Region:Europe

Author(s):Geetanshi

Product Code:KRAC0017

Pages:89

Published On:August 2025

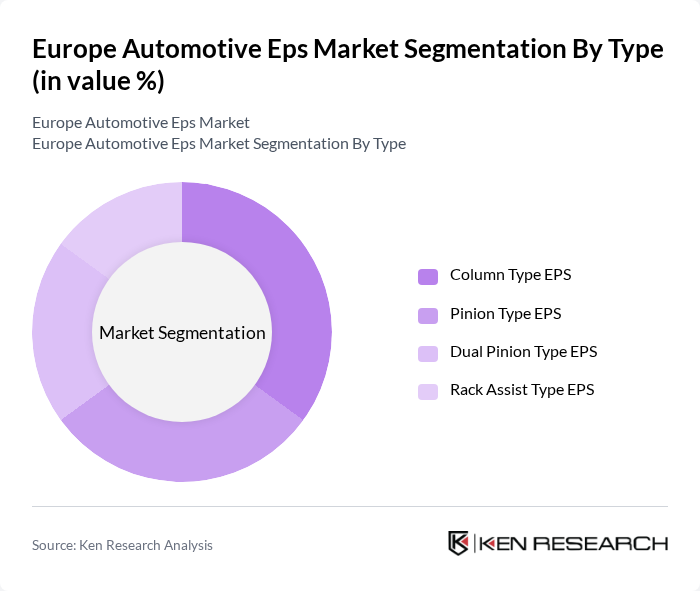

By Type:The market can be segmented into four types of EPS systems: Column Type EPS, Pinion Type EPS, Dual Pinion Type EPS, and Rack Assist Type EPS. Among these, the Column Type EPS is gaining traction due to its compact design and efficiency, making it suitable for a wide range of vehicles. The Pinion Type EPS is also popular for its direct steering response, while the Dual Pinion Type EPS is preferred for high-performance vehicles. The Rack Assist Type EPS is increasingly adopted in electric vehicles for its lightweight and energy-efficient characteristics. The growing integration of advanced sensors and software in these systems is further enhancing their performance and reliability.

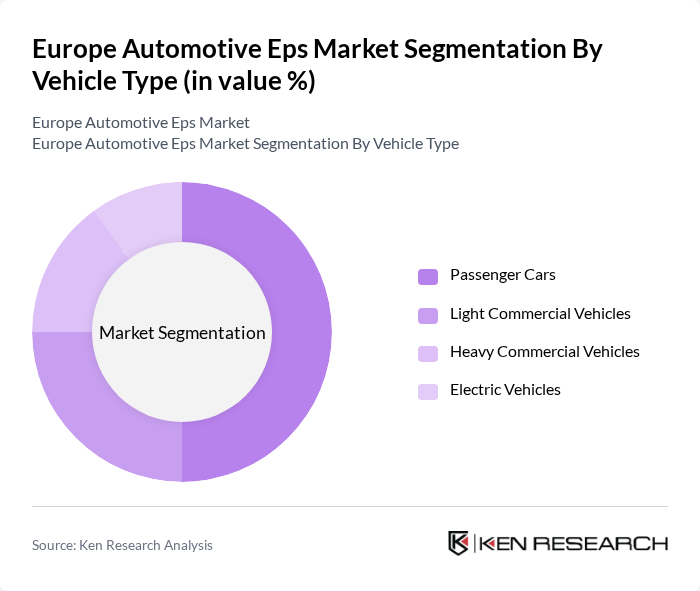

By Vehicle Type:The market is categorized into Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Electric Vehicles. Passenger Cars dominate the market due to their high production volume and consumer preference for fuel-efficient and technologically advanced vehicles. The increasing trend towards electric vehicles is also contributing to the growth of EPS systems, as they require efficient steering solutions to enhance performance and energy savings. The integration of EPS in electric and hybrid vehicles is accelerating as manufacturers seek to meet emission regulations and improve vehicle safety and comfort.

The Europe Automotive EPS market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, ZF Friedrichshafen AG, JTEKT Corporation, Nexteer Automotive Group Limited, NSK Ltd., Thyssenkrupp AG, Hyundai Mobis Co., Ltd., Mando Corporation, DENSO Corporation, Aisin Corporation, Valeo S.A., Continental AG, Schaeffler AG, Hitachi Astemo, Ltd., Delphi Technologies (now part of BorgWarner Inc.) contribute to innovation, geographic expansion, and service delivery in this space. These companies are focusing on product innovation, strategic partnerships, and expanding their EPS portfolios to meet evolving market demands.

The future of the EPS market in Europe appears promising, driven by the increasing integration of smart technologies and the growing emphasis on sustainability. As automotive manufacturers invest in advanced driver-assistance systems (ADAS) and autonomous driving technologies, EPS systems will play a crucial role in enhancing vehicle performance and safety. Additionally, the ongoing shift towards electric and hybrid vehicles will further accelerate the adoption of EPS, positioning the market for significant growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Column Type EPS Pinion Type EPS Dual Pinion Type EPS Rack Assist Type EPS |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles |

| By Component | Steering Column/Rack Electric Motor Sensor Electronic Control Unit (ECU) |

| By Sales Channel | OEMs Aftermarket |

| By Country | Germany France United Kingdom Italy Spain Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle EPS Systems | 100 | Product Managers, Automotive Engineers |

| Commercial Vehicle EPS Applications | 60 | Fleet Managers, Procurement Officers |

| Electric Vehicle EPS Integration | 50 | R&D Directors, Technical Leads |

| Aftermarket EPS Solutions | 40 | Sales Managers, Distribution Partners |

| EPS Technology Providers | 45 | Business Development Managers, Engineers |

The Europe Automotive EPS market is valued at approximately USD 5.3 billion, driven by the increasing demand for fuel-efficient vehicles, advancements in automotive technology, and the rising adoption of electric vehicles.