Region:Europe

Author(s):Geetanshi

Product Code:KRAC0121

Pages:98

Published On:August 2025

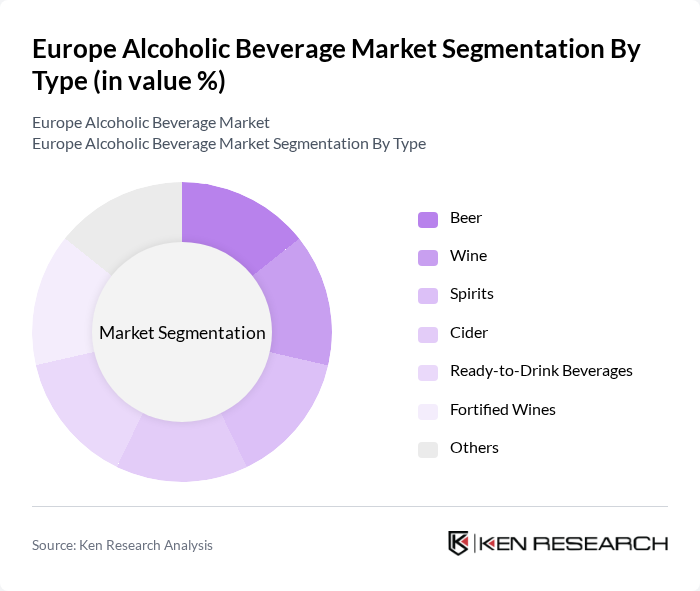

By Type:The market is segmented into various types of alcoholic beverages, including beer, wine, spirits, cider, ready-to-drink beverages, fortified wines, and others. Beer and wine remain the most popular categories, driven by entrenched cultural preferences and established consumption patterns across different European regions. There is also notable growth in premium spirits, craft beers, and low-alcohol alternatives, reflecting evolving consumer tastes and health-conscious trends.

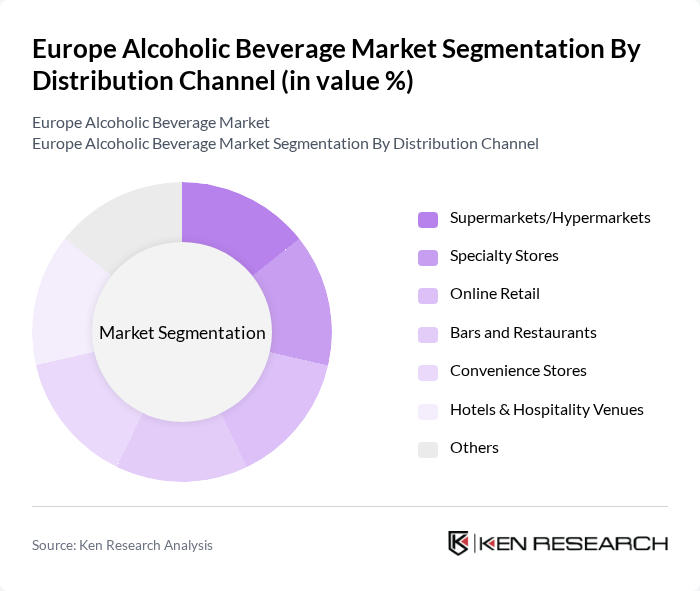

By Distribution Channel:The distribution channels for alcoholic beverages include supermarkets/hypermarkets, specialty stores, online retail, bars and restaurants, convenience stores, hotels & hospitality venues, and others. Supermarkets and hypermarkets are the leading channels due to their extensive reach and product variety, while online retail is experiencing rapid growth as consumers increasingly seek convenience and home delivery. Specialty stores and bars/restaurants remain important for premium and experiential purchases.

The Europe Alcoholic Beverage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Anheuser-Busch InBev, Heineken N.V., Diageo plc, Pernod Ricard S.A., Carlsberg Group, Molson Coors Beverage Company, Asahi Group Holdings, Ltd., Constellation Brands, Inc., Treasury Wine Estates, Brown-Forman Corporation, Campari Group, Bacardi Limited, Edrington Group, Moët Hennessy Louis Vuitton (LVMH), Rémy Cointreau S.A., Grupo Osborne S.A., Distell Group Holdings Limited, Royal Unibrew A/S, AB Svenska Returpack, Arcus ASA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European alcoholic beverage market appears promising, driven by evolving consumer preferences and innovative product offerings. The demand for low-alcohol and no-alcohol beverages is expected to rise, reflecting a broader trend towards healthier lifestyles. Additionally, the market is likely to see increased investment in sustainable practices, including eco-friendly packaging solutions. As brands adapt to these trends, they will enhance their market positioning and appeal to a more health-conscious consumer base, ensuring continued growth and relevance in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Beer Wine Spirits Cider Ready-to-Drink Beverages Fortified Wines Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Bars and Restaurants Convenience Stores Hotels & Hospitality Venues Others |

| By Packaging Type | Glass Bottles Cans Kegs Tetra Packs PET Bottles Others |

| By Alcohol Content | Low Alcohol (?5% ABV) Medium Alcohol (5-20% ABV) High Alcohol (>20% ABV) |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Urban vs. Rural |

| By Occasion | Social Gatherings Celebrations Casual Drinking Food Pairing Others |

| By Region | Western Europe (UK, France, Germany, Netherlands, Belgium, etc.) Eastern Europe (Poland, Czech Republic, Hungary, Russia, etc.) Northern Europe (Sweden, Denmark, Finland, Norway, etc.) Southern Europe (Italy, Spain, Portugal, Greece, etc.) Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Beer | 120 | Regular Beer Drinkers, Age 21-45 |

| Wine Consumption Trends | 100 | Wine Enthusiasts, Age 30-60 |

| Spirits Market Insights | 90 | Spirits Consumers, Age 25-50 |

| Impact of Health Trends on Alcohol Consumption | 60 | Health-Conscious Consumers, Age 18-40 |

| Retailer Perspectives on Alcohol Sales | 50 | Retail Managers, Beverage Category Buyers |

The Europe Alcoholic Beverage Market is valued at approximately USD 250 billion, driven by increasing consumer demand for premium and craft beverages, as well as the expansion of e-commerce platforms that enhance accessibility for consumers.