Region:Europe

Author(s):Dev

Product Code:KRAD0424

Pages:91

Published On:August 2025

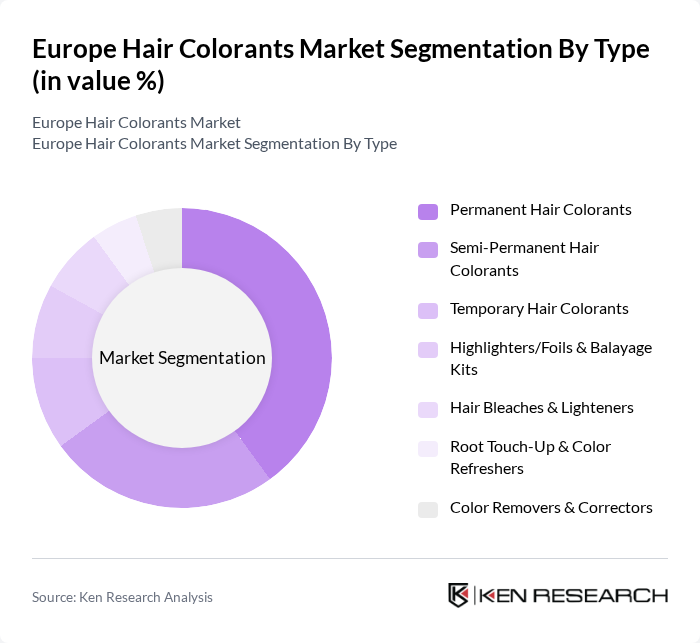

By Type:The hair colorants market is segmented into various types, including Permanent Hair Colorants, Semi-Permanent Hair Colorants, Temporary Hair Colorants, Highlighters/Foils & Balayage Kits, Hair Bleaches & Lighteners, Root Touch-Up & Color Refreshers, and Color Removers & Correctors. Among these, Permanent Hair Colorants dominate the market due to their long-lasting effects and the growing trend of consumers seeking more durable solutions for hair coloring. The increasing preference for vibrant and bold colors and innovations such as ammonia-free and fade-resistant formulas have contributed to the rise in demand for high-quality permanent colorants.

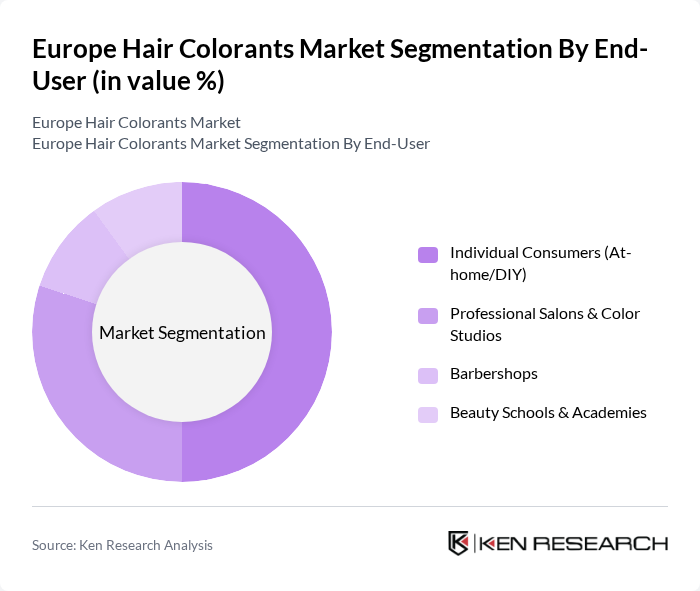

By End-User:The market is segmented by end-users, including Individual Consumers (At-home/DIY), Professional Salons & Color Studios, Barbershops, and Beauty Schools & Academies. The Individual Consumers segment is the leading end-user category, driven by the increasing trend of DIY hair coloring among consumers seeking convenience and cost-effectiveness, supported by broad availability in supermarkets/hypermarkets and e-commerce. Social media and influencer-led tutorials further encourage at-home experimentation, while professional salons remain significant for advanced services and premium formulations.

The Europe Hair Colorants Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal S.A. (L'Oréal Paris, Garnier, Matrix, Redken), Wella Company (Wella Professionals, Koleston Perfect, Clairol), Henkel AG & Co. KGaA (Schwarzkopf Professional, got2b, Palette), Coty Inc. (Clairol, Nice'n Easy; legacy brands), Revlon, Inc. (Revlon Colorsilk), Kao Corporation (Goldwell, John Frieda), Unilever PLC (TRESemmé, TIGI/Bed Head color lines), Estée Lauder Companies Inc. (Aveda), Shiseido Company, Limited (Japan; selective salon presence in EU), Davines S.p.A., Eugène Perma France, Alfaparf Milano, Laboratorios Phergal S.A. (Naturtint), Crazy Color Ltd. (Renbow), Umberto Giannini Hair Cosmetics Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe hair colorants market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for sustainable and innovative products continues to rise, brands are likely to invest in eco-friendly formulations and personalized solutions. Additionally, the increasing penetration of e-commerce will facilitate greater access to diverse product offerings, enhancing consumer choice. Companies that adapt to these trends and focus on quality and sustainability are expected to thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Permanent Hair Colorants Semi-Permanent Hair Colorants Temporary Hair Colorants Highlighters/Foils & Balayage Kits Hair Bleaches & Lighteners Root Touch-Up & Color Refreshers Color Removers & Correctors |

| By End-User | Individual Consumers (At-home/DIY) Professional Salons & Color Studios Barbershops Beauty Schools & Academies |

| By Distribution Channel | Supermarkets/Hypermarkets Specialist Retailers/Beauty Stores Drugstores/Pharmacies Online Retail/E-commerce Professional Salon Supply/Distributors |

| By Price Range | Premium/Professional Mid-range/Masstige Economy/Value |

| By Brand Type | Global Established Brands Indie/Emerging Brands Private Labels/Retailer Brands |

| By Formulation | Oxidative (Ammonia/MEA-Based) Ammonia-Free Plant-Based/Herbal Vegan & Cruelty-Free PPD/PTD-Free & Hypoallergenic |

| By Geography | United Kingdom Germany France Italy Spain Russia Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Hair Colorants | 150 | End Consumers, Beauty Enthusiasts |

| Professional Insights from Salons | 120 | Salon Owners, Hair Stylists |

| Retail Distribution Channels | 90 | Retail Managers, Category Buyers |

| Market Trends and Innovations | 70 | Product Development Experts, Marketing Managers |

| Regulatory Impact on Hair Colorants | 60 | Regulatory Affairs Specialists, Compliance Officers |

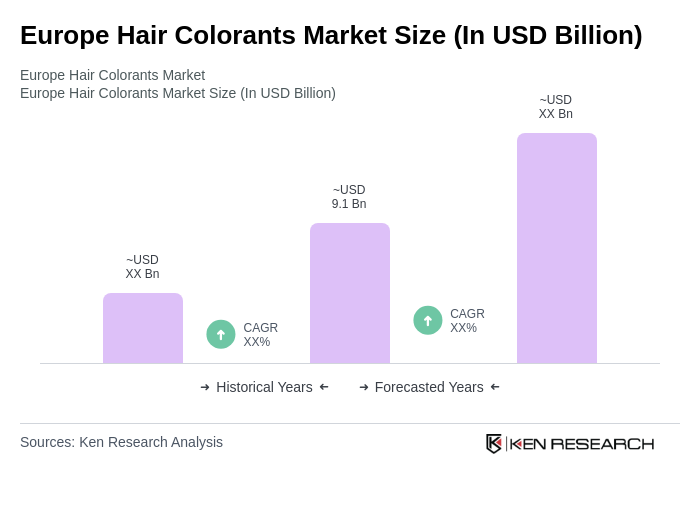

The Europe Hair Colorants Market is valued at approximately USD 9.1 billion, reflecting a significant growth driven by consumer demand for diverse hair color products, including innovative formulations that prioritize safety and sustainability.