Region:Europe

Author(s):Geetanshi

Product Code:KRAA0234

Pages:88

Published On:August 2025

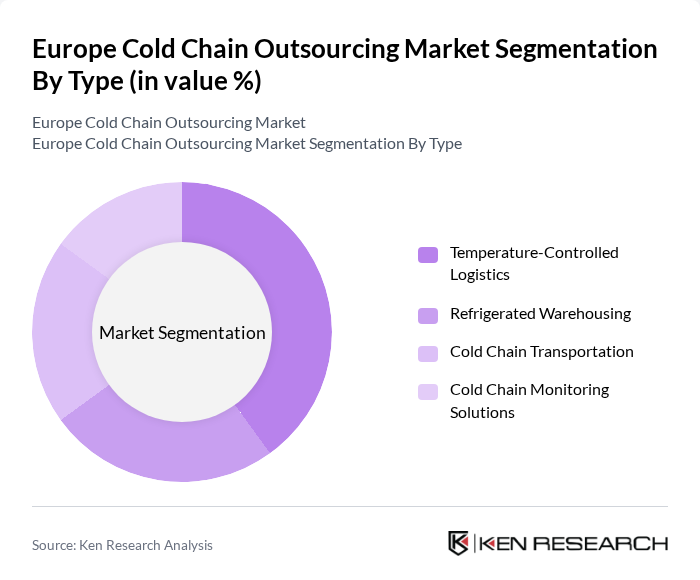

By Type:The cold chain outsourcing market can be segmented into four main types: Temperature-Controlled Logistics, Refrigerated Warehousing, Cold Chain Transportation, and Cold Chain Monitoring Solutions. Each of these segments plays a crucial role in ensuring the integrity and safety of temperature-sensitive products throughout the supply chain. Temperature-Controlled Logistics covers end-to-end management of perishable goods, Refrigerated Warehousing provides specialized storage facilities, Cold Chain Transportation ensures safe movement across modes, and Cold Chain Monitoring Solutions offer real-time data and compliance assurance through IoT and RFID technologies .

The Temperature-Controlled Logistics segment is currently dominating the market due to the increasing demand for efficient and reliable logistics solutions that maintain product integrity. This segment is characterized by the use of advanced technologies such as IoT and real-time monitoring systems, which enhance operational efficiency and ensure compliance with safety standards. The growing trend of e-commerce and online grocery shopping has further fueled the need for temperature-controlled logistics, making it a critical component of the cold chain outsourcing market .

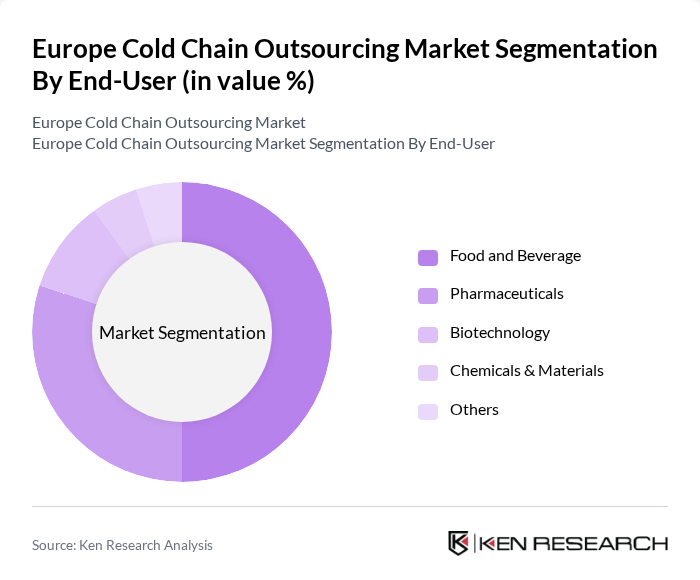

By End-User:The market can be segmented based on end-users into Food and Beverage, Pharmaceuticals, Biotechnology, Chemicals & Materials, and Others. Each end-user category has distinct requirements and challenges that influence their cold chain logistics needs. Food and Beverage require stringent temperature controls to prevent spoilage, Pharmaceuticals and Biotechnology demand validated and compliant environments for sensitive products, while Chemicals & Materials need specialized handling for hazardous or regulated substances .

The Food and Beverage segment leads the market, driven by the increasing consumer demand for fresh and high-quality products. This segment requires stringent temperature control to prevent spoilage and maintain product quality, which has led to significant investments in cold chain logistics. The rise in health-conscious consumers and the growing trend of organic and fresh food consumption further bolster the demand for efficient cold chain solutions in this sector .

The Europe Cold Chain Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, Lineage Logistics, NewCold, Norfrig (NORDFROST GmbH & Co. KG), STEF Group, Maersk (AP Moller Maersk AS), GARTNER KG, DSV A/S, Blue Water Shipping, Kraftverkehr Nagel SE & Co. KG, SNCF Logistics (GEFCO), CEVA Logistics, Arbon Equipment Corp. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cold chain outsourcing market in Europe appears promising, driven by technological innovations and evolving consumer preferences. As sustainability becomes a priority, companies are likely to adopt eco-friendly practices, enhancing their competitive edge. Furthermore, the integration of AI and IoT technologies will streamline operations, improving efficiency and reducing waste. The market is expected to witness significant growth as businesses adapt to these trends, positioning themselves to meet the increasing demand for high-quality perishable goods.

| Segment | Sub-Segments |

|---|---|

| By Type | Temperature-Controlled Logistics Refrigerated Warehousing Cold Chain Transportation Cold Chain Monitoring Solutions |

| By End-User | Food and Beverage Pharmaceuticals Biotechnology Chemicals & Materials Others |

| By Region | Western Europe (e.g., Germany, France, UK, Netherlands) Eastern Europe (e.g., Poland, Hungary, Czech Republic) Northern Europe (e.g., Sweden, Denmark, Finland) Southern Europe (e.g., Italy, Spain, Portugal) Rest of Europe |

| By Service Type | Transportation Services Warehousing Services Value-Added Services (Packaging, Labeling, etc.) Others |

| By Temperature Range | Chilled (0°C to 5°C) Frozen (-18°C and below) Ambient (15°C to 25°C) Others |

| By Technology | IoT-Enabled Solutions RFID & Real-Time Monitoring Automated Storage & Retrieval Systems Blockchain Technology Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 100 | Supply Chain Managers, Quality Assurance Directors |

| Pharmaceutical Cold Chain Logistics | 80 | Logistics Coordinators, Regulatory Affairs Managers |

| Biotechnology Product Distribution | 60 | Operations Managers, Compliance Officers |

| Retail Cold Chain Management | 70 | Warehouse Managers, Inventory Control Specialists |

| Temperature-Sensitive Product Handling | 50 | Logistics Analysts, Procurement Managers |

The Europe Cold Chain Outsourcing Market is valued at approximately USD 96 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, along with rising consumer expectations for quality and safety.