Region:Middle East

Author(s):Dev

Product Code:KRAD0474

Pages:96

Published On:August 2025

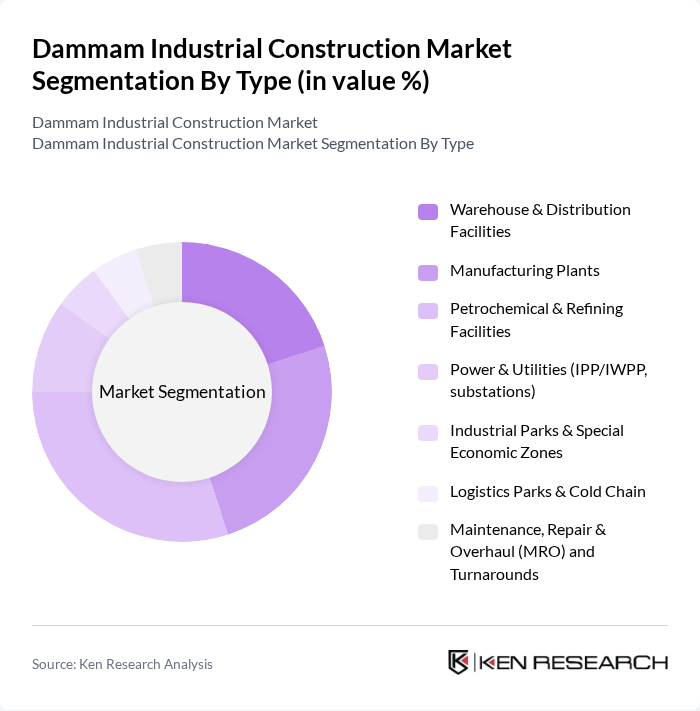

By Type:The Dammam Industrial Construction Market is segmented into Warehouse & Distribution Facilities, Manufacturing Plants, Petrochemical & Refining Facilities, Power & Utilities (IPP/IWPP, substations), Industrial Parks & Special Economic Zones, Logistics Parks & Cold Chain, and Maintenance, Repair & Overhaul (MRO) and Turnarounds. Each of these segments plays a crucial role in supporting the industrial ecosystem in Dammam. Recent sources indicate manufacturing facilities and warehousing/logistics are among the largest and fastest-growing components due to e-commerce, industrial diversification, and supply-chain localization, while petrochemical and refining remain structurally important given the energy base.

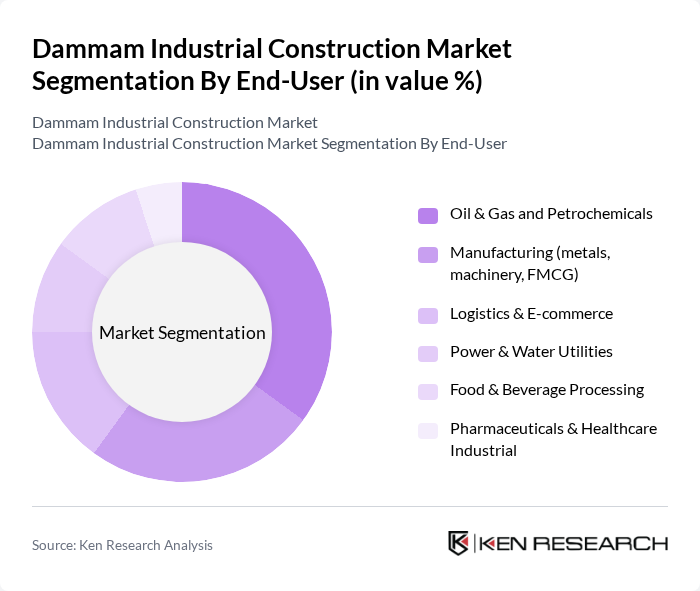

By End-User:The end-user segmentation includes Oil & Gas and Petrochemicals, Manufacturing (metals, machinery, FMCG), Logistics & E-commerce, Power & Water Utilities, Food & Beverage Processing, and Pharmaceuticals & Healthcare Industrial. Each end-user category reflects the diverse industrial landscape in Dammam, catering to various sectors that drive economic growth. Oil and gas/petrochemicals anchor demand, while manufacturing and logistics construction are expanding with Vision 2030 localization and trade/logistics initiatives.

The Dammam Industrial Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nesma & Partners Contracting Company, Al Bawani Co., Al Kifah Contracting Co. (AlKifah Holding), Zamil Steel Construction Co., Alfanar Construction, El Seif Engineering Contracting, Saudi Aramco Project Management (as client EPCM/prequalifier), Sinohydro Corporation Limited (Saudi Branch), Hyundai Engineering & Construction Co., Ltd., Larsen & Toubro (L&T) — Saudi Operations, Rawabi Holding (Rawabi Specialized Contracting), SATCO — Saudi Arabian Trading & Construction Co., Al-Mabani General Contractors, Al Fouzan Trading & General Construction Co., Mohammed Al?Rashid Trading & Contracting Co. (MRTCC) contribute to innovation, geographic expansion, and service delivery in this space.

The Dammam industrial construction market is poised for significant growth, driven by ongoing infrastructure investments and a strong push for economic diversification. As the government continues to implement Vision 2030 initiatives, the demand for industrial facilities is expected to rise, creating new opportunities for construction firms. Additionally, advancements in construction technologies and sustainable practices will likely shape the future landscape, enhancing efficiency and reducing environmental impacts in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Warehouse & Distribution Facilities Manufacturing Plants Petrochemical & Refining Facilities Power & Utilities (IPP/IWPP, substations) Industrial Parks & Special Economic Zones Logistics Parks & Cold Chain Maintenance, Repair & Overhaul (MRO) and Turnarounds |

| By End-User | Oil & Gas and Petrochemicals Manufacturing (metals, machinery, FMCG) Logistics & E?commerce Power & Water Utilities Food & Beverage Processing Pharmaceuticals & Healthcare Industrial |

| By Application | Greenfield Industrial Facilities Brownfield Expansion & Modernization Industrial Warehousing & Fulfillment Centers Industrial Utilities & Infrastructure (roads, pipe racks) |

| By Investment Source | Private Sector Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) State-Owned Enterprises and Government Capex |

| By Policy Support | Industrial Land/Lease Incentives (MODON, Royal Commission) Tax & Zakat Incentives Local Content & Procurement (LCP/NIDLP) Export & Financing Support (SIDF, PIF) |

| By Project Size | Small Scale Projects ( |

| By Construction Method | EPC (Engineering, Procurement, Construction) Design-Build Modular/Offsite Industrial Construction Turnkey and Fast-Track Delivery |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Construction Projects | 110 | Project Managers, Site Engineers |

| Construction Material Suppliers | 80 | Sales Managers, Procurement Officers |

| Regulatory Compliance in Construction | 60 | Compliance Officers, Legal Advisors |

| Construction Equipment Rental Services | 70 | Operations Managers, Business Development Executives |

| Infrastructure Development Initiatives | 90 | Urban Planners, Government Officials |

The Dammam Industrial Construction Market is valued at approximately USD 4 billion, reflecting significant growth driven by rapid industrialization, urbanization, and major infrastructure programs in the Eastern Province, particularly influenced by Saudi Aramco's activities in the region.