Region:Africa

Author(s):Dev

Product Code:KRAB3003

Pages:87

Published On:October 2025

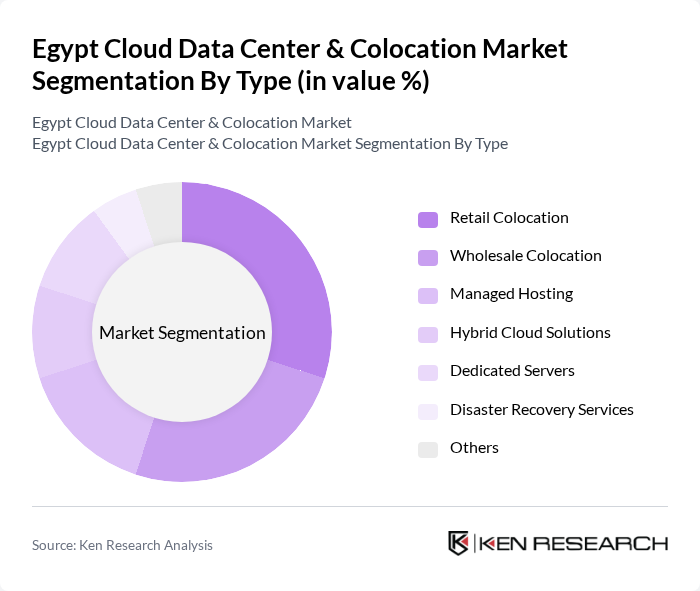

By Type:The market is segmented into various types, including Retail Colocation, Wholesale Colocation, Managed Hosting, Hybrid Cloud Solutions, Dedicated Servers, Disaster Recovery Services, and Others. Each of these segments caters to different customer needs, with Retail Colocation being popular among small to medium enterprises seeking cost-effective solutions, while Wholesale Colocation appeals to larger organizations requiring extensive data center space.

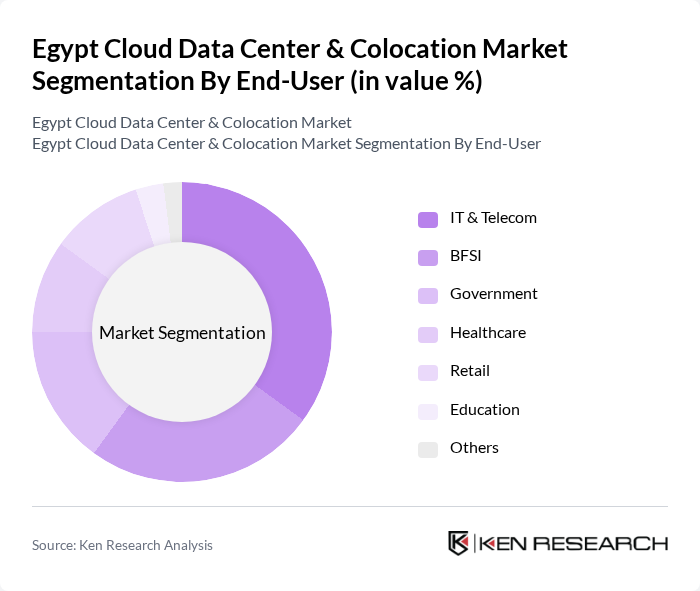

By End-User:The end-user segmentation includes IT & Telecom, BFSI, Government, Healthcare, Retail, Education, and Others. The IT & Telecom sector is the largest consumer of cloud services, driven by the need for scalable infrastructure and enhanced data management capabilities. BFSI follows closely, as financial institutions increasingly adopt cloud solutions for improved operational efficiency and regulatory compliance.

The Egypt Cloud Data Center & Colocation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Orange Business Services, Vodafone Egypt, Etisalat Misr, IBM Egypt, Microsoft Egypt, Amazon Web Services (AWS) Egypt, Noor Data Network, Giza Systems, Raya Data Center, Telecom Egypt, Ingram Micro Egypt, Link Data Center, Cloud Egypt, MenaCloud, Data Center Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt Cloud Data Center and Colocation Market appears promising, driven by increasing digital transformation and government support. As businesses continue to recognize the importance of cloud solutions, the market is expected to witness a surge in investments and innovations. Additionally, the growing focus on cybersecurity and sustainable practices will shape the landscape, ensuring that data centers not only meet current demands but also align with future technological advancements and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail Colocation Wholesale Colocation Managed Hosting Hybrid Cloud Solutions Dedicated Servers Disaster Recovery Services Others |

| By End-User | IT & Telecom BFSI Government Healthcare Retail Education Others |

| By Industry Vertical | E-commerce Media & Entertainment Manufacturing Transportation & Logistics Energy & Utilities Others |

| By Service Model | IaaS (Infrastructure as a Service) PaaS (Platform as a Service) SaaS (Software as a Service) DaaS (Desktop as a Service) Others |

| By Deployment Type | On-Premises Off-Premises Hybrid Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Pricing Model | Pay-as-you-go Subscription-based Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 150 | IT Managers, CTOs, CIOs |

| Colocation Services Utilization | 100 | Data Center Managers, Operations Directors |

| Cloud Security Solutions | 80 | Security Officers, Compliance Managers |

| SME Cloud Migration | 70 | Business Owners, IT Consultants |

| Public Sector Cloud Initiatives | 60 | Government IT Officials, Project Managers |

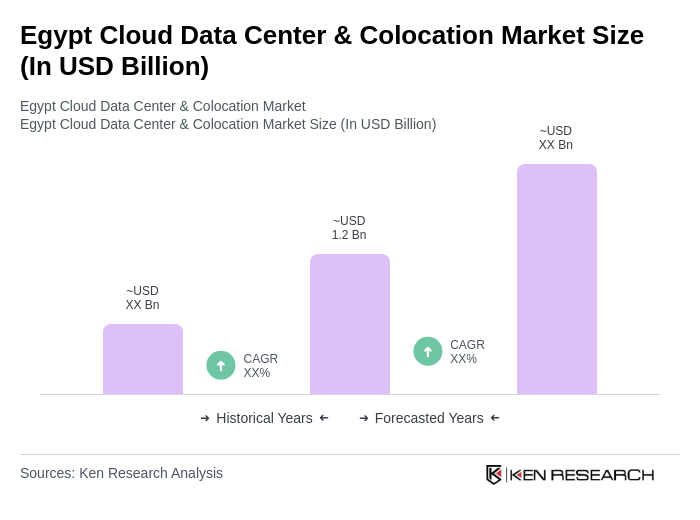

The Egypt Cloud Data Center & Colocation Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing demand for cloud services, digital transformation, and the rise of e-commerce in the region.