Region:Europe

Author(s):Geetanshi

Product Code:KRAC0075

Pages:88

Published On:August 2025

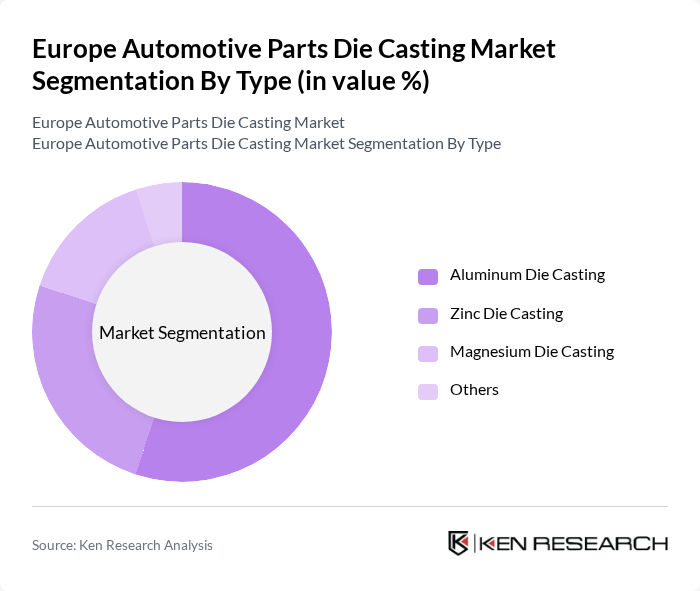

By Type:The die casting market is segmented into aluminum, zinc, magnesium, and others. Among these, aluminum die casting is the most prominent due to its lightweight properties and excellent corrosion resistance, making it ideal for automotive applications. Zinc die casting is also gaining traction due to its strength and durability, particularly in smaller components. The demand for magnesium die casting is increasing as manufacturers seek to reduce vehicle weight for improved fuel efficiency .

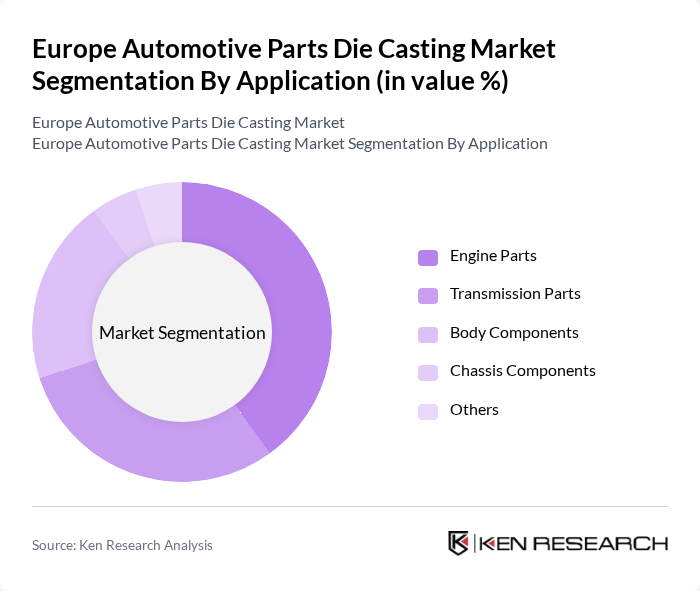

By Application:The applications of die casting in the automotive sector include engine parts, transmission parts, body components, chassis components, and others. Engine parts dominate the market due to the high demand for lightweight and high-strength components that enhance engine performance and efficiency. Transmission parts also hold a significant share as they require precision and durability, while body and chassis components are increasingly being designed for weight reduction and improved safety .

The Europe Automotive Parts Die Casting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Martinrea Honsel Germany GmbH, Ryobi Die Casting (UK) Ltd., Georg Fischer Automotive (GF Casting Solutions), Bühler Group, Rheinmetall Automotive AG (KS HUAYU AluTech GmbH), Nemak S.A.B. de C.V., Aludyne Inc., Endurance Technologies Europe, Teksid S.p.A., Dynacast International, Montupet S.A. (CIE Automotive), Constellium SE, Italpresse Gauss (Norican Group), Bodner Metall GmbH, Druckguss Westfalen GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe automotive parts die casting market appears promising, driven by technological advancements and a shift towards sustainable practices. As manufacturers increasingly adopt automation and Industry 4.0 technologies, production efficiency is expected to improve significantly. Additionally, the growing emphasis on electric vehicles will create new opportunities for die casting applications, particularly in lightweight components. The market is likely to see a surge in demand for innovative solutions that align with environmental regulations and consumer preferences for sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Aluminum Die Casting Zinc Die Casting Magnesium Die Casting Others |

| By Application | Engine Parts Transmission Parts Body Components Chassis Components Others |

| By End-User | Passenger Vehicles Commercial Vehicles Electric Vehicles Automotive Aftermarket Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | Western Europe Eastern Europe Northern Europe Southern Europe Others |

| By Component | Castings Molds Tooling Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs | 60 | Product Development Managers, Procurement Directors |

| Die Casting Manufacturers | 50 | Operations Managers, Quality Control Engineers |

| Automotive Parts Distributors | 40 | Supply Chain Managers, Sales Directors |

| Industry Regulatory Bodies | 40 | Policy Analysts, Compliance Officers |

| Automotive Aftermarket Suppliers | 45 | Marketing Managers, Product Line Managers |

The Europe Automotive Parts Die Casting Market is valued at approximately USD 5.5 billion, driven by the increasing demand for lightweight and durable automotive components, particularly in the context of rising electric vehicle production.