Region:Africa

Author(s):Shubham

Product Code:KRAA3601

Pages:96

Published On:September 2025

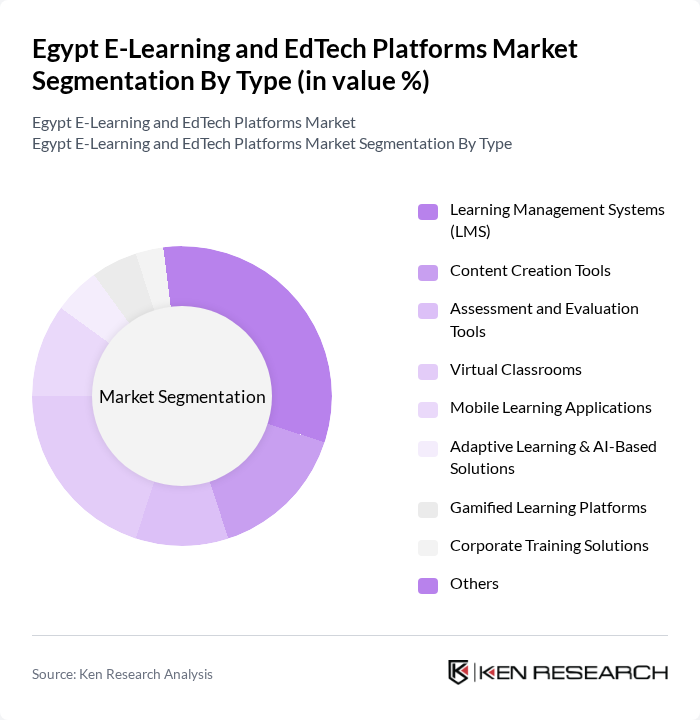

By Type:The market can be segmented into various types, including Learning Management Systems (LMS), Content Creation Tools, Assessment and Evaluation Tools, Virtual Classrooms, Mobile Learning Applications, Adaptive Learning & AI-Based Solutions, Gamified Learning Platforms, Corporate Training Solutions, and Others. Each of these sub-segments plays a crucial role in enhancing the educational experience and meeting the diverse needs of learners. The market is witnessing a surge in demand for adaptive and AI-based solutions, as well as gamified platforms that promote engagement and personalized learning pathways .

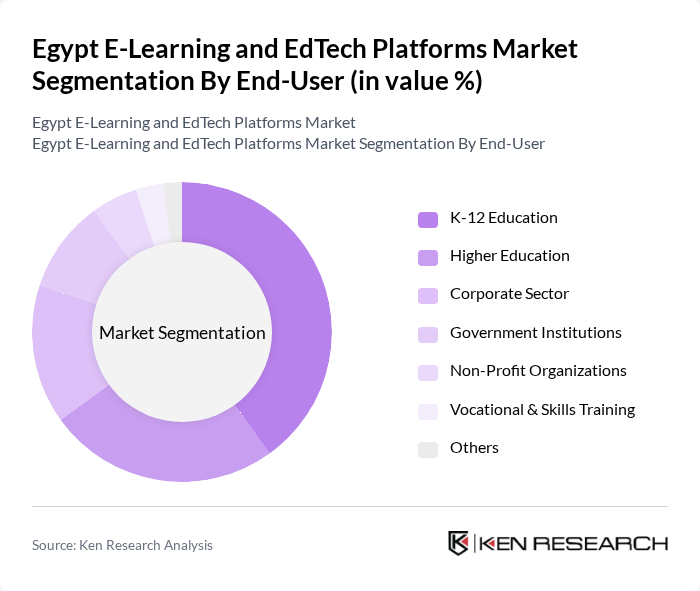

By End-User:The end-user segmentation includes K-12 Education, Higher Education, Corporate Sector, Government Institutions, Non-Profit Organizations, Vocational & Skills Training, and Others. Each segment has unique requirements and preferences, influencing the types of e-learning solutions adopted. K-12 and higher education remain the largest segments, driven by government digitalization initiatives and the integration of EdTech into formal curricula. The corporate sector and vocational training are also expanding, reflecting the growing need for upskilling and lifelong learning .

The Egypt E-Learning and EdTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almentor, Edraak, Nafham, OTO Courses, Knowledge Officer, Orcas, Edfa3ly, Skillz, Learn Egypt, Tahrir Academy, Al-Azhar University Online, Future Academy, Innovito, Classera, Ahlan Academy, and Farid contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's e-learning and EdTech platforms appears promising, driven by ongoing government support and increasing digital literacy among the population. As more educational institutions embrace technology, the demand for innovative learning solutions will likely rise. Additionally, the integration of artificial intelligence and data analytics into educational tools is expected to enhance personalized learning experiences, making education more accessible and effective for diverse student populations across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Learning Management Systems (LMS) Content Creation Tools Assessment and Evaluation Tools Virtual Classrooms Mobile Learning Applications Adaptive Learning & AI-Based Solutions Gamified Learning Platforms Corporate Training Solutions Others |

| By End-User | K-12 Education Higher Education Corporate Sector Government Institutions Non-Profit Organizations Vocational & Skills Training Others |

| By Delivery Mode | Online Learning Blended Learning Offline Learning Live Tutoring Others |

| By Subject Area | Science and Technology Arts and Humanities Business and Management Language Learning Mental Health & Character Development Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Institutional Licensing Others |

| By Geographic Reach | Local Regional International Others |

| By User Demographics | Age Group (Children, Teenagers, Adults) Professional Background (Students, Working Professionals) Socioeconomic Status Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 E-Learning Platforms | 100 | School Administrators, Teachers, IT Coordinators |

| Higher Education Online Courses | 80 | University Professors, Course Designers, Student Affairs Officers |

| Vocational Training Programs | 60 | Training Managers, Curriculum Developers, Industry Experts |

| Corporate E-Learning Solutions | 50 | HR Managers, Learning and Development Specialists, Corporate Trainers |

| EdTech Startups and Innovations | 40 | Founders, Product Managers, Educational Technologists |

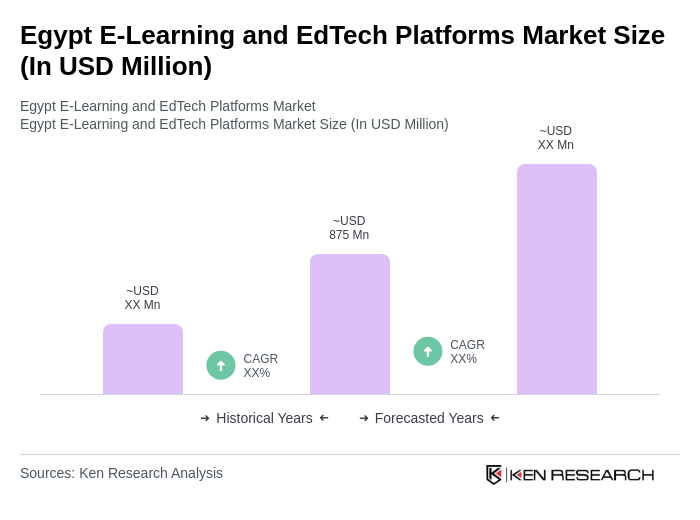

The Egypt E-Learning and EdTech Platforms Market is valued at approximately USD 875 million, reflecting significant growth driven by digital learning adoption, government investments, and increasing internet penetration.