Region:Europe

Author(s):Shubham

Product Code:KRAA0723

Pages:88

Published On:August 2025

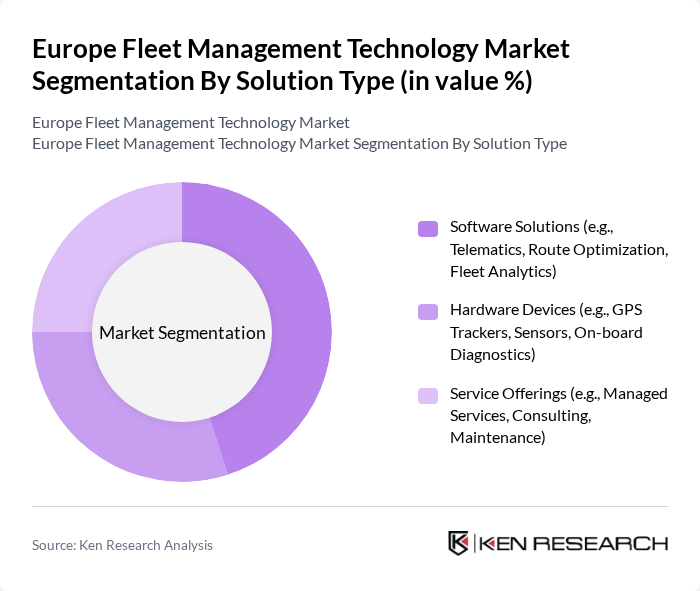

By Solution Type:The solution type segmentation includes software solutions, hardware devices, and service offerings. Software solutions encompass telematics, route optimization, and fleet analytics, while hardware devices include GPS trackers, sensors, and on-board diagnostics. Service offerings consist of managed services, consulting, and maintenance. The increasing integration of AI-powered analytics and cloud-based telematics is enhancing the value proposition of software solutions, while hardware advancements focus on real-time data collection and diagnostics .

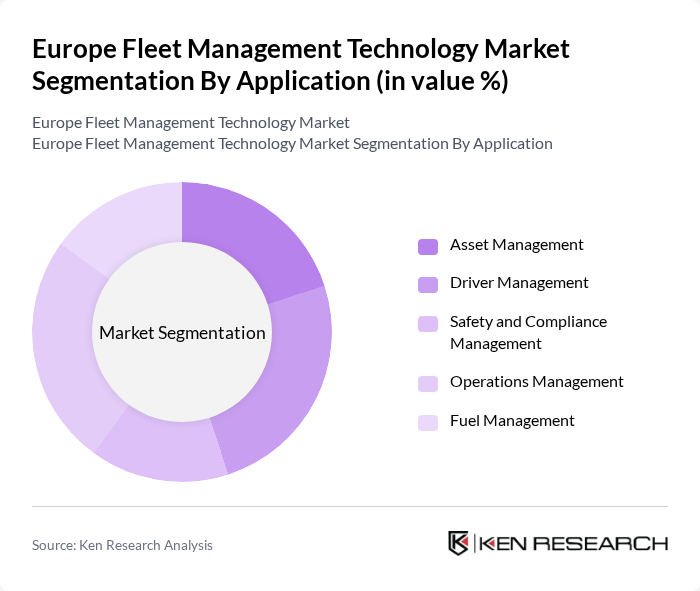

By Application:The application segmentation includes asset management, driver management, safety and compliance management, operations management, and fuel management. Each application serves a specific purpose in enhancing fleet efficiency and safety. Asset management focuses on vehicle utilization and lifecycle optimization; driver management addresses behavior monitoring and training; safety and compliance management ensures adherence to regulations; operations management streamlines dispatch and routing; and fuel management targets consumption reduction and cost savings .

The Europe Fleet Management Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Webfleet (Bridgestone Mobility Solutions), Verizon Connect, Geotab, Teletrac Navman, Trimble Transportation, Fleet Complete, Masternaut (a Michelin Group company), Gurtam, Microlise, Chevin Fleet Solutions, Ctrack (Inseego), Quartix, ABAX, Fleetio, Omnitracs contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fleet management technology market in Europe appears promising, driven by ongoing advancements in technology and increasing regulatory pressures. As companies prioritize sustainability, the integration of electric vehicles into fleets is expected to rise, supported by government incentives. Additionally, the growing trend of Mobility-as-a-Service (MaaS) will likely reshape fleet operations, encouraging the adoption of innovative solutions that enhance efficiency and reduce environmental impact, ultimately transforming the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Software Solutions (e.g., Telematics, Route Optimization, Fleet Analytics) Hardware Devices (e.g., GPS Trackers, Sensors, On-board Diagnostics) Service Offerings (e.g., Managed Services, Consulting, Maintenance) |

| By Application | Asset Management Driver Management Safety and Compliance Management Operations Management Fuel Management |

| By End-User Vertical | Transportation & Logistics Construction Public Sector & Municipal Fleets Retail & Distribution Manufacturing |

| By Fleet Size | Small Fleets (1-50 vehicles) Medium Fleets (51-500 vehicles) Large Fleets (500+ vehicles) |

| By Deployment Mode | On-Premises Cloud-Based |

| By Country | Germany United Kingdom France Spain Italy Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 100 | Fleet Managers, Operations Directors |

| Public Transport Fleet Optimization | 80 | Transport Planners, Fleet Supervisors |

| Corporate Fleet Technology Adoption | 60 | IT Managers, Procurement Officers |

| Electric Vehicle Fleet Integration | 50 | Sustainability Managers, Fleet Analysts |

| Telematics and Data Analytics in Fleet | 70 | Data Analysts, Technology Officers |

The Europe Fleet Management Technology Market is valued at approximately USD 8 billion, driven by the need for operational efficiency, cost reduction, and enhanced safety measures in fleet operations, alongside the adoption of advanced technologies like telematics and GPS tracking.