Region:Europe

Author(s):Geetanshi

Product Code:KRAA0101

Pages:96

Published On:August 2025

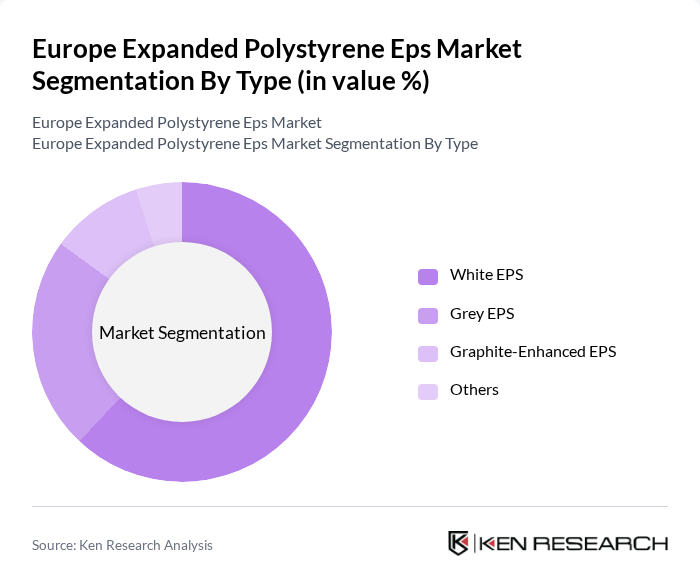

By Type:The EPS market is segmented into various types, including White EPS, Grey EPS, Graphite-Enhanced EPS, and Others. Among these, White EPS remains the most widely used due to its cost-effectiveness, ease of processing, and excellent insulation properties. Grey EPS, recognized for its enhanced thermal performance, is increasingly adopted in energy-efficient construction. Graphite-Enhanced EPS is preferred for high-performance insulation applications, particularly in green building projects. The 'Others' category includes specialized EPS products tailored for niche and technical applications .

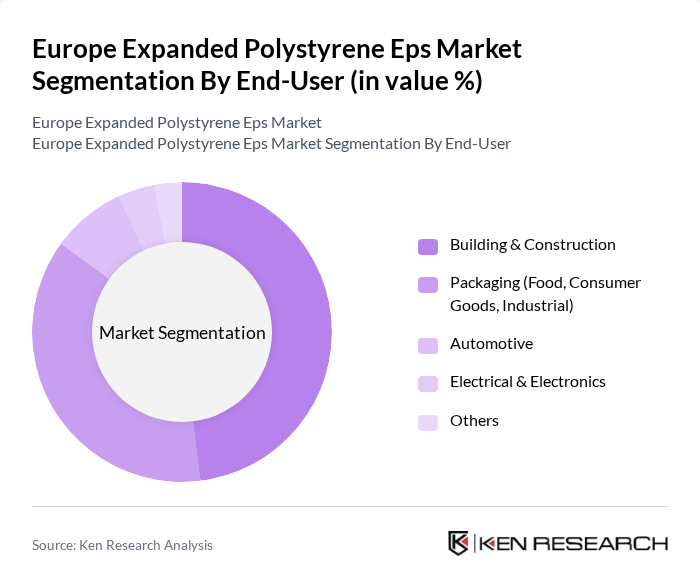

By End-User:The EPS market serves a range of end-user industries, including Building & Construction, Packaging (Food, Consumer Goods, Industrial), Automotive, Electrical & Electronics, and Others. The Building & Construction sector is the largest consumer of EPS, driven by the increasing demand for energy-efficient insulation materials and green building initiatives. The Packaging sector follows, utilizing EPS for its lightweight, shock-absorbing, and insulating properties, particularly in food, consumer goods, and industrial packaging. Automotive and Electrical & Electronics sectors use EPS for protective and lightweight components, while the 'Others' category includes medical and specialty applications .

The Europe Expanded Polystyrene EPS Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Synthos S.A., Sunpor Kunststoff GmbH, BEWi ASA, Versalis S.p.A. (Eni Group), Ravago Group, TotalEnergies, Alpek S.A.B. de C.V., Knauf Insulation, StyroChem Finland Oy, Hirsch Servo AG, Unipol Holland BV, Polystyrenes Europe (PlasticsEurope), SIBUR, NOVA Chemicals contribute to innovation, geographic expansion, and service delivery in this space.

The future of the EPS market in Europe appears promising, driven by increasing demand for sustainable packaging and construction materials. As environmental regulations tighten, companies are likely to invest in innovative recycling technologies and bio-based EPS alternatives. The integration of smart technologies in EPS applications is also expected to enhance product functionality. In future, the market is poised for growth, with a focus on sustainability and efficiency, aligning with broader EU environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | White EPS Grey EPS Graphite-Enhanced EPS Others |

| By End-User | Building & Construction Packaging (Food, Consumer Goods, Industrial) Automotive Electrical & Electronics Others |

| By Region | Western Europe (Germany, France, UK, Benelux) Eastern Europe (Poland, Czech Republic, Hungary, Others) Northern Europe (Sweden, Denmark, Finland, Norway) Southern Europe (Italy, Spain, Portugal, Greece) |

| By Application | Insulation (Thermal, Acoustic) Protective Packaging Construction Components (Blocks, Panels, Boards) Others |

| By Density | Low Density EPS Medium Density EPS High Density EPS Others |

| By Color | White EPS Grey EPS Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry EPS Usage | 100 | Project Managers, Architects, Building Contractors |

| Packaging Sector Insights | 90 | Product Managers, Packaging Engineers, Supply Chain Analysts |

| Automotive Applications of EPS | 60 | Design Engineers, Procurement Managers, Quality Assurance Heads |

| EPS Recycling Practices | 50 | Recycling Facility Managers, Environmental Compliance Officers |

| Consumer Insights on EPS Products | 40 | End-users, Retail Managers, Sustainability Advocates |

The Europe Expanded Polystyrene (EPS) market is valued at approximately USD 2.2 billion, driven by the increasing demand for insulation materials in construction and sustainable packaging solutions.