Region:Europe

Author(s):Rebecca

Product Code:KRAD0317

Pages:100

Published On:August 2025

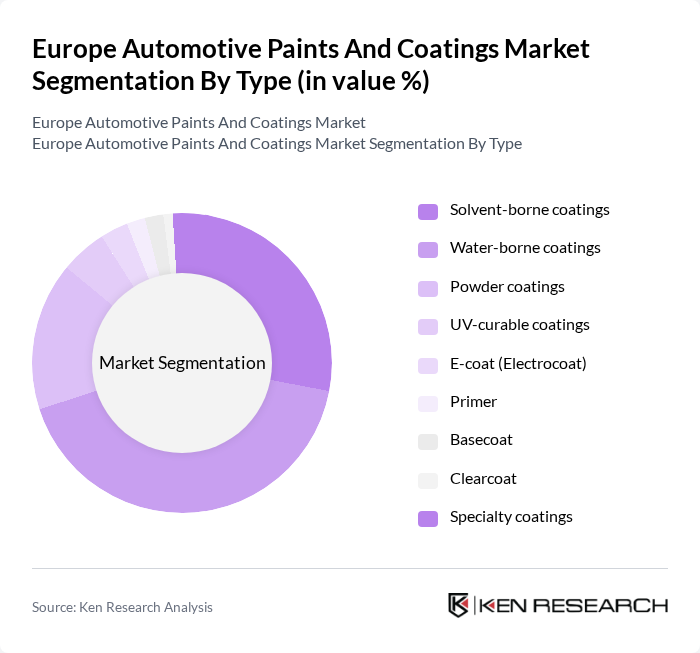

By Type:The market is segmented into various types of coatings, each serving specific needs and applications within the automotive industry. The dominant sub-segment is water-borne coatings, which are favored for their lower environmental impact and compliance with stringent regulations. Solvent-borne coatings also hold a significant share due to their excellent performance characteristics. The increasing trend towards sustainability is driving the adoption of eco-friendly options, making water-borne and powder coatings the preferred choices among manufacturers .

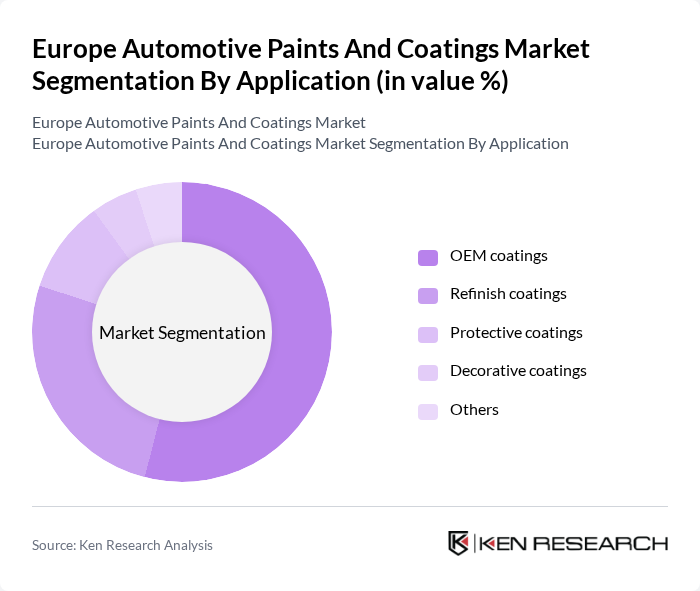

By Application:The application segment includes OEM coatings, refinish coatings, protective coatings, decorative coatings, and others. OEM coatings dominate the market due to the high volume of new vehicle production and the need for high-quality finishes. Refinish coatings are also significant, driven by the growing aftermarket services and consumer demand for vehicle customization. The trend towards vehicle personalization is boosting the decorative coatings segment, while protective coatings are essential for enhancing durability and longevity .

The Europe Automotive Paints and Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF Coatings GmbH, PPG Industries, Inc., AkzoNobel N.V., The Sherwin-Williams Company, Axalta Coating Systems Ltd., Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Jotun A/S, RPM International Inc., Hempel A/S, Valspar Corporation, Covestro AG, Henkel AG & Co. KGaA, Solvay S.A., Tikkurila Oyj, 3M Company, Albi Protective Coatings, Nullifire contribute to innovation, geographic expansion, and service delivery in this space .

The future of the European automotive paints and coatings market appears promising, driven by ongoing technological advancements and a shift towards sustainability. As manufacturers increasingly adopt eco-friendly formulations and innovative application techniques, the market is expected to evolve significantly. Additionally, the rise of electric vehicles will create new demands for specialized coatings, further enhancing growth opportunities. The focus on customization and personalization in vehicle aesthetics will also play a crucial role in shaping market dynamics, ensuring a vibrant and competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Solvent-borne coatings Water-borne coatings Powder coatings UV-curable coatings E-coat (Electrocoat) Primer Basecoat Clearcoat Specialty coatings |

| By Application | OEM coatings Refinish coatings Protective coatings Decorative coatings Others |

| By End-User | Passenger cars Light commercial vehicles Heavy commercial vehicles Two-wheelers Others |

| By Distribution Channel | OEM Aftermarket Distributors Online sales Retail outlets Others |

| By Region | Western Europe Eastern Europe Northern Europe Southern Europe Others |

| By Price Range | Economy Mid-range Premium |

| By Coating Finish | Matte finish Gloss finish Satin finish Textured finish Metallic finish Solid finish Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEM Automotive Manufacturers | 100 | Production Managers, Quality Assurance Leads |

| Automotive Paint Suppliers | 80 | Sales Directors, Product Development Managers |

| Automotive Repair Shops | 60 | Shop Owners, Lead Technicians |

| Regulatory Bodies | 40 | Compliance Officers, Environmental Analysts |

| Industry Experts and Consultants | 50 | Market Analysts, Industry Advisors |

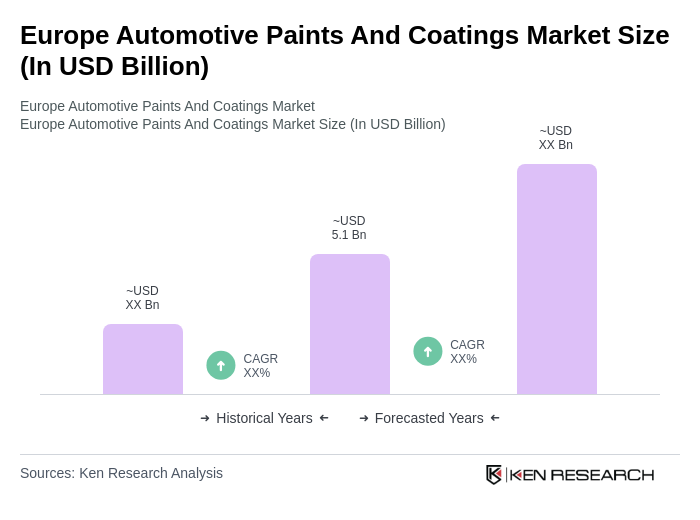

The Europe Automotive Paints and Coatings Market is valued at approximately USD 5.1 billion, driven by the demand for high-performance coatings that offer durability, aesthetic appeal, and compliance with environmental regulations.