Region:Europe

Author(s):Dev

Product Code:KRAB0428

Pages:100

Published On:August 2025

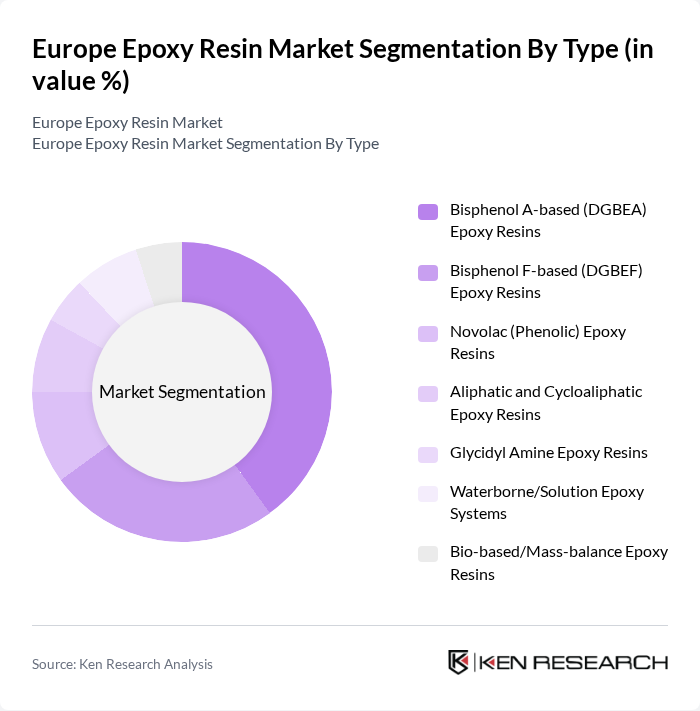

By Type:The epoxy resin market can be segmented into various types, including Bisphenol A-based (DGBEA) Epoxy Resins, Bisphenol F-based (DGBEF) Epoxy Resins, Novolac (Phenolic) Epoxy Resins, Aliphatic and Cycloaliphatic Epoxy Resins, Glycidyl Amine Epoxy Resins, Waterborne/Solution Epoxy Systems, and Bio-based/Mass-balance Epoxy Resins. Among these, Bisphenol A-based epoxy resins are the most widely used due to their excellent mechanical properties and versatility in applications.

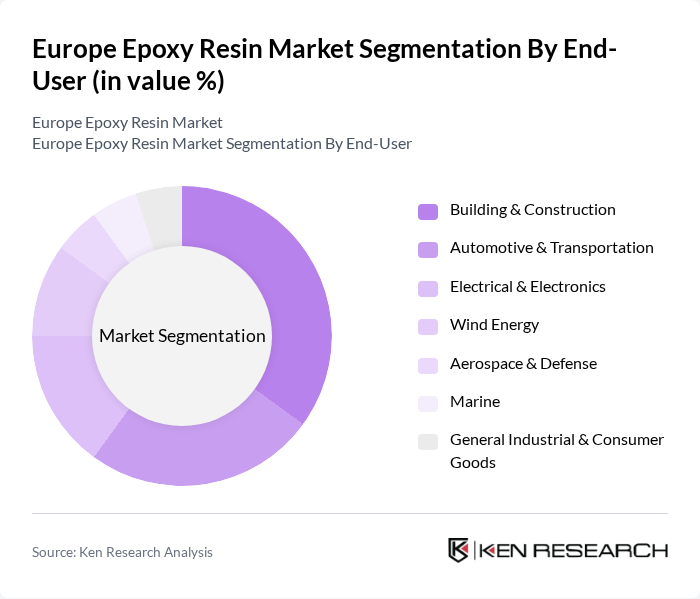

By End-User:The epoxy resin market is segmented by end-user industries, including Building & Construction, Automotive & Transportation, Electrical & Electronics, Wind Energy, Aerospace & Defense, Marine, and General Industrial & Consumer Goods. The Building & Construction sector is the largest consumer of epoxy resins, driven by the increasing demand for durable and high-performance materials in construction applications.

The Europe Epoxy Resin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Olin Corporation (Olin Epoxy), Westlake Epoxy (formerly Hexion Epoxy), Huntsman Corporation, BASF SE, Covestro AG, Dow Inc., 3M Company, Sika AG, Arkema S.A. (Bostik, Sartomer), Evonik Industries AG, Aditya Birla Chemicals, KUKDO Chemical Co., Ltd., Nan Ya Plastics Corporation, Mitsubishi Chemical Group Corporation, TotalEnergies SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the epoxy resin market in Europe appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in bio-based epoxy formulations are expected to gain traction, aligning with the EU's sustainability goals. Additionally, the increasing integration of epoxy resins in electric vehicle production will likely enhance market dynamics. As manufacturers adapt to regulatory changes and invest in eco-friendly solutions, the market is poised for significant growth, fostering a competitive landscape that prioritizes innovation and environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Bisphenol A-based (DGBEA) Epoxy Resins Bisphenol F-based (DGBEF) Epoxy Resins Novolac (Phenolic) Epoxy Resins Aliphatic and Cycloaliphatic Epoxy Resins Glycidyl Amine Epoxy Resins Waterborne/Solution Epoxy Systems Bio-based/Mass-balance Epoxy Resins |

| By End-User | Building & Construction Automotive & Transportation Electrical & Electronics Wind Energy Aerospace & Defense Marine General Industrial & Consumer Goods |

| By Application | Paints & Protective Coatings Adhesives & Sealants Fiber-Reinforced Composites & Laminates Electrical/Electronic Encapsulation & Potting Flooring, Grouts & Mortars Tooling, Castings & 3D Printing |

| By Distribution Channel | Direct Sales to OEMs and Tier-1s Specialty Chemical Distributors Online/Direct-to-Professional Platforms Retail/DIY Channels |

| By Region | Western Europe Eastern Europe Northern Europe Southern Europe Central Europe |

| By Price Range | Commodity Grades Mid-range Performance Grades High-performance/Specialty Grades |

| By Product Form | Liquid Epoxy Resins (LER) Solid Epoxy Resins (SER) Solvent-borne/Epoxy Solutions Waterborne Dispersions Powder Epoxy Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coatings | 100 | Product Managers, R&D Engineers |

| Construction Adhesives | 80 | Procurement Managers, Project Engineers |

| Electronics Encapsulation | 70 | Manufacturing Engineers, Quality Assurance Managers |

| Composite Materials | 60 | Design Engineers, Supply Chain Managers |

| Industrial Applications | 90 | Operations Managers, Technical Sales Representatives |

The Europe Epoxy Resin Market is valued at approximately USD 4 billion, reflecting a robust growth trajectory driven by demand from industries such as automotive, construction, and electronics, alongside advancements in technology and sustainable materials.