Region:Europe

Author(s):Dev

Product Code:KRAB0608

Pages:96

Published On:August 2025

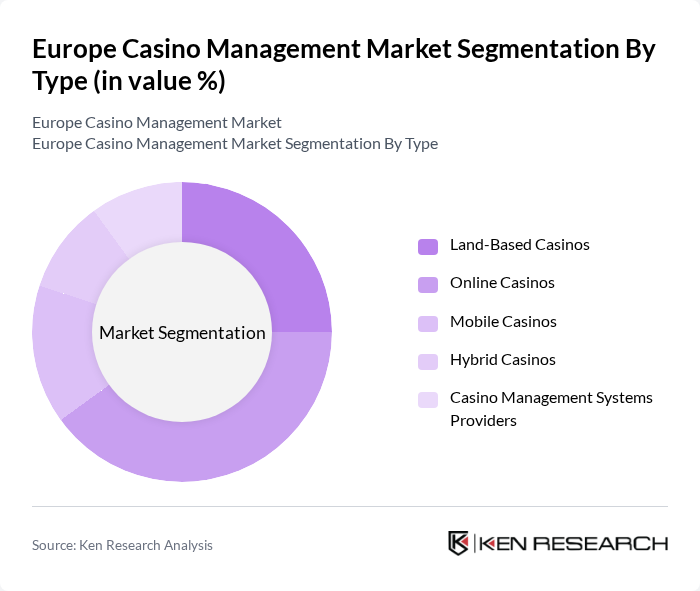

By Type:The market is segmented into Land-Based Casinos, Online Casinos, Mobile Casinos, Hybrid Casinos, and Casino Management Systems Providers. Online Casinos have gained significant traction due to the convenience they offer, the increasing penetration of smartphones and internet access, and the accelerated shift towards digital platforms driven by evolving consumer preferences—especially among younger demographics who favor online gaming experiences. The adoption of cashless and digital payment solutions is also a major trend shaping this segment .

By Purpose:The market is also segmented by purpose, including Accounting and Handling, Security and Surveillance, Hotel Management, Analytics and Reporting, Player Tracking and Loyalty Programs, and Compliance and Fraud Detection. Security and Surveillance is a particularly crucial segment as casinos increasingly prioritize the safety of patrons and assets. The sophistication of security threats has led to higher demand for advanced surveillance technologies, integrated security solutions, and compliance tools that support responsible gambling and regulatory adherence .

The Europe Casino Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novomatic AG, Playtech PLC, International Game Technology PLC, Scientific Games Corporation, Evolution Gaming Group AB, Betsson AB, Kindred Group PLC, 888 Holdings PLC, LeoVegas AB, Red Tiger Gaming, Yggdrasil Gaming Ltd., EveryMatrix Ltd., Pariplay Ltd., Greentube Internet Entertainment Solutions GmbH, Pragmatic Play Ltd., Amatic Industries GmbH, Euro Games Technology Ltd., Ensico CMS d.o.o., Advansys d.o.o., Synectics plc, Dallmeier electronic GmbH & Co.KG, Konami Gaming, Inc., SAS Institute Inc., Apex Gaming Technology, Decart Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe Casino Management Market is poised for significant transformation, driven by technological innovations and evolving consumer preferences. As mobile gaming continues to gain traction, operators are expected to invest heavily in mobile platforms to enhance accessibility. Additionally, the integration of virtual reality technologies is anticipated to create immersive gaming experiences, attracting a broader audience. These trends will likely reshape the competitive landscape, encouraging collaboration between casinos and technology providers to deliver cutting-edge solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Land-Based Casinos Online Casinos Mobile Casinos Hybrid Casinos Casino Management Systems Providers |

| By Purpose | Accounting and Handling Security and Surveillance Hotel Management Analytics and Reporting Player Tracking and Loyalty Programs Compliance and Fraud Detection |

| By Region | United Kingdom Germany France Spain Italy Rest of Europe |

| By Game Type | Slot Machines Table Games Sports Betting Live Dealer Games Electronic Gaming Machines |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Distributors |

| By Customer Demographics | Age Groups Gender Income Levels |

| By Customer Engagement | Loyalty Programs Promotions and Bonuses Social Media Engagement |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Land-based Casino Operations | 100 | Casino Managers, Operations Directors |

| Online Gaming Platforms | 80 | Product Managers, Marketing Executives |

| Regulatory Compliance in Gaming | 60 | Compliance Officers, Legal Advisors |

| Customer Experience in Casinos | 90 | Customer Service Managers, Guest Relations Officers |

| Market Trends and Innovations | 70 | Industry Analysts, Market Researchers |

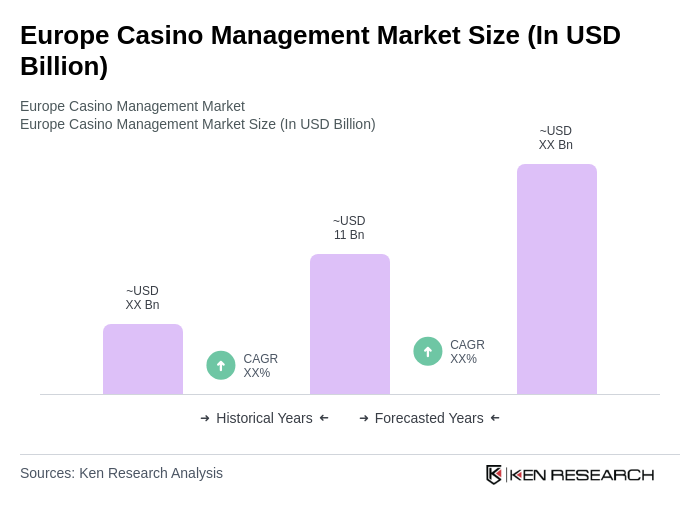

The Europe Casino Management Market is valued at approximately USD 11 billion, reflecting a significant growth trend driven by the increasing popularity of online gaming platforms and advancements in technology such as AI and data analytics.