goals

11. India Air Purifier Market Future Size, 2025-2030

11.1 By Value

11.2 By Volume

11.3 By Average Selling Price

Go-To-Market Strategy Phase

1. Whitespace Analysis + Business Model Canvas

1.1 Market Gaps Identification

1.2 Value Proposition Development

1.3 Revenue Streams Analysis

1.4 Cost Structure Evaluation

1.5 Key Partnerships Exploration

1.6 Customer Segmentation

1.7 Channels of Distribution

2. Marketing and Positioning Recommendations

2.1 Branding Strategies

2.2 Product USPs

2.3 Target Audience Identification

2.4 Communication Strategy

2.5 Digital Marketing Approaches

2.6 Offline Marketing Tactics

2.7 Performance Metrics

3. Distribution Plan

3.1 Urban Retail Strategies

3.2 Rural NGO Tie-ups

3.3 E-commerce Integration

3.4 Direct Sales Channels

3.5 Distribution Partnerships

3.6 Logistics and Supply Chain Management

3.7 Inventory Management Solutions

4. Channel & Pricing Gaps

4.1 Underserved Routes

4.2 Pricing Bands Analysis

4.3 Competitor Pricing Strategies

4.4 Consumer Price Sensitivity

4.5 Discounting Strategies

4.6 Bundling Opportunities

4.7 Value-Based Pricing Models

5. Unmet Demand & Latent Needs

5.1 Category Gaps Identification

5.2 Consumer Segments Analysis

5.3 Product Development Opportunities

5.4 Market Entry Strategies

5.5 Feedback Collection Mechanisms

5.6 Innovation in Product Features

5.7 Future Trends Anticipation

6. Customer Relationship

6.1 Loyalty Programs

6.2 After-sales Service

6.3 Customer Feedback Systems

6.4 Community Engagement Initiatives

6.5 Customer Education Programs

6.6 Relationship Management Tools

6.7 Retention Strategies

7. Value Proposition

7.1 Sustainability Initiatives

7.2 Integrated Supply Chains

7.3 Customer-Centric Innovations

7.4 Competitive Differentiation

7.5 Long-term Value Creation

7.6 Brand Loyalty Development

7.7 Market Leadership Positioning

8. Key Activities

8.1 Regulatory Compliance

8.2 Branding Initiatives

8.3 Distribution Setup

8.4 Market Research Activities

8.5 Training and Development Programs

8.6 Performance Monitoring

8.7 Stakeholder Engagement

9. Entry Strategy Evaluation

9.1 Domestic Market Entry Strategy

9.1.1 Product Mix Considerations

9.1.2 Pricing Band Analysis

9.1.3 Packaging Strategies

9.2 Export Entry Strategy

9.2.1 Target Countries Identification

9.2.2 Compliance Roadmap Development

10. Entry Mode Assessment

10.1 Joint Ventures

10.2 Greenfield Investments

10.3 Mergers & Acquisitions

10.4 Distributor Model Evaluation

11. Capital and Timeline Estimation

11.1 Capital Requirements Analysis

11.2 Timelines for Market Entry

12. Control vs Risk Trade-Off

12.1 Ownership vs Partnerships

13. Profitability Outlook

13.1 Breakeven Analysis

13.2 Long-term Sustainability Considerations

14. Potential Partner List

14.1 Distributors

14.2 Joint Ventures

14.3 Acquisition Targets

15. Execution Roadmap

15.1 Phased Plan for Market Entry

15.1.1 Market Setup

15.1.2 Market Entry

15.1.3 Growth Acceleration

15.1.4 Scale & Stabilize

15.2 Key Activities and Milestones

15.2.1 Milestone Planning

15.2.2 Activity Tracking

Disclaimer Contact UsResearch Methodology

```html

Phase 1: Approach

Desk Research

- Market reports from industry associations such as the Air Quality Association of India

- Government publications on air quality standards and regulations from the Ministry of Environment, Forest and Climate Change

- Academic journals and white papers focusing on air pollution and health impacts in urban India

Primary Research

- Interviews with product managers at leading air purifier manufacturers

- Surveys with retailers and distributors in the home appliance sector

- Focus groups with consumers to understand preferences and purchasing behavior

Validation & Triangulation

- Cross-validation of findings through multiple data sources including sales data and consumer feedback

- Triangulation of market trends with insights from environmental NGOs and health organizations

- Sanity checks through expert panels comprising industry veterans and market analysts

Phase 2: Market Size Estimation

Top-down Assessment

- Analysis of national air quality data to estimate the demand for air purifiers

- Segmentation of the market by residential, commercial, and industrial applications

- Incorporation of urbanization trends and population density metrics in major cities

Bottom-up Modeling

- Sales volume data from major retailers and e-commerce platforms

- Cost analysis based on average selling prices and market penetration rates

- Estimation of growth rates based on historical sales data and emerging market trends

Forecasting & Scenario Analysis

- Multi-variable forecasting using economic indicators and air quality improvement initiatives

- Scenario planning based on potential regulatory changes and consumer awareness campaigns

- Development of baseline, optimistic, and pessimistic market growth scenarios through 2030

Phase 3: CATI Sample Composition

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Air Purifier Market | 120 | Homeowners, Apartment Residents |

| Commercial Air Purifier Solutions | 100 | Facility Managers, Office Administrators |

| Industrial Air Quality Management | 80 | Plant Managers, Environmental Compliance Officers |

| Retail Distribution Channels | 70 | Retail Managers, Supply Chain Coordinators |

| Consumer Preferences and Trends | 100 | General Consumers, Health-Conscious Buyers |

```

Frequently Asked Questions

What is the current value of the India Air Purifier Market?

The India Air Purifier Market is valued at approximately USD 580 million, driven by increasing air pollution levels, rising health awareness, and urbanization. This growth reflects a significant demand for improved indoor air quality solutions among consumers and businesses.

What factors are driving the growth of the air purifier market in India?

Key growth drivers include rising air pollution levels, heightened health awareness among consumers, government initiatives for clean air, and technological advancements in air purification. These factors collectively contribute to the increasing demand for air purifiers, especially in urban areas.

Which cities in India have the highest demand for air purifiers?

Delhi, Mumbai, and Bangalore are the leading cities in the India Air Purifier Market. High pollution levels from industrial emissions and vehicular traffic in these urban centers drive significant demand for air purification solutions among health-conscious consumers.

What types of air purifiers are popular in India?

The most popular types of air purifiers in India include HEPA filters, activated carbon filters, UV light purifiers, ionizers, and ozone generators. HEPA filters are favored for their efficiency in capturing particulate matter, while activated carbon filters are preferred for odor removal.

How does the National Clean Air Programme (NCAP) impact the air purifier market?

The National Clean Air Programme (NCAP) aims to reduce PM10 and PM2.5 concentrations in non-attainment cities by 20-30% by 2024. This initiative encourages the adoption of air quality improvement devices, positively influencing the demand for air purifiers in India.

What challenges does the India Air Purifier Market face?

Challenges include high initial costs of quality air purifiers, which can range from 10,500 to 52,000, limiting accessibility for many consumers. Additionally, a lack of consumer awareness regarding the benefits of air purifiers hinders market growth.

What opportunities exist for air purifier manufacturers in India?

Manufacturers can expand into Tier 2 and Tier 3 cities where air pollution is rising. Additionally, developing smart air purifiers with IoT capabilities presents a lucrative opportunity to attract tech-savvy consumers seeking advanced air quality solutions.

How does urbanization affect the air purifier market in India?

Urbanization leads to increased air pollution levels, prompting consumers to seek effective air purification solutions. As more people move to urban areas, the demand for air purifiers is expected to grow, making it a critical factor for market expansion.

What role does consumer health awareness play in the air purifier market?

Growing health awareness among consumers significantly drives the air purifier market. With rising concerns about indoor air quality and respiratory diseases, many consumers are investing in air purifiers to mitigate health risks associated with poor air quality.

Which air purifier brands are leading the market in India?

Leading brands in the India Air Purifier Market include Philips India, Dyson Technology India, Honeywell India, Xiaomi India, and Eureka Forbes. These companies contribute to innovation and service delivery, enhancing competition in the market.

What technological advancements are influencing the air purifier market?

Technological advancements such as IoT connectivity and AI-enabled air quality monitoring are influencing the air purifier market. These features enhance user experience, allowing consumers to monitor and control air quality remotely, thus driving adoption.

What is the expected future outlook for the air purifier market in India?

The future outlook for the India Air Purifier Market is promising, driven by increasing urbanization and a focus on health and wellness. As air quality deteriorates, consumers are likely to prioritize air purification solutions, leading to market growth.

How do government initiatives support the air purifier market?

Government initiatives, such as the National Clean Air Programme, promote awareness and investment in air quality management. By allocating funds for air quality improvement, these initiatives encourage consumers to adopt air purification technologies, positively impacting market growth.

What is the segmentation of the air purifier market by end-user?

The air purifier market is segmented by end-users into residential, commercial, industrial, and government sectors. The residential segment dominates, driven by increasing consumer awareness regarding health and air quality, while the commercial segment also shows significant growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.