Region:Europe

Author(s):Shubham

Product Code:KRAA1935

Pages:83

Published On:August 2025

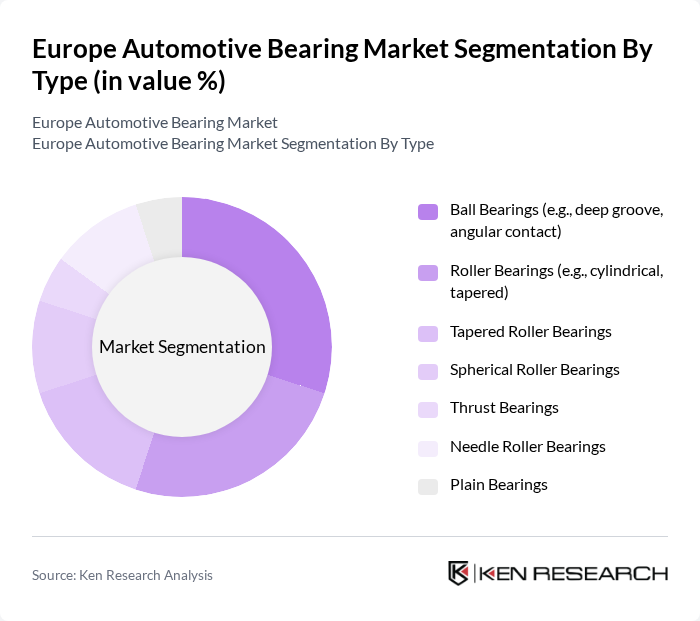

By Type:The market is segmented into various types of bearings, each serving specific applications within the automotive sector. The key types include ball bearings, roller bearings, tapered roller bearings, spherical roller bearings, thrust bearings, needle roller bearings, and plain bearings. Each type has unique characteristics that cater to different automotive needs, such as load capacity, speed, and durability.

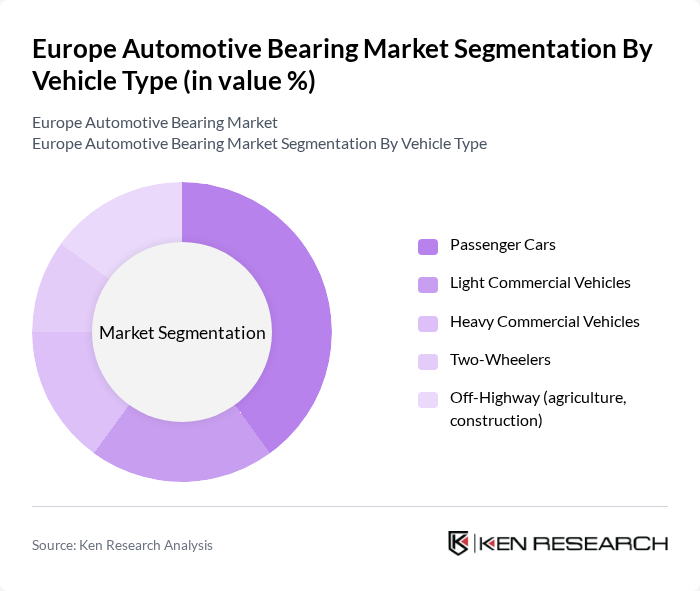

By Vehicle Type:The automotive bearing market is also segmented by vehicle type, which includes passenger cars, light commercial vehicles, heavy commercial vehicles, two-wheelers, and off-highway vehicles such as those used in agriculture and construction. Each vehicle type has distinct requirements for bearings based on factors like weight, load, and operational conditions. Passenger cars account for the largest bearing demand in Europe due to high production volumes and higher bearing counts per vehicle relative to other segments.

The Europe Automotive Bearing Market is characterized by a dynamic mix of regional and international players. Leading participants such as SKF Group, Schaeffler AG (incl. FAG brand), NSK Ltd., NTN-SNR Roulements, JTEKT Corporation (Koyo), The Timken Company, ZF Friedrichshafen AG (bearings/e-axle components), Schaeffler LuK Aftermarket GmbH & Co. KG, MinebeaMitsumi Inc. (NMB/Minebea Access), Rheinmetall AG (engine bearings), Wälzlager Industriewerke BERTOLINO GmbH & Co. KG (WIB), C&U Group, ZKL Group, NTN Corporation (Europe operations), Myonic GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe automotive bearing market appears promising, driven by technological innovations and a shift towards sustainable practices. As manufacturers increasingly adopt lightweight materials and smart technologies, the demand for advanced bearings will likely rise. Additionally, the integration of IoT in automotive applications is expected to enhance performance monitoring, leading to improved product offerings. The market is poised for growth as companies adapt to evolving consumer preferences and regulatory landscapes, ensuring a competitive edge in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Ball Bearings (e.g., deep groove, angular contact) Roller Bearings (e.g., cylindrical, tapered) Tapered Roller Bearings Spherical Roller Bearings Thrust Bearings Needle Roller Bearings Plain Bearings |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Two-Wheelers Off-Highway (agriculture, construction) |

| By Component/Application Area | Wheel End (hub/wheel bearings) Engine & Powertrain (crankshaft, camshaft, auxiliaries) Transmission & Drivetrain (manual/automatic/e-axle) Chassis & Suspension (strut mounts, steering column) Electric Motor & e-Powertrain Bearings (EV/HEV specific) |

| By Sales Channel | OEM Aftermarket (independent and authorized) Online Retail Distributors Others |

| By Distribution Mode | Direct Sales Wholesale Retail E-commerce Others |

| By Price Range | Economy Mid-range Premium Performance/High-precision |

| By End Use | OEM Production Aftermarket Repair & Maintenance Remanufacturing & Refurbishment Motorsports & Customization |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Bearings | 120 | Product Managers, Automotive Engineers |

| Commercial Vehicle Bearings | 100 | Procurement Managers, Fleet Operations Directors |

| Electric Vehicle Bearings | 80 | R&D Engineers, Sustainability Officers |

| Aftermarket Bearing Suppliers | 70 | Sales Managers, Distribution Heads |

| Specialty Bearings for Performance Vehicles | 60 | Performance Engineers, Motorsport Team Managers |

The Europe Automotive Bearing Market is valued at approximately USD 8.3 billion, reflecting a five-year historical analysis. This valuation is driven by increasing demand for high-performance bearings and the rising electrification of vehicles.