Region:Europe

Author(s):Dev

Product Code:KRAC0418

Pages:82

Published On:August 2025

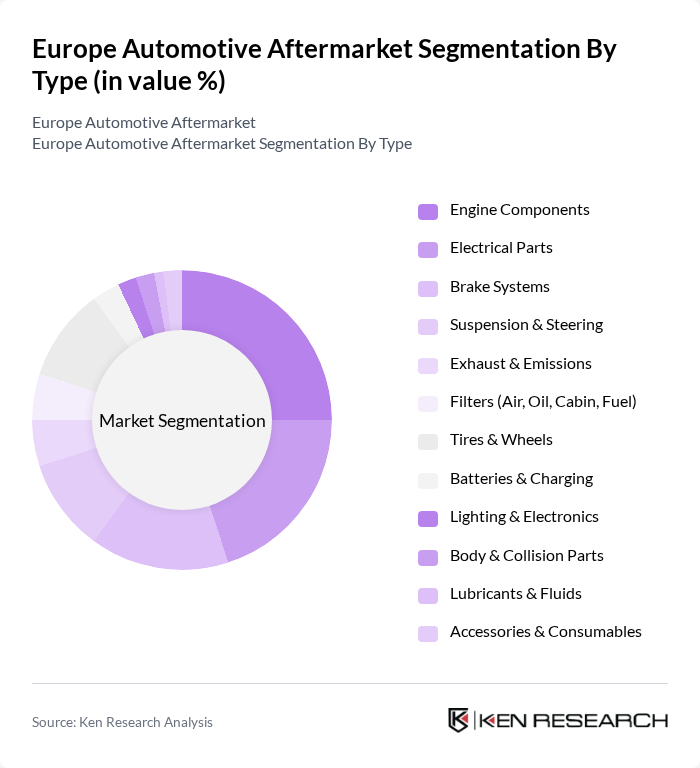

By Type:The market is segmented into various types of spare parts, including engine components, electrical parts, brake systems, suspension & steering, exhaust & emissions, filters (air, oil, cabin, fuel), tires & wheels, batteries & charging, lighting & electronics, body & collision parts, lubricants & fluids, and accessories & consumables. Among these, engine components and electrical parts are particularly significant due to their essential roles in vehicle performance and safety.

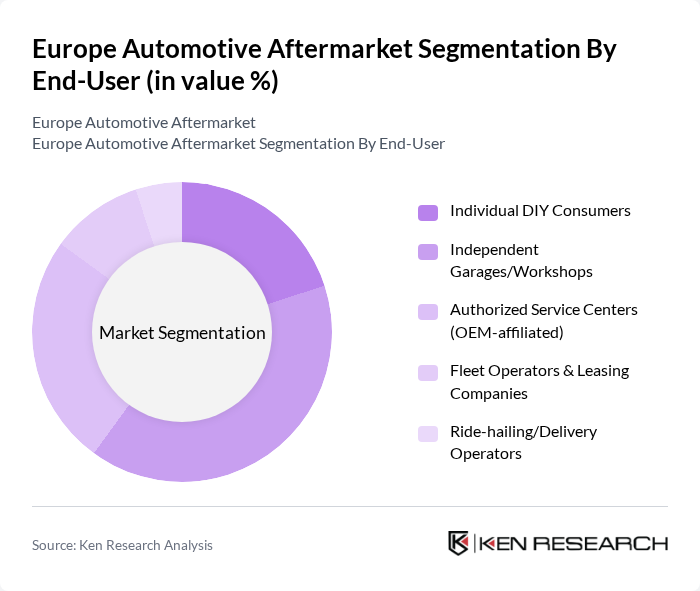

By End-User:The end-user segmentation includes individual DIY consumers, independent garages/workshops, authorized service centers (OEM-affiliated), fleet operators & leasing companies, and ride-hailing/delivery operators. The independent garages/workshops segment is particularly dominant, as they cater to a large number of consumers seeking affordable repair options and personalized services.

The Europe Automotive Aftermarket market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH (Bosch Automotive Aftermarket), Continental AG, ZF Friedrichshafen AG, Valeo S.A., DENSO Corporation, Aisin Corporation, Marelli Europe S.p.A., BorgWarner Inc. (incl. Delphi Technologies), AB SKF, Tenneco Inc. (Monroe, Walker), MAHLE GmbH, TRW (a ZF brand), HELLA GmbH & Co. KGaA (FORVIA HELLA), NGK Spark Plug Co., Ltd. (Niterra), Federal-Mogul (a Tenneco company), Schaeffler AG (LuK, INA, FAG), Brembo S.p.A., Clarios (VARTA), Michelin (Tires) & Euromaster, LKQ Europe (Euro Car Parts, Stahlgruber, Rhiag) contribute to innovation, geographic expansion, and service delivery in this space.

The European automotive aftermarket is poised for transformative growth driven by technological advancements and changing consumer preferences. As digital transformation accelerates, companies are increasingly adopting e-commerce platforms and AI-driven inventory management systems. Additionally, the focus on sustainability will shape product offerings, with a rise in demand for eco-friendly spare parts. The integration of advanced technologies will enhance operational efficiency, positioning businesses to capitalize on emerging trends and consumer demands in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Engine Components Electrical Parts Brake Systems Suspension & Steering Exhaust & Emissions Filters (Air, Oil, Cabin, Fuel) Tires & Wheels Batteries & Charging Lighting & Electronics Body & Collision Parts Lubricants & Fluids Accessories & Consumables |

| By End-User | Individual DIY Consumers Independent Garages/Workshops Authorized Service Centers (OEM-affiliated) Fleet Operators & Leasing Companies Ride-hailing/Delivery Operators |

| By Sales Channel | Online (Marketplaces, D2C) Offline Retailers (Brick-and-Mortar) Wholesalers & Distributors OEM Dealer Networks |

| By Region | Western Europe (Germany, France, UK, Benelux) Southern Europe (Italy, Spain, Portugal, Greece) Northern Europe (Nordics, Baltics, Ireland) Eastern Europe (Poland, Czechia, Hungary, Rest) |

| By Component | Mechanical Components Electrical/Electronic Components Body & Trim Accessories Replacement Wear Parts (Brake Pads, Wipers, Belts) |

| By Price Range | Budget Mid-Range Premium |

| By Brand | OEM Genuine Parts Independent Aftermarket Brands Private Labels (Retailer/Distributor Brands) Remanufactured & Refurbished Parts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Parts Retailers | 120 | Store Managers, Sales Representatives |

| Independent Repair Shops | 100 | Shop Owners, Service Technicians |

| OEM Service Centers | 80 | Service Managers, Parts Coordinators |

| Aftermarket Accessory Suppliers | 60 | Product Managers, Marketing Directors |

| Consumer Insights on Automotive Services | 100 | Car Owners, Fleet Managers |

The Europe Automotive Aftermarket Spare Parts Market is valued at approximately USD 105 billion, driven by factors such as an increasing vehicle population, rising average vehicle age, and a shift towards cost-effective maintenance and repairs.