Region:Europe

Author(s):Rebecca

Product Code:KRAA1417

Pages:83

Published On:August 2025

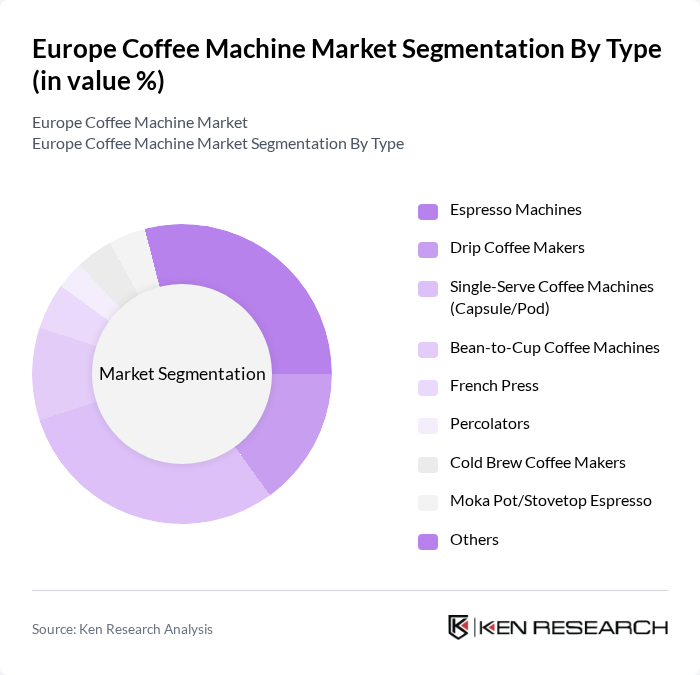

By Type:The coffee machine market can be segmented into various types, including Espresso Machines, Drip Coffee Makers, Single-Serve Coffee Machines (Capsule/Pod), Bean-to-Cup Coffee Machines, French Press, Percolators, Cold Brew Coffee Makers, Moka Pot/Stovetop Espresso, and Others. Among these, Single-Serve Coffee Machines have gained significant popularity due to their convenience and ease of use, catering to the busy lifestyles of consumers. Espresso Machines also hold a substantial share, driven by the growing preference for café-style coffee at home. The market is also witnessing increased demand for smart and connected models, as well as energy-efficient and sustainable brewing solutions.

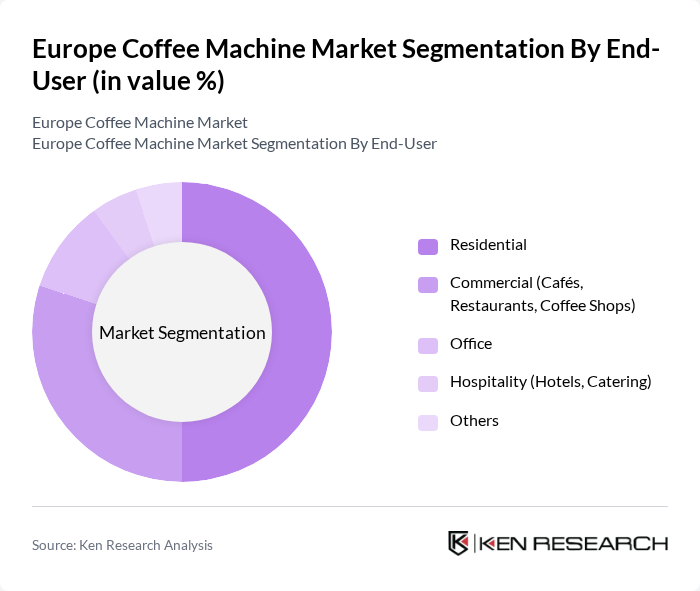

By End-User:The market can be segmented based on end-users, including Residential, Commercial (Cafés, Restaurants, Coffee Shops), Office, Hospitality (Hotels, Catering), and Others. The Residential segment is currently the largest, driven by the increasing trend of home brewing and the desire for high-quality coffee experiences at home. The Commercial segment also plays a crucial role, as cafés and restaurants invest in premium coffee machines to meet customer demands. Offices and hospitality venues are increasingly adopting energy-efficient and smart coffee machines to enhance user experience and operational efficiency.

The Europe Coffee Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A. (Nespresso, Dolce Gusto), JURA Elektroapparate AG, De'Longhi S.p.A., Breville Group Limited, Koninklijke Philips N.V., Bosch Home Appliances (BSH Hausgeräte GmbH), Krups S.A.S. (Groupe SEB), Saeco International Group S.p.A. (Philips), Gaggia S.p.A., Hamilton Beach Brands Holding Company, Cuisinart (Conair Corporation), Smeg S.p.A., Rancilio Group S.p.A., La Marzocco S.r.l., Tchibo GmbH, Melitta Group, Miele & Cie. KG, Siemens Home Appliances (BSH Hausgeräte GmbH), WMF Group GmbH, Lavazza Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe coffee machine market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for specialty coffee continues to rise, manufacturers are likely to focus on developing innovative, user-friendly machines that cater to this trend. Additionally, the integration of sustainable practices and eco-friendly materials in production will become increasingly important, aligning with consumer values. The market is expected to adapt to these changes, fostering growth and enhancing the overall coffee experience for consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Espresso Machines Drip Coffee Makers Single-Serve Coffee Machines (Capsule/Pod) Bean-to-Cup Coffee Machines French Press Percolators Cold Brew Coffee Makers Moka Pot/Stovetop Espresso Others |

| By End-User | Residential Commercial (Cafés, Restaurants, Coffee Shops) Office Hospitality (Hotels, Catering) Others |

| By Distribution Channel | Online Retail Specialty Stores Supermarkets/Hypermarkets Direct Sales (B2B) Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| By Features | Programmable Settings Built-in Grinder Milk Frother Smart Connectivity (Wi-Fi/Bluetooth) Energy Efficiency Touchless Operation Others |

| By Material | Plastic Stainless Steel Glass Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Coffee Machine Users | 120 | Homeowners, Coffee Enthusiasts |

| Commercial Coffee Machine Users | 90 | Café Owners, Restaurant Managers |

| Retail Buyers of Coffee Machines | 60 | Retail Managers, Purchasing Agents |

| Online Coffee Machine Shoppers | 50 | E-commerce Managers, Digital Marketing Specialists |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

The Europe Coffee Machine Market is valued at approximately USD 5.2 billion, reflecting a significant growth driven by the increasing demand for premium coffee experiences and the rise of specialty coffee culture among consumers.