Europe Alcohol Ingredients Market Overview

- The Europe Alcohol Ingredients Market is valued at USD 790 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for craft beverages, innovation in flavoring agents, and the rising trend of premiumization among consumers. The market has seen a significant shift towards natural and organic ingredients, reflecting changing consumer preferences towards healthier options. The adoption of clean-label products and sustainable sourcing is further accelerating market expansion, as manufacturers respond to consumer demand for transparency and quality in ingredient selection.

- Key players in this market include Germany, the United Kingdom, and France. Germany leads due to its strong brewing tradition and a high number of breweries, while the UK is known for its diverse spirits market. France's dominance is attributed to its prestigious wine industry, which significantly influences the demand for various alcohol ingredients. These countries also benefit from robust infrastructure, established beverage brands, and a culture of innovation in alcoholic product development.

- In 2023, the European Union implemented stricter regulations on the labeling of alcoholic beverages, mandating that all ingredients and nutritional information be clearly stated on packaging. This regulation aims to enhance consumer awareness and promote transparency in the alcohol industry, thereby influencing ingredient sourcing and formulation practices. The new rules have prompted manufacturers to reformulate products and invest in traceable, high-quality ingredients to comply with evolving standards.

Europe Alcohol Ingredients Market Segmentation

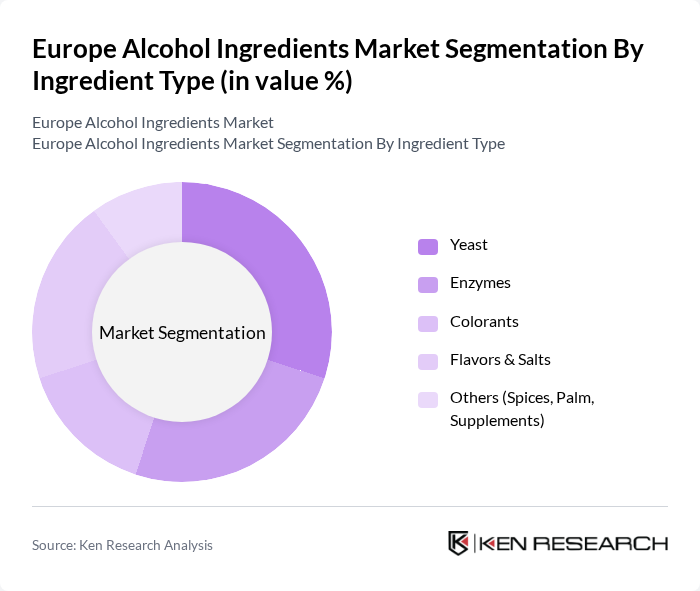

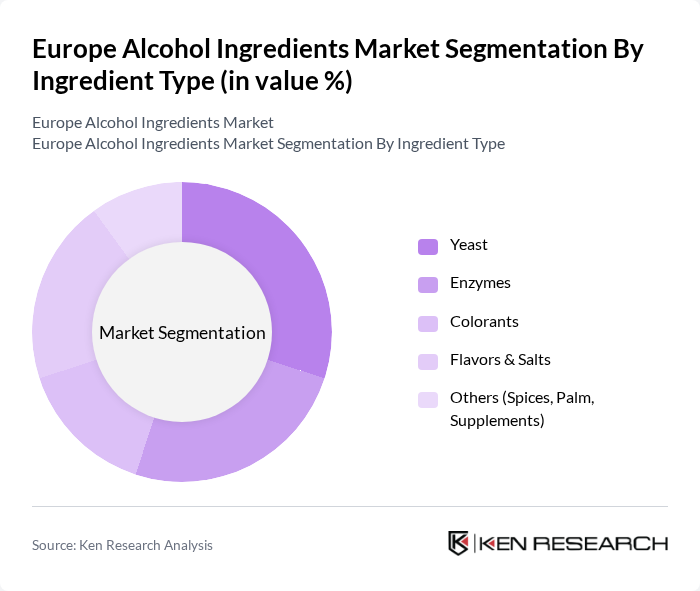

By Ingredient Type:The ingredient type segmentation includes various components essential for the production of alcoholic beverages. The subsegments are yeast, enzymes, colorants, flavors & salts, and others (spices, palm, supplements). Yeast is a critical ingredient in fermentation, while enzymes enhance the brewing process. Colorants and flavors are vital for product differentiation and consumer appeal. The "others" category includes various natural additives that enhance flavor and aroma, such as botanicals and plant-based extracts, which are increasingly sought after for their ability to create unique sensory profiles and support clean-label claims.

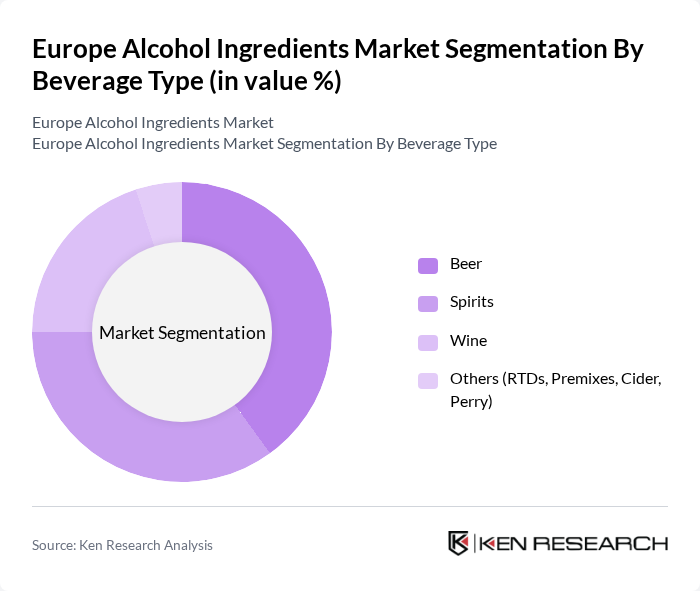

By Beverage Type:The beverage type segmentation encompasses various categories of alcoholic drinks, including beer, spirits, wine, and others (RTDs, premixes, cider, perry). Beer remains the largest segment due to its widespread consumption across Europe. Spirits, including vodka and gin, are gaining popularity, particularly in the UK. Wine, especially from France and Italy, continues to be a staple, while the "others" category captures the growing trend of ready-to-drink beverages, which are increasingly favored for convenience and innovative flavor offerings.

Europe Alcohol Ingredients Market Competitive Landscape

The Europe Alcohol Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company (ADM), Cargill, Incorporated, DSM-Firmenich AG, Döhler Group SE, Chr. Hansen Holding A/S, Kerry Group plc, Tate & Lyle PLC, Sensient Technologies Corporation, Symrise AG, Givaudan SA, TREATT PLC, Biospringer (Lesaffre Group), Ashland Global Holdings Inc., BASF SE, Ingredion Incorporated contribute to innovation, geographic expansion, and service delivery in this space. These companies are investing in advanced ingredient technologies, sustainable sourcing, and product portfolio diversification to meet evolving market requirements.

Europe Alcohol Ingredients Market Industry Analysis

Growth Drivers

- Increasing Demand for Craft Beverages:The craft beverage sector in Europe has seen a remarkable surge, with over 13,000 craft breweries operating in future, a 10% increase from the previous year. This growth is driven by consumer preference for unique flavors and artisanal production methods. The craft beer market alone is projected to reach €45 billion by future, indicating a robust demand for diverse alcohol ingredients that enhance flavor profiles and authenticity in beverages.

- Rising Health Consciousness and Demand for Natural Ingredients:In future, approximately 50% of European consumers are expected to prioritize health-conscious choices, leading to a 15% increase in demand for natural and organic alcohol ingredients. This trend is supported by a growing awareness of health issues related to alcohol consumption, prompting manufacturers to innovate with natural flavors and low-calorie options. The shift towards clean-label products is reshaping ingredient sourcing and formulation strategies across the industry.

- Expansion of E-commerce in Alcohol Sales:E-commerce sales of alcoholic beverages in Europe are projected to exceed €10 billion in future, reflecting a strong growth from the previous year. This shift is driven by changing consumer shopping habits, particularly among younger demographics who prefer online purchasing. The convenience of home delivery and the ability to explore a wider range of products are key factors fueling this trend, creating new opportunities for alcohol ingredient suppliers to reach consumers directly.

Market Challenges

- Stringent Regulatory Framework:The European alcohol market is heavily regulated, with dozens of specific regulations governing production, labeling, and advertising. Compliance with these regulations can be costly and time-consuming for manufacturers, particularly smaller producers. In future, the enforcement of stricter health and safety standards is expected to increase operational costs by approximately 5%, posing a significant challenge for market entrants and established brands alike.

- High Competition Among Established Brands:The European alcohol ingredients market is characterized by intense competition, with leading brands holding over 70% market share. This competitive landscape makes it difficult for new entrants to gain traction. In future, the top five companies are expected to invest over €500 million in marketing and innovation to maintain their market positions, further intensifying the challenge for smaller players seeking to differentiate their products.

Europe Alcohol Ingredients Market Future Outlook

The Europe Alcohol Ingredients Market is poised for significant transformation as consumer preferences evolve towards healthier and more sustainable options. Innovations in flavoring and fortification will drive product development, while the rise of e-commerce will enhance accessibility. Additionally, the increasing popularity of non-alcoholic and low-alcohol beverages will create new avenues for growth. As brands adapt to these trends, the market is expected to witness a shift towards transparency in ingredient sourcing, aligning with consumer demand for authenticity and quality.

Market Opportunities

- Growth in Non-Alcoholic and Low-Alcohol Beverages:The non-alcoholic beverage segment is projected to grow by €2 billion in future, driven by a 30% increase in consumer interest. This trend presents opportunities for ingredient suppliers to develop innovative flavoring solutions that cater to this expanding market, allowing brands to diversify their product offerings and attract health-conscious consumers.

- Development of Sustainable and Organic Ingredients:With 40% of consumers willing to pay a premium for sustainable products, the demand for organic alcohol ingredients is set to rise significantly. This trend encourages manufacturers to invest in sustainable sourcing practices and develop eco-friendly products, positioning themselves favorably in a market increasingly focused on environmental responsibility and ethical consumption.