Region:Europe

Author(s):Dev

Product Code:KRAA2208

Pages:83

Published On:August 2025

By Type:The collagen market can be segmented into Gelatin, Hydrolyzed Collagen, Native Collagen, Synthetic Collagen, Bovine Collagen, Porcine Collagen, Marine Collagen, Chicken Collagen, and Others. Hydrolyzed Collagen is gaining significant traction due to its high bioavailability and ease of incorporation into a wide range of products, especially in dietary supplements and functional beverages. The demand for Marine Collagen continues to rise, driven by its perceived health benefits, sustainability, and appeal to pescatarian and flexitarian consumers. The growing preference for natural and clean-label products is influencing market dynamics, with a notable shift towards marine and plant-based sources .

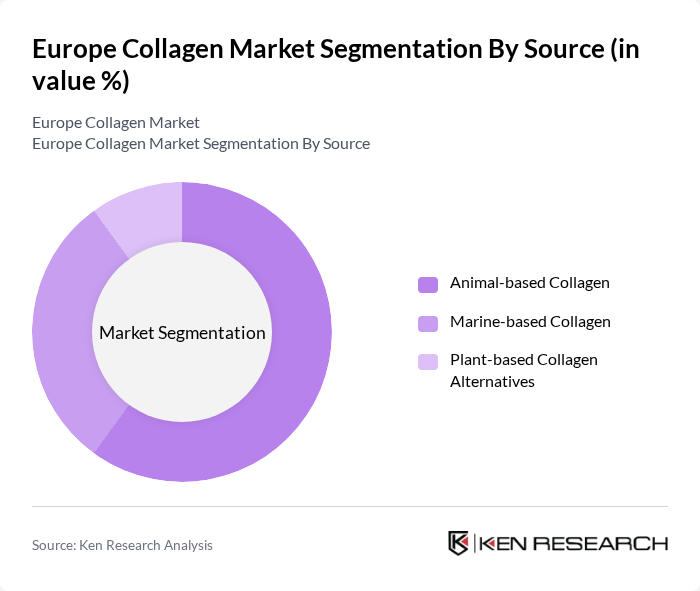

By Source:The collagen market is also segmented by source, including Animal-based Collagen, Marine-based Collagen, and Plant-based Collagen Alternatives. Animal-based Collagen remains the most widely used due to its abundant supply and cost-effectiveness. However, demand for Marine-based Collagen is increasing, driven by consumer preferences for sustainable and environmentally friendly products. Plant-based alternatives are emerging as a viable option for vegan and vegetarian consumers, reflecting the broader trend toward plant-based diets and ethical sourcing .

The Europe Collagen Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gelita AG, Collagen Solutions PLC, Rousselot (a Darling Ingredients company), Nitta Gelatin Inc., Ewald-Gelatine GmbH, PB Gelatins (part of Tessenderlo Group NV), Weishardt, Junca Gelatines S.L., Symatese, Collagen Matrix, Inc., Advanced BioMatrix, Inc., Connoils LLC, Vital Proteins LLC, Amicogen Inc., Tessenderlo Group NV contribute to innovation, geographic expansion, and service delivery in this space.

The future of the collagen market in Europe appears promising, driven by increasing consumer interest in health and wellness products. Innovations in collagen formulations, particularly plant-based alternatives, are expected to gain traction as consumers seek sustainable options. Additionally, the rise of e-commerce platforms is facilitating greater access to collagen products, allowing brands to reach a broader audience. As the market evolves, personalized nutrition trends will likely shape product offerings, catering to individual health needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Gelatin Hydrolyzed Collagen Native Collagen Synthetic Collagen Bovine Collagen Porcine Collagen Marine Collagen Chicken Collagen Others |

| By Source | Animal-based Collagen Marine-based Collagen Plant-based Collagen Alternatives |

| By Application | Food and Beverages Nutraceuticals/Dietary Supplements Cosmetics and Personal Care Pharmaceuticals/Medical Devices Meat Processing Biomaterials & Packaging Others |

| By End-User | Health and Wellness Beauty and Skincare Sports Nutrition Food Industry Medical & Pharmaceutical Industry |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies |

| By Formulation | Powder Liquid Capsules/Tablets Bars/Functional Foods |

| By Region | Germany France United Kingdom Italy Spain Netherlands Rest of Europe |

| By Price Range | Premium Mid-Range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetic Product Manufacturers | 100 | Product Development Managers, Marketing Directors |

| Dietary Supplement Retailers | 60 | Store Managers, Category Buyers |

| Pharmaceutical Companies | 50 | Regulatory Affairs Specialists, R&D Managers |

| Health and Wellness Influencers | 40 | Nutritionists, Fitness Coaches |

| Food & Beverage Manufacturers | 70 | Product Innovation Managers, Quality Assurance Officers |

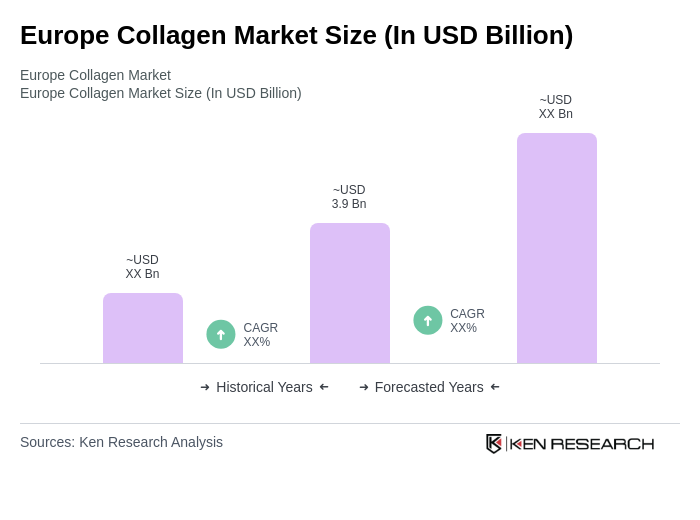

The Europe Collagen Market is valued at approximately USD 3.9 billion, driven by increasing demand across various sectors such as food and beverages, cosmetics, nutraceuticals, and pharmaceuticals, reflecting a growing consumer focus on health and wellness.