Region:Europe

Author(s):Shubham

Product Code:KRAC0771

Pages:83

Published On:August 2025

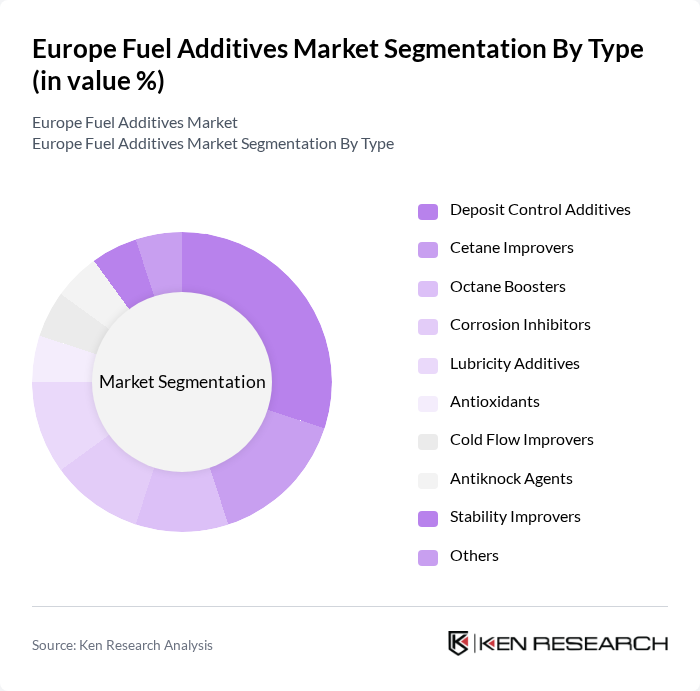

By Type:

The fuel additives market is segmented into Deposit Control Additives, Cetane Improvers, Octane Boosters, Corrosion Inhibitors, Lubricity Additives, Antioxidants, Cold Flow Improvers, Antiknock Agents, Stability Improvers, and Others. Among these, Deposit Control Additives lead the market due to their critical role in maintaining engine cleanliness and performance. The increasing focus on fuel efficiency and engine longevity drives demand for these additives, as they help prevent deposit formation in fuel injectors and combustion chambers .

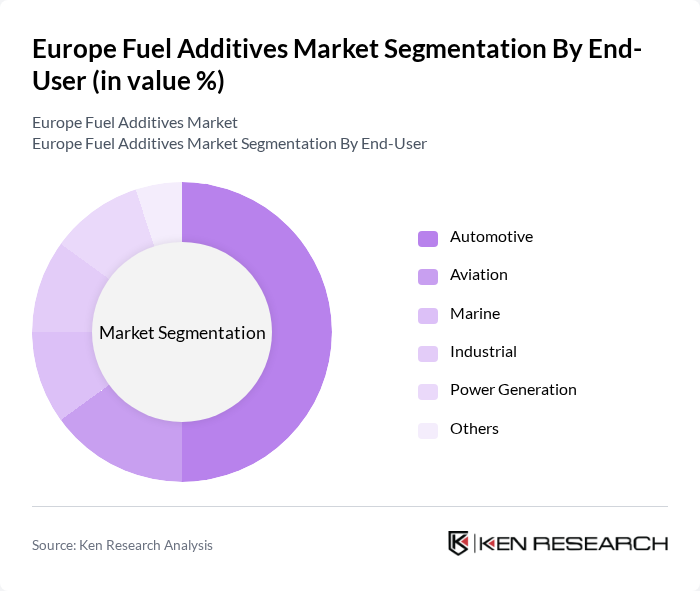

By End-User:

The end-user segmentation includes Automotive, Aviation, Marine, Industrial, Power Generation, and Others. The Automotive sector dominates the market, driven by the increasing number of vehicles and the demand for high-performance fuels. The growing emphasis on fuel efficiency and emissions reduction in the automotive industry propels the use of fuel additives, making it the leading end-user segment .

The Europe Fuel Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Chevron Oronite Company LLC, Evonik Industries AG, Afton Chemical Corporation, Innospec Inc., TotalEnergies SE, Clariant AG, Shell Global Solutions International B.V., LyondellBasell Industries N.V., Huntsman Corporation, Croda International Plc, Kraton Corporation, Solvay S.A., Eastman Chemical Company, Perstorp Holding AB, The Lubrizol Corporation, LANXESS AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe fuel additives market is poised for transformation, driven by a growing emphasis on sustainability and innovation. As environmental regulations tighten, manufacturers will increasingly focus on developing eco-friendly additives that meet stringent standards. Additionally, advancements in technology will facilitate the creation of more efficient fuel formulations, enhancing performance while reducing emissions. The market is expected to witness a shift towards bio-based additives, reflecting consumer preferences for greener alternatives and aligning with broader sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Deposit Control Additives Cetane Improvers Octane Boosters Corrosion Inhibitors Lubricity Additives Antioxidants Cold Flow Improvers Antiknock Agents Stability Improvers Others |

| By End-User | Automotive Aviation Marine Industrial Power Generation Others |

| By Application | Gasoline Diesel Jet Fuel / Aviation Turbine Fuel Biodiesel & Biofuel Blends Heating Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | Germany United Kingdom France Italy Spain Russia Rest of Europe |

| By Price Range | Economy Mid-Range Premium |

| By Regulatory Compliance | EU Standards National Standards Industry Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Fuel Additives | 120 | Product Managers, R&D Directors |

| Aviation Fuel Additives | 60 | Operations Managers, Compliance Officers |

| Marine Fuel Additives | 40 | Procurement Managers, Technical Directors |

| Regulatory Compliance in Fuel Additives | 50 | Regulatory Affairs Specialists, Legal Advisors |

| Emerging Technologies in Fuel Additives | 45 | Innovation Managers, Sustainability Officers |

The Europe Fuel Additives Market is currently valued at approximately USD 2.2 billion. This valuation reflects the growing demand for high-performance fuels and the impact of stringent environmental regulations across the region.