Saudi Arabia Bags & Luggage Market Outlook to 2025 (Second Edition)

Driven By Change In Lifestyle, Increasing Travel And Tourism And Customer Inclination Toward High-End Brands

Region:Middle East

Author(s):Apoorva Narula and Nishika Chowcharia

Product Code:KR1061

May 2021

167

About the Report

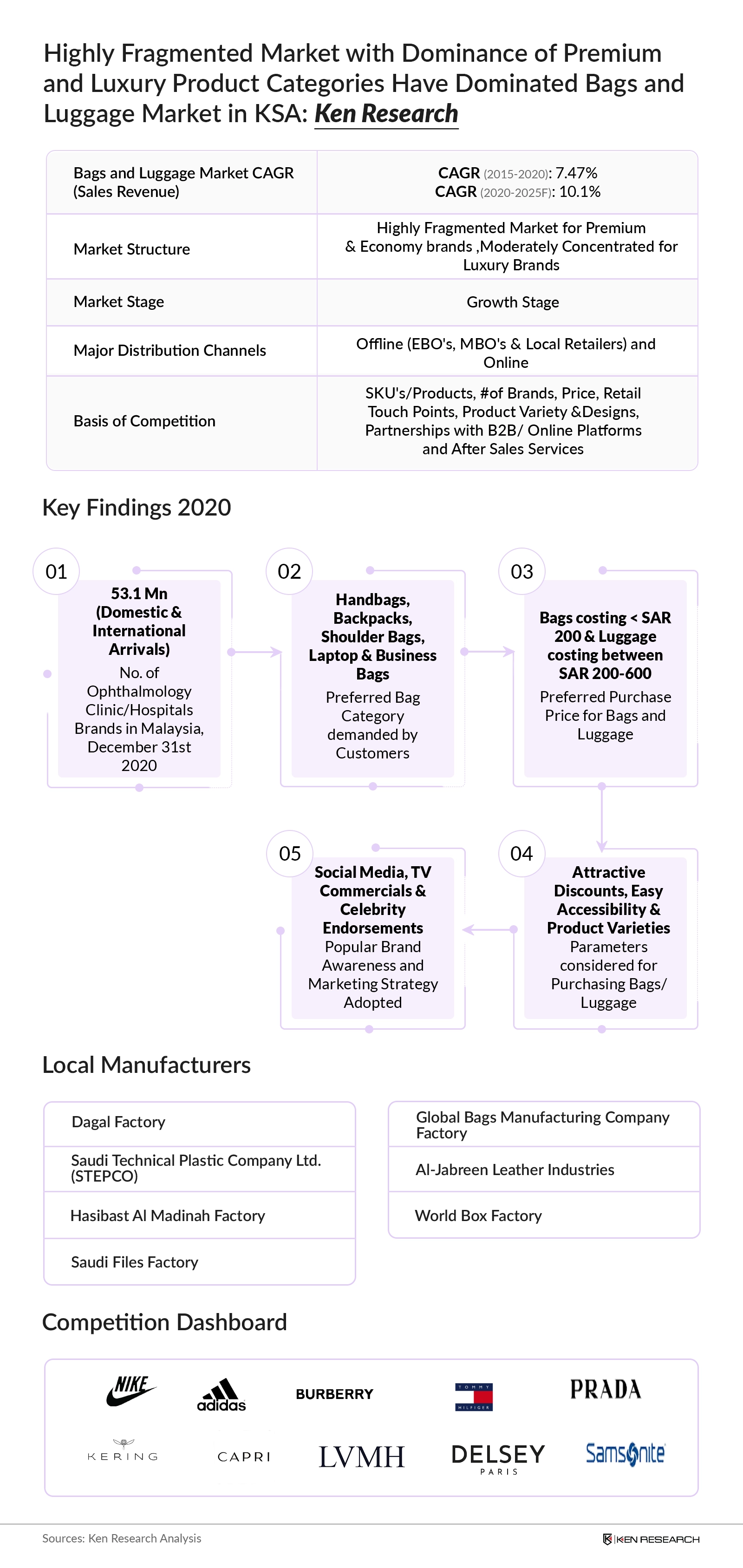

The report titled “Saudi Arabia Bags & Luggage Market Outlook to 2025 (Second Edition) – Driven By Change In Lifestyle, Increasing Travel And Tourism And Customer Inclination Toward High-End Brands” provides a comprehensive analysis of the bags and luggage industry of Saudi Arabia. The report covers various aspects including the current bags and luggage sales in the Kingdom, its segmentations viz, Type of Bags (Handbags, Backpacks, Business Bags, Wallets, Crossbody Bags, Duffel Bags, Briefcases, and Other Bags), Type of Luggage (Hard Case and Soft Case), By Price Segment (Luxury, Premium, and Economy), By Sales Channel (Offline and Online), By Retail Format (EBOs, MBOs, and Local Retailers) and By Type Cities (Riyadh, Jeddah, Dammam, Al Khobar, Mecca & Medina, and others), Consumer Preferences and Trends Analysis, Pricing Analysis, Major trends and development, issues and challenges and competitive benchmarking. The report concludes with market projections for the future of the industry including forecasted industry size by revenue along with GTM Strategy and Recommendations.

Saudi Arabia Bags and Luggage Market

The bags market consists of luxury and nonluxury bags sold online as well as offline channels fuelled by changing demographics, surging the young and women population along with a high tourist influx into the Kingdom. It is an import-driven market where products are contract manufactured in countries such as China, Vietnam, Brazil, and Bangladesh and are directly imported into the Kingdom. KSA luggage and bags market saw a dramatic decline in the historical period 2015-2020 owing to the global pandemic which led to a reduction in footfall to shopping malls and retailing stores along with leisure and business travels decreasing significantly as consumers had to stay at home. This had a particularly detrimental impact on bags as many of these sales are either dependent on the tourist population or carried out on impulse. However, Companies are focusing on building an omnichannel strategy since the conventional brick and mortar retail business will follow a downward trend over the years with e-retailing to exponentially grow to post the corona pandemic.

Saudi Arabia Segmentation

By Product Type (Bags and Luggage): The bags segment held a higher share in the market owing to the launch of new product variants within handbags, backpacks, and duffel bags. However, the growing customer inclination towards high-end luggage equipped with Global Positioning System (GPS) tracker, rising urbanization, and increasing disposable income are expected to drive the luggage market over the predicted years.

By Region: Riyadh is the capital region witnessed very high infrastructure accompanied by strong retail growth and contributed the majority of the revenue share due to its high population followed by Jeddah with high tourist influx during the festivals such as Ramadan drawing huge crowds to the historical city. The Eastern region is expected to foresee some major development like the construction of Neom. Many luxury brands are now focusing on Dammam which is the biggest city in the eastern region.

Saudi Arabia Bags Market Segmentation

By Type of Bags: Handbags dominate the market in terms of revenue for 2020 followed by backpacks and business bags owing to an increase in a number of ex-pats requiring business bags (including laptop bags) for their daily activities Handbags and other bags such as crossbody, backpacks, and wallets has been boosted by the increase in a number of shops opened across numerous shopping malls in the country.

By Price Range: Economy bags remained the dominant category in the market in terms of revenues in KSA. The majority of the brands in the economy bags category follow the product launches of luxury brands and make their product similar to them, thus providing a cheaper alternative to the luxury bags.

By Sales Channel: Bags specialist retailers, including EBOs, MBOs, and Local Retailers in KSA were observed to dominate in 2020 in terms of revenue share. However, the working population (20-35 years old) usually prefers online E-commerce platforms for purchasing bags and luggage due to the attractive discounts and product varieties visible on the platforms.

By Retail Format: Local Retailers dominated the offline market with the majority of the revenue share in 2020. Bags such as Handbags, Crossbody, Business, and Laptop Bags are mostly purchased through EBOs such as Samsonite, TUMI, Delsey, Nike, Gucci, American Tourister, LMVH, Michael Kors, Adidas while Backpacks and Wallets are mostly purchased from Multi-Brand Stores such as Splash, Lifestyle, Centre Point, Rubaiyat, and others

Saudi Arabia Luggage Market Segmentation

By Type of Luggage: Hard Case Luggage from brands such as TUMI, Samsonite, and Delsey with economical pricing dominates the Luggage Market in KSA. The hard case segment includes luggage made from Aluminum, Polycarbonate, Polypropylene, Leather, and ABS. Preference is given to a durable material that is lighter and can be altered according to the latest styles.

By Price Range: Premium luggage remained the dominant category in the market in terms of revenues in 2020. Infrastructure development in Saudi Arabia is expected to increase the number of shopping malls in the kingdom leading to higher footfall in EBOs and MBOs, thus driving the demand for luggage in the premium and luxury price segment.

By Sales Channel: Offline channels, particularly the MBO’s showcasing wide varieties of Luggage with multiple price points and ease of return/exchange services are preferred by customers in KSA. The competition in the luggage market is expected to intensify in the coming which will push the brands to open more EBOs in order to improve their brand visibility.

By Retail Format: Local Retailers dominated the offline market in the luggage category with the majority of the revenue share in 2020. Most of the brands use the EBO retail format in order to enhance their brand pull. These stores generally do not offer discounts on products, thus having a low market share.

Comparative Landscape in Saudi Arabia Bags and Luggage Market

The competition was observed to be highly fragmented for premium & economy brands and concentrated for high-end luxury brands with the presence of a broad gamut of modern trade channels. Companies are increasingly adopting the omnichannel distribution strategy post-COVID to gain a foothold in the market since customers are skeptical about visiting offline stores. Brands such as Samsonite will cut down their advertising spends for the coming years and increase their spend on the digital medium to gain more traction. The company is also focusing on smaller products that can carry items like hand sanitizer and extra masks which can be folded up into a tiny square when not in use and other accessories such as iPhones and sunglasses. Companies are competing on various parameters such as SKUs, Price offered, After Sale Services, Retail TouchPoints, Partnerships with B2B/Online Platforms, Brands, and more.

Saudi Arabia Bags and Luggage Market Future Outlook and Projections

The bags and luggage market in Saudi Arabia are expected to experience double-digit growth owing to new product variants, investment in smart luggage products, online distribution, and shift from mass to premium pricing bags and luggage category. The market is expected to gain momentum with rising in disposable income per capita and an increase in the target population along with a majority of the demand from Tier 1 and Tier 2 cities such as Riyadh, Jeddah, Dammam, and others. The growing customer inclination towards bags with fingerprint locking, built-in GPS, Bluetooth speakers, self-weighing scales to gain traction in the near future.

Key Topics Covered in the Report

- Saudi Arabia Luggage and Bags Market Introduction

- Saudi Arabia Luggage and Bags Market Size, 2015-2020

- Saudi Arabia Luggage and Bags Market Segmentation, 2015-2020

- Growth Drivers for KSA Luggage and Bags Market

- Understanding the Target Market for Bags & Luggage Industry

- Recommended Store Layout & Proposed Business Framework

- The landscape of Local Manufacturers, Distributors & Retailers in KSA Bags and Luggage Market

- Potential B2B Partnership Strategy (Partnership with Corporate, Schools, CSD, and Local Retailers )

- Competition Scenario of Bags and Luggage Market in KSA

- 4Ps and Pricing Analysis in KSA Luggage and Bags Market

- Global Practices and Global Case Scenarios that can be Adopted in KSA

- Technological Innovations in Bags and Luggage Market

- Consumer’s Decision Making Parameters and Buying Behavior in KSA Luggage and Bags Market

- Issues and Challenges in KSA Luggage and Bags Market

- KSA Luggage and Bags Market Future Outlook and Projections, 2020-2025F

- GTM and Market Opportunities for KSA Luggage and Bags Market

Products

Key Target Audience

Luggage Manufacturers

Bags Manufacturer

Retailers and Distributors

Time Period Captured in the Report:

Historical Period: 2015-2020

Forecast Period: 2020–2025

Companies

Local Manufacturers:

Dagal Factory for tanning leather and leather goods

Saudi Technical Plastic Company Ltd. (STEPCO)

Global Bags Manufacturing Company Factory

Hasibast Al Madinah Factory

Al-Jabreen Leather Industries

Saudi Files Factory

World Box Factory

Distributors/ Trading Companies:

Al Futtaim

Al Malki Group

Chaloub Group

Al Shamasy

Ali Zaid Al Quarishi & Brothers

Al Sawani Group

Al Sannat for Luggage

Al Tayer

Rubaiyat

Grand Stores LLC

Etoile Group

Fawaz Alhokair Group

Al Athar Group

Apparel Group

Saudi Jawahir

Sun & Sand LLC

Bags and Luggage Brands

LVMH

Samsonite Group (Samsonite, Kamiliant, High Sierra, American Tourister)

Kering

Capri Holding

Prada

Delsey

Burberry

Tommy

Nike

Adidas

TUMI

Aldo Group

Christian Dior

Table of Contents

1. Socio-Economic Landscape of Saudi Arabia

2. KSA Bags and Luggage Market Overview

2.1 Total Addressable Market (Basis Population, Income, Age composition, Expat Population, Gender, and Tourists Expenditure)

2.2 Industry Ecosystem (Domestic Manufacturers, EBO’s, MBO’s, E-Commerce Websites and Distributors)

2.3 Value Chain Analysis (Entities Involved, Role of Entities, End-Consumers and Operators)

2.4 KSA Luggage and Bags Market Size, 2015-2020

2.5 KSA Luggage and Bags Market Segmentation by Type, 2015-2020

2.6 Growth Drivers for KSA Luggage and Bags Market

3. KSA Bags and Luggage Market Segmentation

3.1 Saudi Arabia Bags Market Segmentation

3.2 By Type of Bags (Handbags, Briefcases, Backpacks, Business Bags, Cross body Bags, Duffel Bags, Wallets and Other Types of Bags), 2020

3.3 By Price Segment (Luxury, Premium, and Economy), 2020

3.4 By Sales Channel (Offline- EBO, MBO Local Retailer and Online Retailers), 2020

3.5 Saudi Arabia Luggage Market Segmentation

3.6 By Case Type (Hard and Soft), 2020

3.7 By Price Segment (High, Medium and Low), 2020

3.8 By Sales Channel (Offline- EBO, MBO Local Retailer and Online Retailers), 2020

4. Future Outlook and Projections for KSA Bags and Luggage Market

4.1 Industry Future Outlook and Projections to 2025F

4.2 Future Segmentations of KSA Bags Market, 2020-2025F

4.3 Future Segmentations of KSA Luggage Market, 2020-2025F

5. GTM Strategy and Recommendations

5.1 Executive Summary

5.2 Understanding the Target Market for Bags & Luggage Industry

5.3 Road Map towards Brand Awareness & Gaining Traction through Expansion

5.4 Identifying Customer Cohorts & Understanding the Target Market

5.5 Recommended Store Layout & Proposed Business Framework

5.6 Recommendations By City- Mix of Products and Sales Techniques to be Adopted (Riyadh, Jeddah, Dammam Al-Khobar, Mecca and Medina)

5.7 Landscape of Local Manufacturers, Distributors & Retailers in KSA Bags and Luggage Category

5.8 Competitive Landscape of Local Manufacturers

5.9 Potential List of Manufacturers, Traders and Distributors (Cross Comparison on the Basis of Vintage, Headquarters, Regional Presence, Product Offerings, Revenues, Production Capacity, Brand Catered and Contact Details)

6. Partnership Strategy

6.1 Partnership with Online Companies (Cross Comparison of Major E-Commerce Websites Basis Establishment Year, Parent Company, Daily Page Per Views, Daily Time on Site, Bounce Rate, Regional Presence, Value Sold/GMV, Best Selling category of Bags and Luggage, Best Selling Bags/ Brand by categories, Number of Bags/SKU listed, Logistics Operations, and Analyst Rating)

6.2 Partnership with Logistics Companies (Cross Comparison on the Basis of Vintage, Headquarters, Regional Presence, Product Offerings, Revenues, Service Mix, Warehouses, Average Price, Technology and others)

7. Competition Analysis

7.1 Competitive Positioning Framework (Market Positioning of Brands in KSA in terms of Price and Product)

7.2 Competition Scenario of Bags and Luggage Market in KSA (Competition Stage, Key Trends, Market Revenues of Major Brands, Competitive Parameters)

7.3 Strengths and Weaknesses of Major Players

7.4 Pricing Analysis

7.5 4Ps Analysis

8. Marketing and Promotional Strategies in KSA

8.1 Potential B2B Partnership Strategy (Partnership with Corporate, Schools , CSD and Local Retailers )

8.2 Global Practices and Global Case Scenarios that can be Adopted in KSA

8.3 Technological Innovations in Bags and Luggage Market

8.4 Risk Factors Associated with the Industry

9. Customer Survey (To understand the Preferred Purchasing Channels and Buying Decisions, Preferred Brands, Preferred Price and other criteria)

9.1 Consumer Survey Analysis and Key Takeaways

9.2 Brand Equity Index (Based on Value for Money, Brand Value: Goodwill, Accessibility, Perceived Quality and Unique Design from Customer Survey)

10. Appendix

10.1 Trends and Developments of Luggage and Bags Market in KSA

10.2 Issues and Challenges in Saudi Arabia Bags and Luggage Market

10.3 Trade Scenario in Bags and Luggage Market (Import, Export and Re Export)

10.4 Pricing Analysis in terms of High and Low Priced SKU’s

11. Research Methodology

11.1 Definitions, Abbreviations, Sample Size Inclusion, Approach Used, Future Forecasting Methodology and Research Limitations

12. Disclaimer

13. Contact Us

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.