Region:Europe

Author(s):Dev

Product Code:KRAB0320

Pages:81

Published On:August 2025

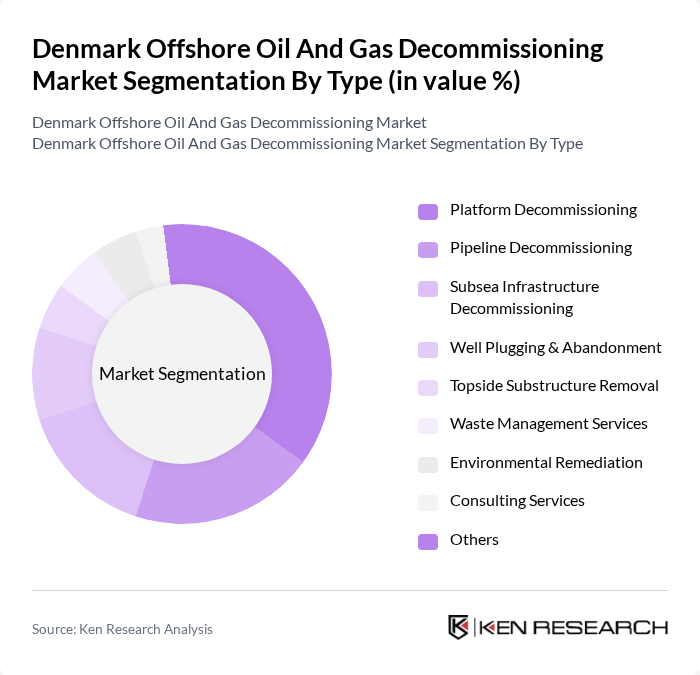

By Type:The decommissioning market is segmented into various types, including platform decommissioning, pipeline decommissioning, subsea infrastructure decommissioning, well plugging and abandonment, topside substructure removal, waste management services, environmental remediation, consulting services, and others. Among these, platform decommissioning remains the most significant segment due to the high number of aging platforms in the North Sea that require dismantling and safe disposal. Plug and abandonment services also represent a substantial portion of the market, reflecting the focus on well decommissioning as fields mature.

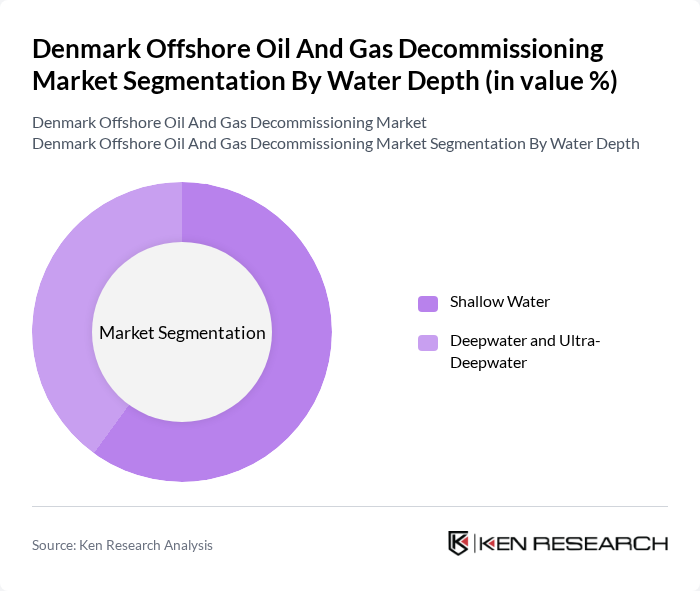

By Water Depth:The market is categorized by water depth into shallow water and deepwater and ultra-deepwater. The shallow water segment is currently leading due to the higher number of decommissioned assets located in these areas, which are often easier and less costly to dismantle compared to deepwater sites. This segmentation reflects the operational focus and cost dynamics of the Danish offshore sector.

The Denmark Offshore Oil and Gas Decommissioning Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maersk Decom, TotalEnergies SE, Ramboll Group, Aker Solutions ASA, TechnipFMC plc, Subsea 7 S.A., Halliburton Company, SLB (Schlumberger), Wood Group plc, Allseas Group S.A., Boskalis Westminster, Heerema Marine Contractors, Petrofac Limited, KBR, Inc., AF Gruppen ASA, Bureau Veritas SA, Saipem S.p.A., ABL Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Denmark offshore oil and gas decommissioning market appears promising, driven by increasing regulatory demands and technological advancements. As the industry shifts towards sustainable practices, companies are likely to invest in innovative solutions that enhance efficiency and reduce environmental impact. Furthermore, the collaboration between private firms and governmental bodies is expected to foster a more streamlined decommissioning process, ensuring compliance with evolving regulations while addressing the challenges posed by aging infrastructure and workforce shortages.

| Segment | Sub-Segments |

|---|---|

| By Type | Platform Decommissioning Pipeline Decommissioning Subsea Infrastructure Decommissioning Well Plugging & Abandonment Topside Substructure Removal Waste Management Services Environmental Remediation Consulting Services Others |

| By Water Depth | Shallow Water Deepwater and Ultra-Deepwater |

| By End-User | Oil and Gas Operators Government Agencies Environmental Organizations Contractors and Service Providers |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| By Project Size | Small Scale Medium Scale Large Scale |

| By Service Type | Engineering Services Project Management Logistics and Transportation |

| By Geographic Scope | National Projects International Projects |

| By Investment Type | Private Investment Public Funding Joint Ventures Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Offshore Decommissioning Projects | 100 | Project Managers, Operations Directors |

| Regulatory Compliance and Environmental Impact | 80 | Regulatory Officers, Environmental Consultants |

| Decommissioning Technology Providers | 60 | Technology Developers, Engineering Managers |

| Waste Management and Disposal Services | 50 | Waste Management Specialists, Logistics Coordinators |

| Stakeholder Engagement and Community Impact | 40 | Community Relations Managers, Public Affairs Officers |

The Denmark Offshore Oil and Gas Decommissioning Market is valued at approximately USD 280 million, driven by the need for decommissioning aging offshore facilities and compliance with stringent environmental regulations.