Region:Europe

Author(s):Geetanshi

Product Code:KRAB0002

Pages:96

Published On:August 2025

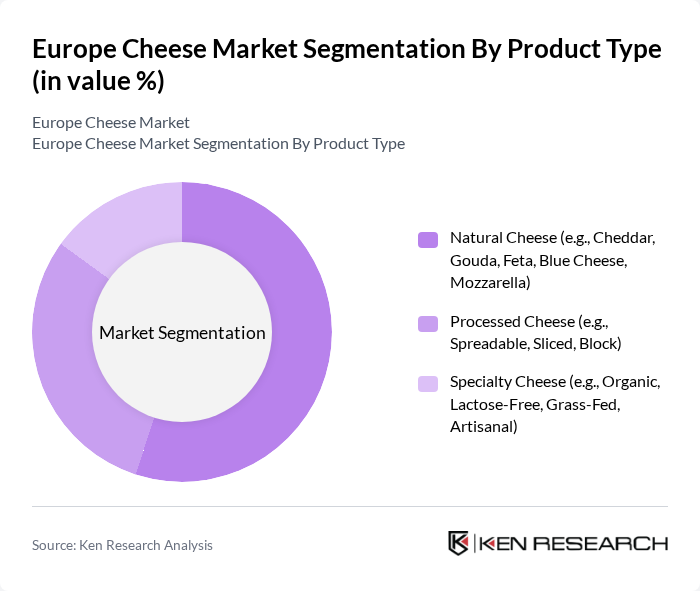

By Product Type:The product type segmentation includesNatural Cheese, Processed Cheese, and Specialty Cheese. Natural Cheese encompasses a variety of traditional cheeses such as Cheddar, Gouda, Feta, Blue Cheese, and Mozzarella. Processed Cheese includes products like spreadable, sliced, and block cheese, while Specialty Cheese covers organic, lactose-free, grass-fed, and artisanal varieties. Natural Cheese remains the leading subsegment due to its popularity and versatility in culinary applications, driven by consumer preferences for authentic flavors, clean labels, and traditional production methods. The demand for specialty and organic cheeses is also rising, reflecting a broader trend toward premiumization and health-oriented choices .

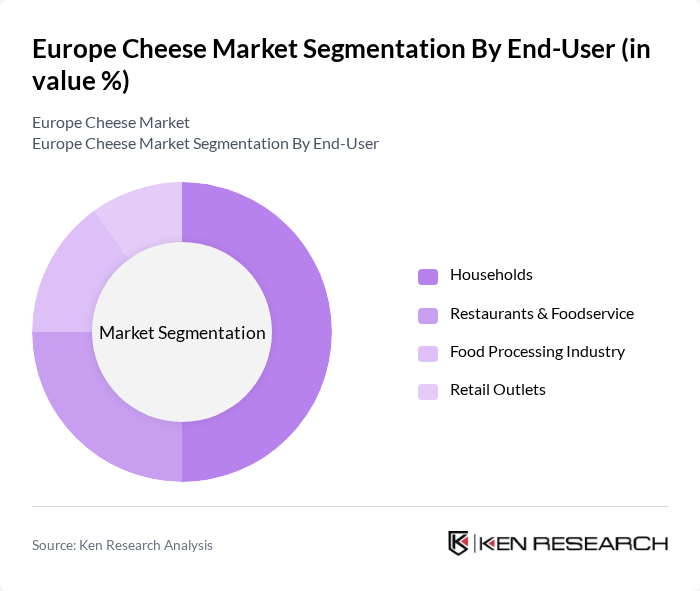

By End-User:The end-user segmentation includesHouseholds, Restaurants & Foodservice, Food Processing Industry, and Retail Outlets. Households represent a significant portion of the market, driven by increasing consumption of cheese in everyday meals and snacks, as well as a growing interest in home cooking and gourmet experiences. Restaurants and foodservice establishments are also key players, utilizing cheese in a wide range of dishes to enhance flavor and appeal. The Food Processing Industry uses cheese as an ingredient in numerous products, while Retail Outlets provide consumers with access to a diverse array of cheese products. Households are currently the dominant end-user segment, reflecting the ongoing trend of at-home meal preparation and snacking .

The Europe Cheese Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lactalis Group, FrieslandCampina, Arla Foods, Danone S.A., Bel Group, Saputo Inc., Fonterra Co-operative Group Limited, Emmi Group, Hochland SE, Müller Group, Fromageries Bel, Parmalat S.p.A., Savencia Fromage & Dairy (formerly Bongrain S.A.), Tine SA, and Lactalis Ingredients contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European cheese market appears promising, driven by evolving consumer preferences and innovative product offerings. As the demand for specialty and organic cheeses continues to rise, producers are likely to invest in new flavors and sustainable practices. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse cheese products, enhancing consumer engagement. Overall, the market is expected to adapt to changing trends while addressing challenges through strategic innovations and collaborations.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Natural Cheese (e.g., Cheddar, Gouda, Feta, Blue Cheese, Mozzarella) Processed Cheese (e.g., Spreadable, Sliced, Block) Specialty Cheese (e.g., Organic, Lactose-Free, Grass-Fed, Artisanal) |

| By End-User | Households Restaurants & Foodservice Food Processing Industry Retail Outlets |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Direct Sales |

| By Price Range | Premium Mid-Range Economy |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Region | Western Europe (France, Germany, UK, Netherlands, etc.) Eastern Europe (Poland, Hungary, Czech Republic, etc.) Northern Europe (Denmark, Sweden, Norway, Finland, etc.) Southern Europe (Italy, Spain, Greece, Portugal, etc.) |

| By Application | Culinary Uses Snack Foods Ingredient in Processed Foods Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Cheese Sales | 120 | Store Managers, Category Buyers |

| Food Service Cheese Usage | 90 | Chefs, Restaurant Owners |

| Consumer Cheese Preferences | 140 | Household Consumers, Food Enthusiasts |

| Cheese Export Market | 60 | Export Managers, Trade Analysts |

| Cheese Production Insights | 50 | Production Managers, Quality Control Officers |

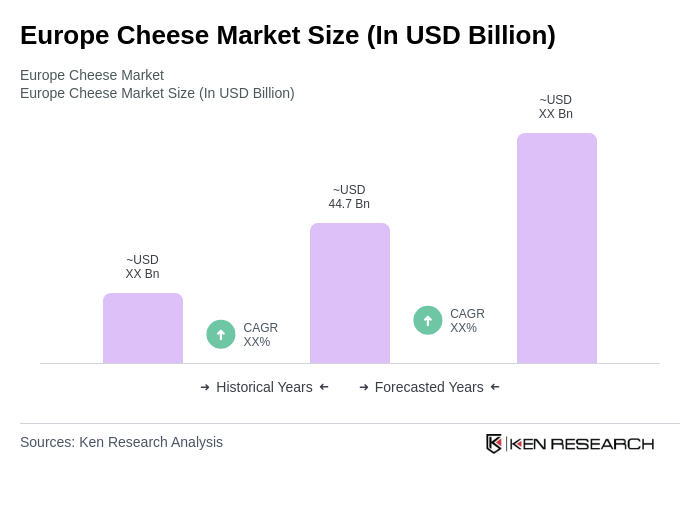

The Europe Cheese Market is valued at approximately USD 44.7 billion, reflecting a significant growth trend driven by increasing consumer demand for diverse cheese varieties and a shift towards premium and specialty products.