Region:Europe

Author(s):Dev

Product Code:KRAC0458

Pages:80

Published On:August 2025

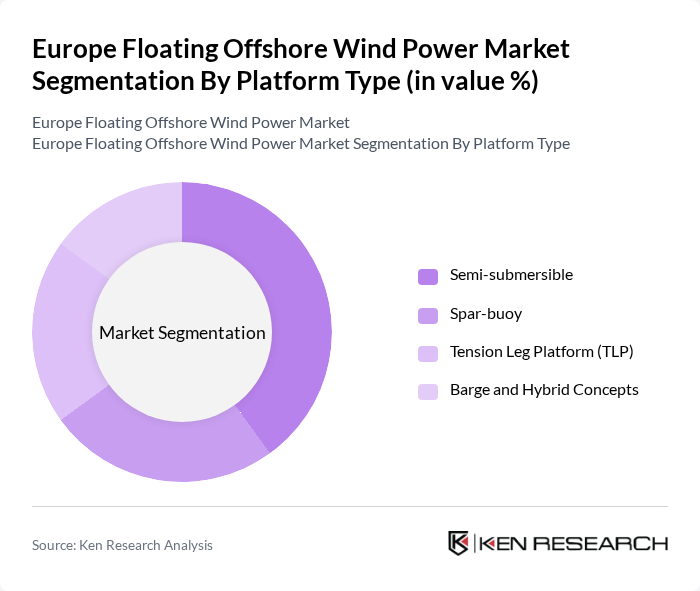

By Platform Type:The platform type segmentation includes various designs that support floating wind turbines. The primary subsegments are Semi-submersible, Spar-buoy, Tension Leg Platform (TLP), and Barge and Hybrid Concepts. Each platform type has unique characteristics that cater to different water depths and environmental conditions, influencing their adoption in various projects. Semi-submersibles and spars are the most commercially proven concepts to date in Europe’s pilots and early arrays, with TLP and barge/hybrid concepts progressing through demonstrations and pre-commercial phases .

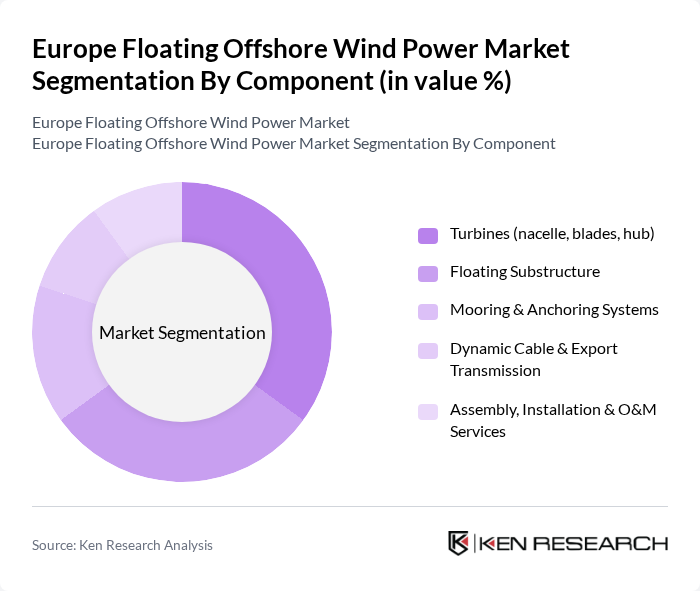

By Component:The component segmentation encompasses the essential parts required for floating offshore wind power systems. This includes Turbines (nacelle, blades, hub), Floating Substructure, Mooring & Anchoring Systems, Dynamic Cable & Export Transmission, and Assembly, Installation & O&M Services. Each component plays a critical role in the overall efficiency and reliability of floating wind farms. European floating wind cost structure is typically led by the floating substructure, turbines, and mooring/cabling, with logistics and assembly strategies (e.g., quayside fabrication and tow-to-port maintenance) key to reducing costs at scale under EU industrial policy initiatives .

The Europe Floating Offshore Wind Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as Equinor ASA, Ocean Winds (EDP Renewables & ENGIE JV), RWE AG, Iberdrola S.A., Ørsted A/S, Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy S.A., GE Vernova, BW Ideol SA, Principle Power, Inc., Aker Solutions ASA, Technip Energies N.V., Hexicon AB, Copenhagen Infrastructure Partners (CIP), TotalEnergies SE contribute to innovation, geographic expansion, and service delivery in this space. The UK and EU auction frameworks and project pipelines position these companies to scale from demonstrators to commercial arrays in deeper waters across the North Sea, Celtic Sea, Atlantic, and Mediterranean basins .

The future of the floating offshore wind power market in Europe appears promising, driven by increasing investments and technological advancements. In future, the market is expected to witness a significant rise in floating wind capacity, with over 20 GW projected to be operational. The integration of energy storage solutions and smart grid technologies will enhance grid stability and efficiency, while partnerships with local governments will facilitate smoother project execution, ensuring a sustainable energy transition across the region.

| Segment | Sub-Segments |

|---|---|

| By Platform Type | Semi-submersible Spar-buoy Tension Leg Platform (TLP) Barge and Hybrid Concepts |

| By Component | Turbines (nacelle, blades, hub) Floating Substructure Mooring & Anchoring Systems Dynamic Cable & Export Transmission Assembly, Installation & O&M Services |

| By Water Depth | Transitional (30–60 m) Deepwater (60–200 m) Ultra-deepwater (>200 m) |

| By Project Phase | Demonstration & Pilot Pre-commercial Commercial-scale |

| By Power Rating | ?5 MW >5–10 MW >10–15 MW >15 MW |

| By Offtake Mechanism | Contracts for Difference (CfD) / Two-way CfD Corporate PPAs Merchant/Spot with Hedges |

| By Application | Grid-connected Power Offshore Oil & Gas Powering/Platform Electrification Hybrid Systems (wind-to-hydrogen, wind+storage) |

| By Sea Basin | North Sea Atlantic (Iberian, Celtic, Bay of Biscay) Mediterranean Baltic & Norwegian Sea Others (Azores/Madeira/Canary pilot zones) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Floating Wind Project Developers | 120 | Project Managers, Technical Directors |

| Regulatory Bodies and Policy Makers | 70 | Government Officials, Energy Policy Analysts |

| Environmental Consultants | 50 | Environmental Impact Assessors, Sustainability Experts |

| Technology Providers for Floating Wind | 80 | Product Managers, R&D Engineers |

| Investors in Renewable Energy Projects | 60 | Investment Analysts, Fund Managers |

The Europe Floating Offshore Wind Power Market is valued at approximately USD 5 billion, reflecting a robust historical analysis and aligning with global assessments of the floating wind sector, highlighting Europe's leadership in deployment and project pipelines.