Region:Africa

Author(s):Dev

Product Code:KRAB4277

Pages:85

Published On:October 2025

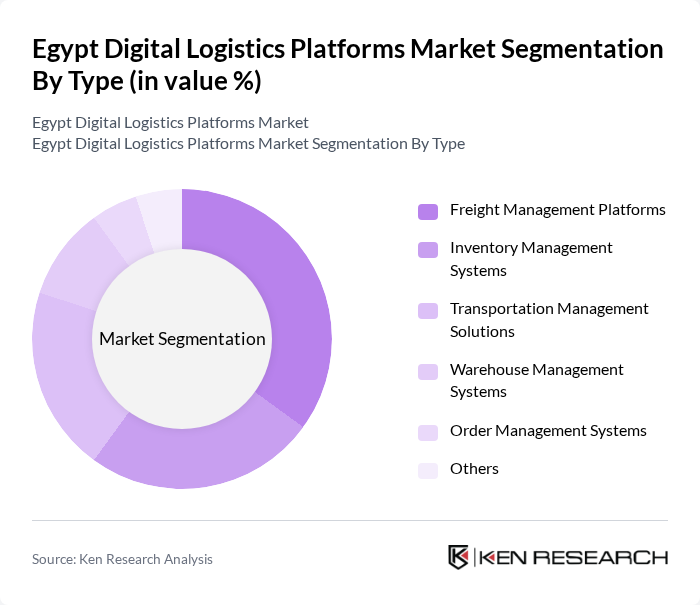

By Type:The market is segmented into various types, including Freight Management Platforms, Inventory Management Systems, Transportation Management Solutions, Warehouse Management Systems, Order Management Systems, and Others. Each of these segments plays a crucial role in streamlining logistics operations and enhancing supply chain efficiency. Among these, Freight Management Platforms are currently leading the market due to their ability to optimize shipping processes and reduce costs.

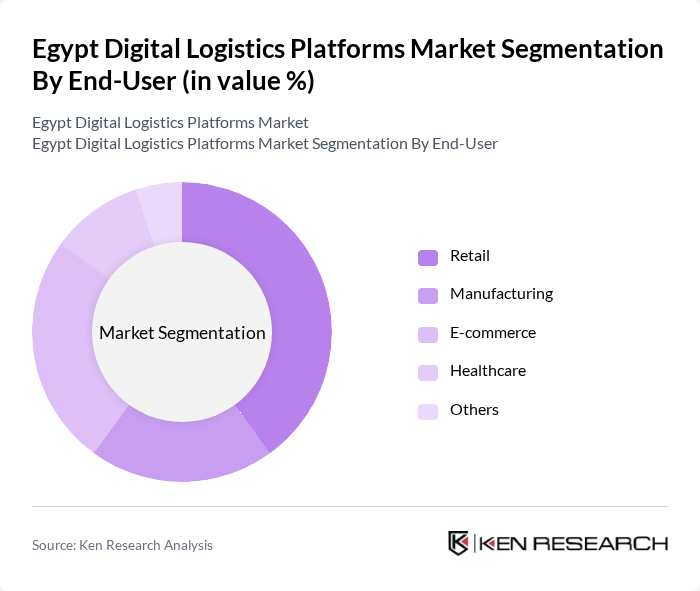

By End-User:The end-user segmentation includes Retail, Manufacturing, E-commerce, Healthcare, and Others. The retail and e-commerce sectors are the most significant contributors to the market, driven by the increasing demand for efficient logistics solutions to meet consumer expectations. E-commerce, in particular, has seen a surge in demand for digital logistics platforms to facilitate quick and reliable deliveries.

The Egypt Digital Logistics Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumia Logistics, Aramex, DHL Egypt, FedEx Egypt, MRS Logistics, El-Wahy Logistics, Transmar, A.P. Moller-Maersk, Agility Logistics, Kuehne + Nagel, GAC Egypt, Al-Futtaim Logistics, A1 Logistics, Suez Canal Container Terminal, Egypt Post contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's digital logistics platforms appears promising, driven by technological advancements and increasing consumer expectations. As urbanization accelerates, logistics companies are likely to invest in automation and data analytics to enhance operational efficiency. Furthermore, the integration of AI and IoT technologies will enable real-time tracking and improved decision-making. These trends, coupled with government support for digital initiatives, are expected to create a more robust logistics ecosystem, fostering innovation and competitiveness in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Management Platforms Inventory Management Systems Transportation Management Solutions Warehouse Management Systems Order Management Systems Others |

| By End-User | Retail Manufacturing E-commerce Healthcare Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Others |

| By Application | B2B Logistics B2C Logistics C2C Logistics Reverse Logistics Others |

| By Sales Channel | Direct Sales Online Sales Distributors Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Tiered Pricing Others |

| By Customer Segment | Small and Medium Enterprises Large Enterprises Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Digital Logistics Adoption | 100 | Logistics Managers, E-commerce Directors |

| Manufacturing Supply Chain Integration | 80 | Operations Managers, Supply Chain Analysts |

| Technology Providers in Logistics | 60 | Product Development Managers, Sales Executives |

| Government Policy Impact on Logistics | 50 | Regulatory Affairs Specialists, Policy Makers |

| Consumer Behavior in E-commerce Logistics | 70 | Market Researchers, Customer Experience Managers |

The Egypt Digital Logistics Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital technologies, the rise of e-commerce, and the demand for efficient supply chain management solutions.