Region:Europe

Author(s):Geetanshi

Product Code:KRAB0113

Pages:93

Published On:August 2025

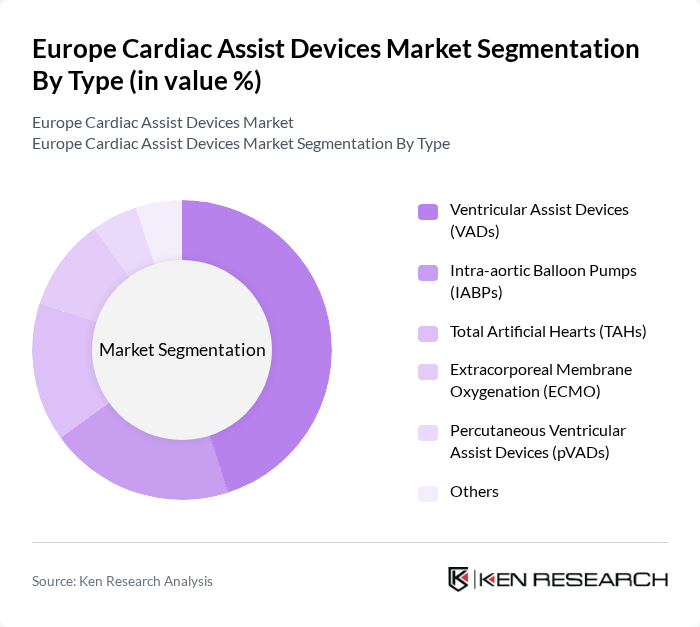

By Type:The market is segmented into various types of cardiac assist devices, including Ventricular Assist Devices (VADs), Intra-aortic Balloon Pumps (IABPs), Total Artificial Hearts (TAHs), Extracorporeal Membrane Oxygenation (ECMO), Percutaneous Ventricular Assist Devices (pVADs), and others. Among these, VADs—especially Left Ventricular Assist Devices (LVADs)—lead the market due to their proven effectiveness in managing advanced heart failure and improving patient survival rates. The adoption of minimally invasive VADs and technological advancements in device design are further accelerating segment growth .

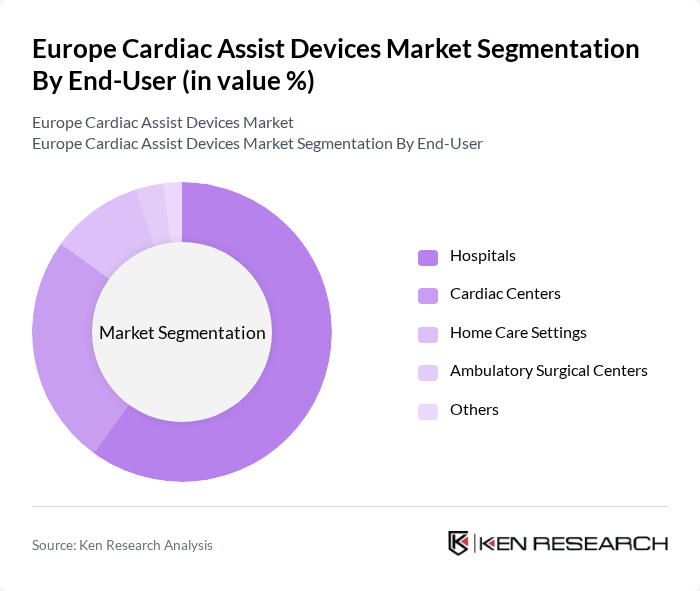

By End-User:The end-user segmentation includes Hospitals, Cardiac Centers, Home Care Settings, Ambulatory Surgical Centers, and others. Hospitals are the primary end-users of cardiac assist devices, driven by the high volume of cardiac surgeries and the need for advanced heart failure treatments. The increasing trend toward outpatient cardiac care and the expansion of specialized cardiac centers are also contributing to the growth of cardiac centers and home care settings as significant end-users .

The Europe Cardiac Assist Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Edwards Lifesciences Corporation, Terumo Corporation, Getinge AB, LivaNova PLC, SynCardia Systems, LLC, ReliantHeart, Inc., Abiomed, Inc., CardiacAssist, Inc., BiVACOR, Inc., Berlin Heart GmbH, CARMAT SA, Jarvik Heart, Inc., MAQUET Cardiopulmonary GmbH (Getinge Group), Teleflex Incorporated, HeartWare International, Inc. (Medtronic), CardioBridge GmbH, Leviticus Cardio Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cardiac assist devices market in Europe appears promising, driven by ongoing technological innovations and an increasing focus on patient-centric care. As healthcare systems adapt to the growing prevalence of cardiovascular diseases, the integration of artificial intelligence and machine learning into device functionality is expected to enhance treatment outcomes. Additionally, the shift towards minimally invasive procedures will likely lead to greater acceptance and utilization of these devices, fostering a more robust market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Ventricular Assist Devices (VADs) Left Ventricular Assist Devices (LVADs) Right Ventricular Assist Devices (RVADs) Biventricular Assist Devices (BiVADs) Intra-aortic Balloon Pumps (IABPs) Total Artificial Hearts (TAHs) Extracorporeal Membrane Oxygenation (ECMO) Percutaneous Ventricular Assist Devices (pVADs) Others |

| By End-User | Hospitals Cardiac Centers Home Care Settings Ambulatory Surgical Centers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Western Europe Eastern Europe Northern Europe Southern Europe |

| By Application | Heart Failure Treatment Cardiogenic Shock Management Cardiac Surgery Support Bridge to Transplantation Destination Therapy Others |

| By Patient Type | Adult Patients Pediatric Patients Geriatric Patients |

| By Price Range | Premium Mid-range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiologist Insights | 100 | Cardiologists, Cardiac Surgeons |

| Hospital Procurement Managers | 70 | Procurement Managers, Supply Chain Managers |

| Patient Experience Feedback | 50 | Patients with LVADs, Caregivers |

| Medical Device Distributors | 60 | Sales Representatives, Distribution Managers |

| Regulatory Insights | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Europe Cardiac Assist Devices Market is valued at approximately USD 600 million, driven by the increasing prevalence of cardiovascular diseases, technological advancements, and an aging population. This market is expected to grow as healthcare providers focus on improving patient outcomes.