Region:Europe

Author(s):Rebecca

Product Code:KRAD0219

Pages:91

Published On:August 2025

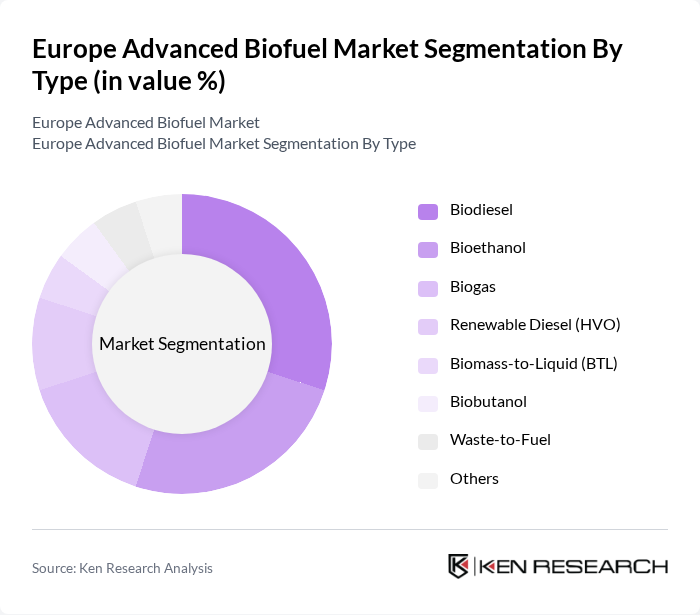

By Type:The advanced biofuel market can be segmented into various types, including biodiesel, bioethanol, biogas, renewable diesel (HVO), biomass-to-liquid (BTL), biobutanol, waste-to-fuel, and others. Each of these subsegments plays a crucial role in the overall market dynamics, catering to different applications and consumer preferences .

Thebiodieselsegment is currently dominating the market due to its widespread use in transportation and its compatibility with existing diesel engines. The increasing focus on reducing carbon emissions and the availability of feedstocks such as used cooking oil and animal fats have further propelled the growth of biodiesel. Additionally, government incentives and mandates supporting biodiesel production have solidified its position as a leading biofuel type in Europe .

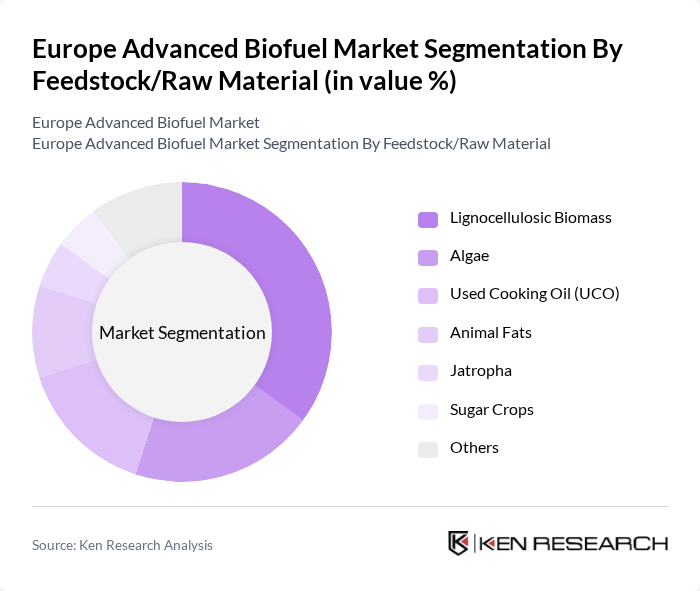

By Feedstock/Raw Material:The feedstock for advanced biofuels includes lignocellulosic biomass, algae, used cooking oil (UCO), animal fats, jatropha, sugar crops, and others. Each feedstock type contributes uniquely to the production processes and sustainability of biofuels .

Lignocellulosic biomassis the leading feedstock in the advanced biofuel market due to its abundance and sustainability. It includes agricultural residues, forestry waste, and dedicated energy crops, which can be converted into biofuels through various technologies. The increasing focus on waste-to-energy solutions and the circular economy further enhance the attractiveness of lignocellulosic biomass as a primary feedstock for biofuel production .

The Europe Advanced Biofuel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Neste Oyj, UPM-Kymmene Oyj, Preem AB, SunPine AB, TotalEnergies SE, BP plc, Shell plc, Cargill, Inc., Archer Daniels Midland Company, Clariant AG, Verbio SE, Abengoa S.A., Green Plains Inc., LanzaTech Global, Inc., Novozymes A/S contribute to innovation, geographic expansion, and service delivery in this space.

The future of the advanced biofuel market in Europe appears promising, driven by increasing regulatory support and technological advancements. As the EU intensifies its focus on carbon neutrality, the demand for sustainable energy solutions is expected to rise. Innovations in biofuel production technologies will likely enhance efficiency and reduce costs, making biofuels more competitive. Furthermore, the integration of biofuels into transportation systems will play a pivotal role in achieving the EU's renewable energy targets, fostering a more sustainable energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Biodiesel Bioethanol Biogas Renewable Diesel (HVO) Biomass-to-Liquid (BTL) Biobutanol Waste-to-Fuel Others |

| By Feedstock/Raw Material | Lignocellulosic Biomass Algae Used Cooking Oil (UCO) Animal Fats Jatropha Sugar Crops Others |

| By Technology | Biochemical Thermochemical |

| By Application | Transportation Fuels Power Generation Heating Chemical Feedstocks |

| By End-User | Transportation Industrial Residential Commercial |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships (PPP) International Aid |

| By Policy Support | Subsidies Tax Incentives Renewable Energy Certificates (RECs) Grants and Loans |

| By Distribution Channel | Direct Sales Distributors Retail Outlets Online Sales |

| By Region | Germany France United Kingdom Italy Spain Sweden Denmark Netherlands Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biofuel Production Facilities | 100 | Plant Managers, Production Engineers |

| Feedstock Suppliers | 80 | Agricultural Producers, Supply Chain Managers |

| Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| End-User Industries (Transport, Energy) | 90 | Fleet Managers, Energy Procurement Officers |

| Research Institutions | 70 | Researchers, Academic Professors |

The Europe Advanced Biofuel Market is valued at approximately USD 3.6 billion, reflecting a significant growth trend driven by government mandates for renewable energy, consumer demand for sustainable fuels, and advancements in biofuel technologies.