Region:Europe

Author(s):Shubham

Product Code:KRAA1882

Pages:84

Published On:August 2025

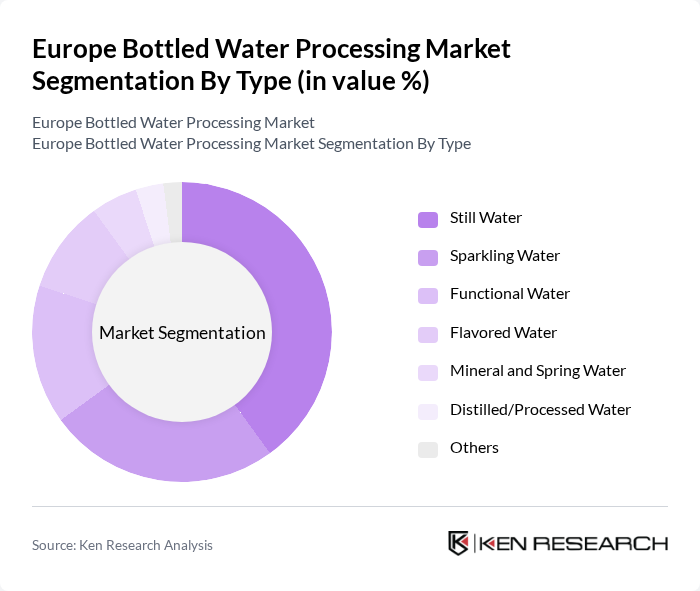

By Type:The bottled water processing market can be segmented into various types, including Still Water, Sparkling Water, Functional Water, Flavored Water, Mineral and Spring Water, Distilled/Processed Water, and Others. Each type caters to different consumer preferences and health trends, with Still Water and Sparkling Water being the most popular choices among consumers. The demand for Functional and Flavored Water is also on the rise, driven by health-conscious consumers seeking added benefits.

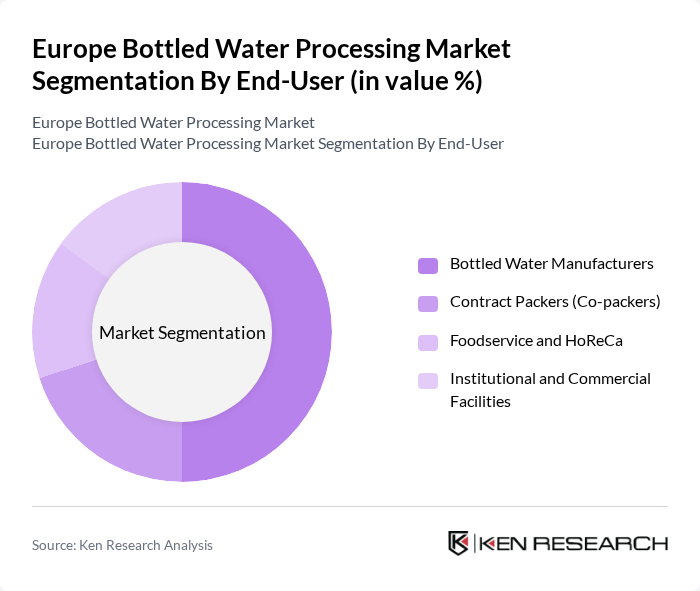

By End-User:The end-user segmentation includes Bottled Water Manufacturers, Contract Packers (Co-packers), Foodservice and HoReCa, and Institutional and Commercial Facilities. Bottled Water Manufacturers are the primary end-users, as they require processing equipment and technology to produce bottled water at scale. The Foodservice and HoReCa sector is also significant, as it drives demand for bottled water in restaurants, hotels, and cafes.

The Europe Bottled Water Processing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Waters (Nestlé S.A.), Danone S.A. (Evian, Volvic, Badoit), The Coca-Cola Company (AQUA Carpatica, Glacéau Smartwater Europe), PepsiCo, Inc. (LIFEWTR, Aquafina Europe), Suntory Beverage & Food Europe (Schweppes, Highland Spring distribution partnerships), Gerolsteiner Brunnen GmbH & Co. KG, Sanpellegrino S.p.A. (Nestlé) – S.Pellegrino, Acqua Panna, Perrier Vittel France S.A.S. (Nestlé) – Perrier, Vittel, Highland Spring Group, Spadel Group (Spa, Bru), Roxane Société (Cristaline, Volcania), Hildon Ltd, Borjomi Europe (IDS Borjomi), Agua Mineral San Benedetto S.p.A. (Acqua di Nepi; San Benedetto), Ferrarelle Società Benefit S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bottled water processing market in Europe appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, companies are likely to invest in eco-friendly packaging and production methods. Additionally, the rise of flavored and functional waters is expected to attract health-conscious consumers, further diversifying product offerings. The integration of digital platforms for sales and marketing will also enhance consumer engagement, ensuring that brands remain competitive in a rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Still Water Sparkling Water Functional Water Flavored Water Mineral and Spring Water Distilled/Processed Water Others |

| By End-User | Bottled Water Manufacturers Contract Packers (Co-packers) Foodservice and HoReCa Institutional and Commercial Facilities |

| By Distribution Channel | Off-trade (Supermarkets/Hypermarkets, Convenience, Online) On-trade (HoReCa) Direct-to-Consumer Subscriptions Direct/B2B Sales |

| By Packaging Type | PET Bottles Glass Bottles Aseptic Cartons Aluminum Cans |

| By Region | Western Europe Eastern Europe Northern Europe Southern Europe |

| By Price Range | Economy Mid-Range Premium |

| By Brand Ownership | Global/National Brands Private Labels Regional/Local Brands |

| By Processing Equipment | Filters Bottle Washers Fillers and Cappers Blow Molders Shrink Wrappers and Packers Other Equipment |

| By Processing Technology | Reverse Osmosis (RO) Ultrafiltration (UF) Microfiltration (MF) Ozonation/Chlorination UV Disinfection |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bottled Water Manufacturers | 100 | Production Managers, Quality Control Supervisors |

| Retail Distribution Channels | 80 | Supply Chain Managers, Retail Buyers |

| Consumer Preferences | 150 | Health-Conscious Consumers, Regular Bottled Water Users |

| Environmental Impact Assessments | 70 | Sustainability Officers, Environmental Compliance Managers |

| Market Trends and Innovations | 90 | Product Development Managers, Marketing Executives |

The Europe Bottled Water Processing Market is valued at approximately EUR 37 billion, reflecting a significant growth trend driven by health consciousness and the preference for bottled water among consumers, particularly in urban areas.