Region:Europe

Author(s):Shubham

Product Code:KRAC0803

Pages:84

Published On:August 2025

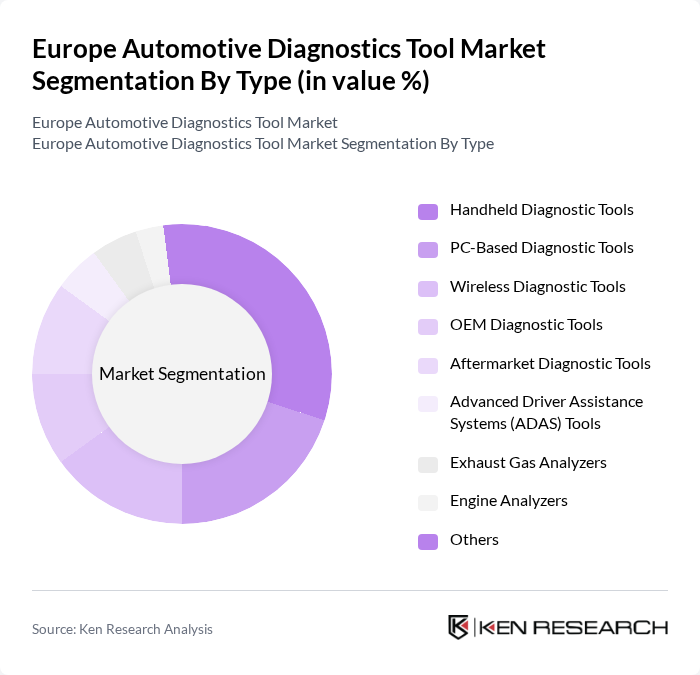

By Type:The market is segmented into various types of diagnostic tools, each catering to specific needs within the automotive sector. The subsegments include Handheld Diagnostic Tools, PC-Based Diagnostic Tools, Wireless Diagnostic Tools, OEM Diagnostic Tools, Aftermarket Diagnostic Tools, Advanced Driver Assistance Systems (ADAS) Tools, Exhaust Gas Analyzers, Engine Analyzers, and Others. Among these, handheld diagnostic tools are gaining significant traction due to their portability and ease of use, making them a preferred choice for both professional mechanics and DIY enthusiasts .

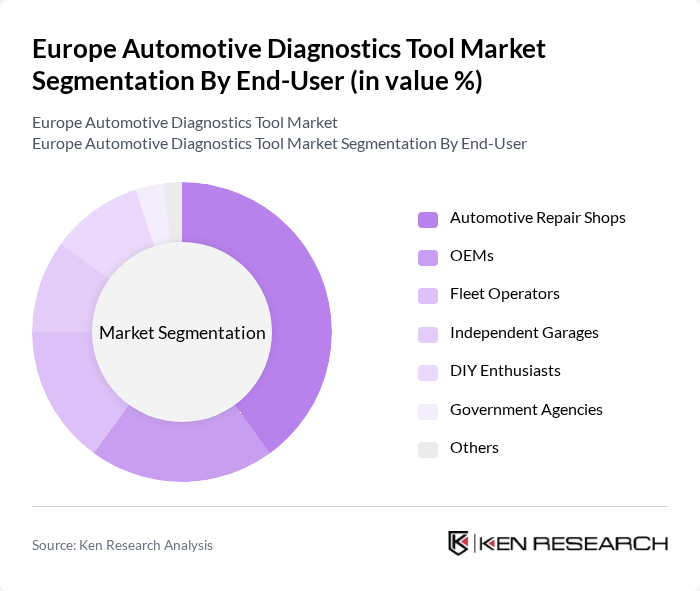

By End-User:The end-user segmentation includes Automotive Repair Shops, OEMs, Fleet Operators, Independent Garages, DIY Enthusiasts, Government Agencies, and Others. Automotive repair shops are the leading end-users of diagnostic tools, driven by the increasing number of vehicles requiring regular maintenance and repairs. The trend towards more complex vehicle systems necessitates the use of advanced diagnostic tools, making repair shops a critical market segment .

The Europe Automotive Diagnostics Tool Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Snap-on Incorporated, Hella Gutmann Solutions GmbH, Autel Intelligent Technology Corp., Ltd., Launch Tech Co., Ltd., Delphi Technologies (BorgWarner Inc.), Continental AG, Actia Group, Texa S.p.A., Foxwell Technology Co., Ltd., Innova Electronics Corporation, CarMD.com Corporation, MAHLE GmbH, AVL List GmbH, Vident Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive diagnostics tool market in Europe appears promising, driven by ongoing technological advancements and increasing vehicle complexity. As the market shifts towards cloud-based solutions and telematics, diagnostic tools will become more integrated and user-friendly. Additionally, the rise of electric and hybrid vehicles will necessitate specialized diagnostic tools, creating new avenues for growth. The focus on sustainability will also push manufacturers to innovate eco-friendly diagnostic solutions, aligning with regulatory trends and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Handheld Diagnostic Tools PC-Based Diagnostic Tools Wireless Diagnostic Tools OEM Diagnostic Tools Aftermarket Diagnostic Tools Advanced Driver Assistance Systems (ADAS) Tools Exhaust Gas Analyzers Engine Analyzers Others |

| By End-User | Automotive Repair Shops OEMs Fleet Operators Independent Garages DIY Enthusiasts Government Agencies Others |

| By Application | Engine Diagnostics Transmission Diagnostics Brake System Diagnostics Emission Diagnostics Electrical System Diagnostics ADAS Calibration Battery & EV System Diagnostics Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Region | Western Europe Eastern Europe Northern Europe Southern Europe Central Europe Others |

| By Price Range | Low-End Tools Mid-Range Tools High-End Tools |

| By Brand | OEM Brands Aftermarket Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Service Centers | 100 | Service Managers, Technicians |

| OEMs and Tier 1 Suppliers | 60 | Product Development Managers, Procurement Officers |

| Aftermarket Parts Distributors | 50 | Sales Managers, Inventory Analysts |

| Automotive Repair Workshops | 80 | Workshop Owners, Lead Technicians |

| Automotive Technology Consultants | 40 | Industry Analysts, Technology Advisors |

The Europe Automotive Diagnostics Tool Market is valued at approximately USD 6.3 billion, reflecting a significant growth trend driven by increasing vehicle complexity, rising demand for maintenance, and advancements in diagnostic technologies.