Region:Europe

Author(s):Shubham

Product Code:KRAA0782

Pages:89

Published On:August 2025

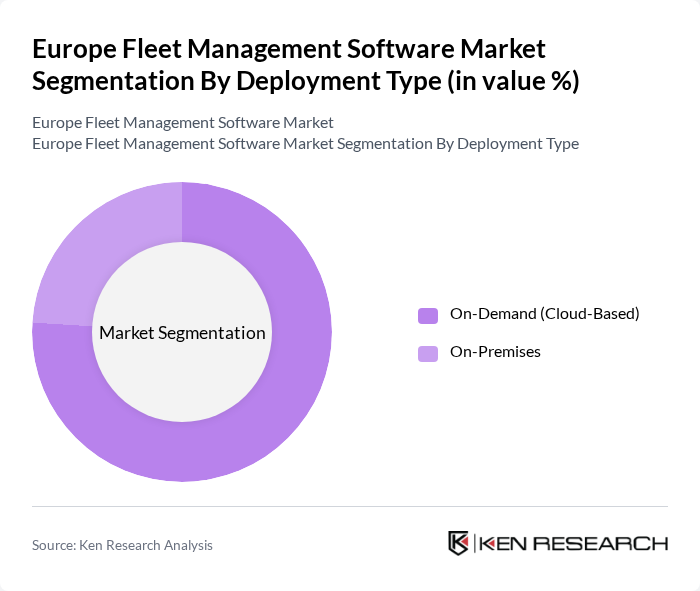

By Deployment Type:

The deployment type segment includes On-Demand (Cloud-Based) and On-Premises solutions. The On-Demand (Cloud-Based) sub-segment is currently leading the market due to its flexibility, scalability, and lower upfront costs, making it an attractive option for businesses of all sizes. The increasing trend of remote work and the need for real-time data access have further accelerated the adoption of cloud-based solutions. On-Premises solutions, while still relevant, are gradually losing ground as companies prefer the advantages offered by cloud technologies. In the broader European fleet management market, cloud-based solutions account for a significant majority of new deployments .

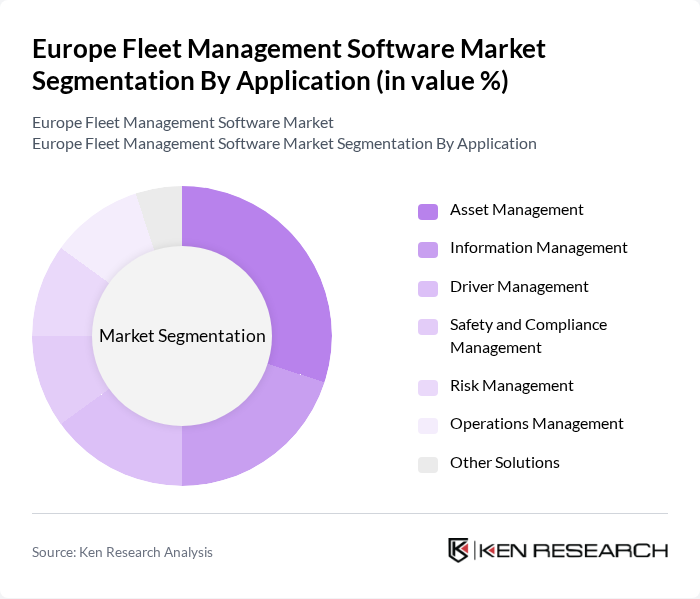

By Application:

The application segment encompasses various functionalities, including Asset Management, Information Management, Driver Management, Safety and Compliance Management, Risk Management, Operations Management, and Other Solutions. Among these, Asset Management is the leading sub-segment, driven by the need for businesses to optimize their fleet assets and reduce operational costs. The increasing focus on data analytics and performance monitoring has made Asset Management solutions essential for fleet operators, enabling them to make informed decisions and enhance overall efficiency .

The Europe Fleet Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Webfleet Solutions (Bridgestone), Verizon Connect, Geotab, Teletrac Navman, Fleet Complete, TomTom Telematics, Gurtam, Microlise, Masternaut (Michelin), Chevin Fleet Solutions, Ctrack (Inseego), Quartix, Fleetio, Omnicomm, Zubie contribute to innovation, geographic expansion, and service delivery in this space .

The future of the European fleet management software market appears promising, driven by technological advancements and evolving consumer demands. As businesses increasingly prioritize sustainability, the integration of electric vehicles and AI-driven analytics will likely reshape operational strategies. Furthermore, the shift towards cloud-based solutions will enhance accessibility and scalability, allowing fleet operators to adapt to changing market conditions. These trends indicate a robust growth trajectory for the industry, fostering innovation and efficiency in fleet management practices.

| Segment | Sub-Segments |

|---|---|

| By Deployment Type | On-Demand (Cloud-Based) On-Premises |

| By Application | Asset Management Information Management Driver Management Safety and Compliance Management Risk Management Operations Management Other Solutions |

| By End-User Vertical | Transportation and Logistics Energy Construction Manufacturing Public Sector Retail Other End-Users |

| By Vehicle Type | Commercial Fleets Passenger Cars |

| By Country | Germany United Kingdom France Spain Italy Netherlands Russia Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Fleet Management | 100 | Fleet Managers, Operations Directors |

| Public Transportation Systems | 60 | Transport Planners, Fleet Supervisors |

| Logistics and Delivery Services | 80 | Logistics Managers, Supply Chain Analysts |

| Construction and Heavy Equipment | 40 | Project Managers, Equipment Fleet Coordinators |

| Telematics and Software Providers | 50 | Product Managers, Software Developers |

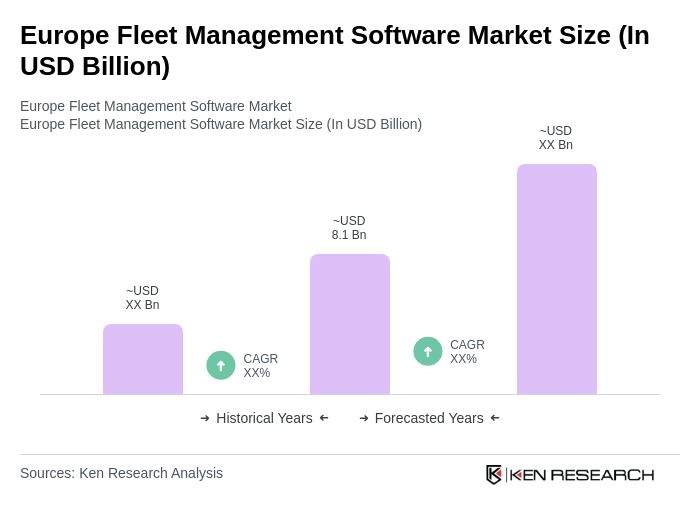

The Europe Fleet Management Software Market is valued at approximately USD 8.1 billion, reflecting a significant growth driven by the need for operational efficiency, cost reduction, and enhanced safety measures in fleet operations across various industries.