Region:Europe

Author(s):Rebecca

Product Code:KRAA1332

Pages:83

Published On:August 2025

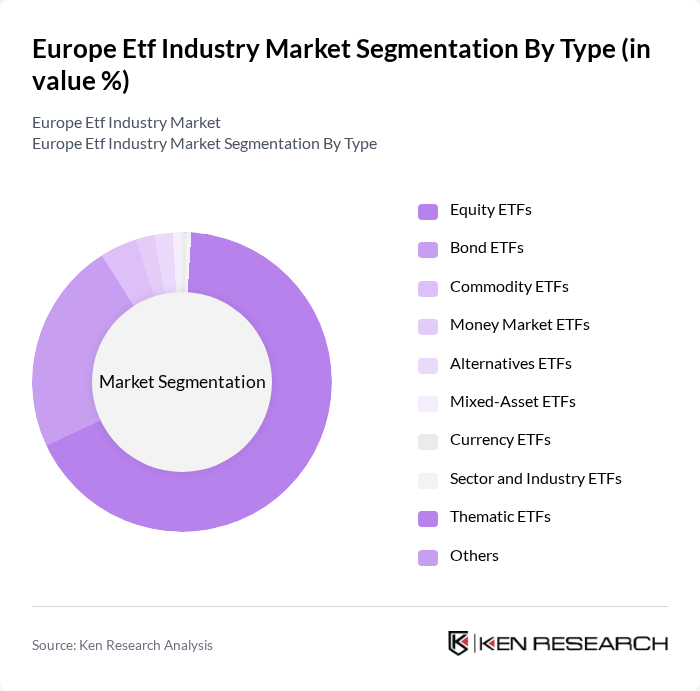

By Type:The Europe ETF market is segmented into Equity ETFs, Bond ETFs, Commodity ETFs, Money Market ETFs, Alternatives ETFs, Mixed-Asset ETFs, Currency ETFs, Sector and Industry ETFs, Thematic ETFs, and Others. Equity ETFs are the most dominant, accounting for the majority of assets, driven by the increasing popularity of stock market investments and the demand for diversified equity exposure. Bond ETFs also hold a significant share, appealing to conservative investors seeking fixed-income solutions. Alternatives ETFs, including ESG and thematic products, are the fastest-growing segment, reflecting evolving investor preferences .

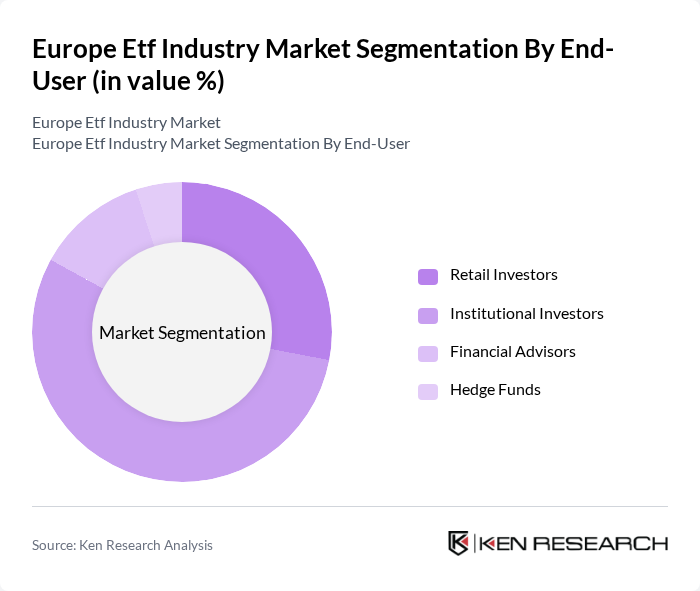

By End-User:The end-user segmentation of the Europe ETF market includes Retail Investors, Institutional Investors (e.g., Pension Funds, Insurance Companies), Financial Advisors, and Hedge Funds. Institutional investors remain the leading segment, driven by their need for efficient portfolio management, risk diversification, and regulatory compliance. Retail investors are also increasingly participating in the ETF market, attracted by the ease of access, digital investment platforms, and lower fees associated with ETFs .

The Europe ETF industry market is characterized by a dynamic mix of regional and international players. Leading participants such as BlackRock, Inc. (iShares), Amundi Asset Management, DWS Group (Xtrackers), Lyxor ETF (now part of Amundi), Vanguard Group, Inc., State Street Global Advisors (SPDR), UBS Asset Management, HSBC Asset Management, Invesco Ltd., Legal & General Investment Management (LGIM), Franklin Templeton Investments, Fidelity International, BNP Paribas Asset Management, WisdomTree Europe, Tabula Investment Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European ETF market appears promising, driven by ongoing trends such as the increasing adoption of sustainable investment practices and the rise of digital platforms. As more investors prioritize environmental, social, and governance (ESG) criteria, the demand for ESG-focused ETFs is expected to surge. Additionally, technological advancements will continue to enhance trading efficiency, making ETFs more accessible to a broader audience, including retail investors seeking diversified portfolios.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity ETFs Bond ETFs Commodity ETFs Money Market ETFs Alternatives ETFs Mixed-Asset ETFs Currency ETFs Sector and Industry ETFs Thematic ETFs Others |

| By End-User | Retail Investors Institutional Investors (e.g., Pension Funds, Insurance Companies) Financial Advisors Hedge Funds |

| By Investment Strategy | Passive Investment (Index Tracking) Active Management Smart Beta Strategies ESG/Sustainable Strategies |

| By Distribution Channel | Online Brokerage Platforms Direct-to-Consumer Digital Platforms Financial Advisors Direct Investment (Institutional) |

| By Asset Class | Equities Fixed Income Alternatives Commodities Money Market |

| By Geographic Focus | Domestic Focus (Europe) International Focus Emerging Markets Focus |

| By Risk Profile | Low Risk Medium Risk High Risk |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Institutional Investors in ETFs | 100 | Pension Fund Managers, Asset Allocators |

| Retail Investor Insights | 70 | Individual Investors, Financial Advisors |

| ETF Providers and Fund Managers | 50 | Product Development Heads, Marketing Directors |

| Regulatory Impact Assessment | 40 | Compliance Officers, Legal Advisors |

| Market Analysts and Researchers | 40 | Financial Analysts, Market Strategists |

The Europe ETF industry market is valued at approximately USD 2.7 trillion, reflecting significant growth driven by increasing investor interest in low-cost investment options and the rise of both passive and active ETF strategies.