Region:Europe

Author(s):Geetanshi

Product Code:KRAA1217

Pages:83

Published On:August 2025

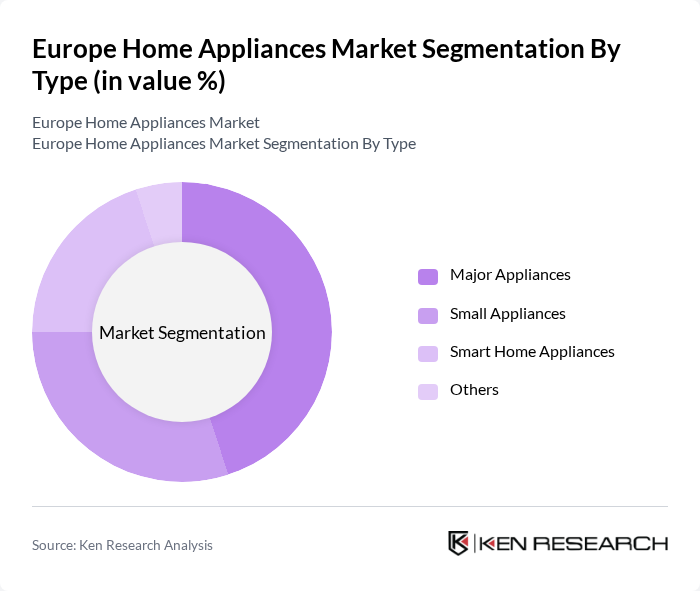

By Type:

The market is segmented into Major Appliances, Small Appliances, Smart Home Appliances, and Others. Major Appliances, including refrigerators, washing machines, and ovens, dominate the market due to their essential role in daily household activities. The increasing adoption of smart home technology has also led to a rise in demand for Smart Home Appliances, which are gaining traction among tech-savvy consumers. Small Appliances, such as vacuum cleaners and coffee makers, are popular for their convenience and efficiency, contributing significantly to market growth .

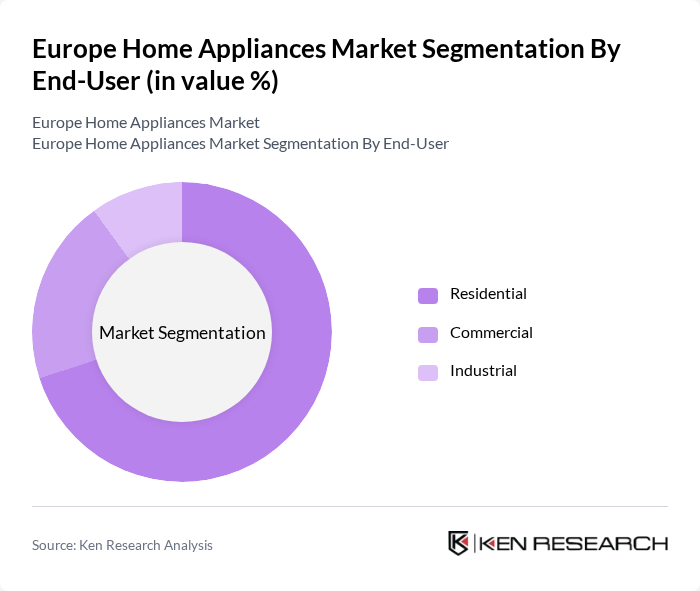

By End-User:

The market is segmented into Residential, Commercial, and Industrial end-users. The Residential segment holds the largest share, driven by the growing number of households and the increasing trend of home renovations. Commercial users, including hotels and restaurants, are also significant consumers of home appliances, particularly in the kitchen segment. The Industrial segment, while smaller, is essential for specialized applications such as laundry services and food processing, contributing to overall market dynamics .

The Europe Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bosch (BSH Hausgeräte GmbH), Siemens (BSH Hausgeräte GmbH), Whirlpool Corporation, Electrolux AB, LG Electronics Inc., Samsung Electronics Co., Ltd., Miele & Cie. KG, Panasonic Corporation, Haier Group Corporation, Beko (Arçelik A.?.), Gorenje (Hisense Europe), AEG (Electrolux Group), Sharp Corporation, Frigidaire (Electrolux Group), Arçelik A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European home appliances market appears promising, driven by technological advancements and a growing emphasis on sustainability. As consumers increasingly prioritize energy efficiency and smart technology, manufacturers are expected to innovate continuously. The market is likely to see a rise in eco-friendly products and connected appliances, aligning with regulatory frameworks aimed at reducing carbon footprints. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility, enhancing consumer engagement and driving sales growth across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Major Appliances (Refrigerators, Freezers, Washing Machines, Dishwashers, Ovens, Cooktops, Heating & Cooling Appliances) Small Appliances (Vacuum Cleaners, Food Processors, Coffee Makers, Air Fryers, Irons, Toasters, Grills, Hair Dryers, Water Purifiers) Smart Home Appliances (IoT-enabled Devices, AI-powered Appliances) Others |

| By End-User | Residential Commercial (Hotels, Restaurants, Offices) Industrial (Laundry Services, Food Processing) |

| By Distribution Channel | Multi-Branded Stores Exclusive Brand Stores Online Retail Wholesale |

| By Price Range | Budget Appliances Mid-Range Appliances Premium Appliances |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers |

| By Product Features | Smart Features Energy Efficiency Ratings Design and Aesthetics |

| By Region | Western Europe (UK, France, Germany, Netherlands, Switzerland) Eastern Europe (Poland, Czech Republic, Hungary, Russia) Northern Europe (Sweden, Denmark, Finland, Norway) Southern Europe (Italy, Spain, Portugal, Greece, Turkey) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refrigerator Market Insights | 60 | Product Managers, Retail Buyers |

| Washing Machine Consumer Preferences | 50 | Home Appliance Users, Market Analysts |

| Oven Purchase Decision Factors | 40 | Kitchen Designers, Homeowners |

| Energy Efficiency Trends in Appliances | 45 | Sustainability Experts, Regulatory Officials |

| Smart Appliance Adoption Rates | 42 | Tech Enthusiasts, Early Adopters |

The Europe Home Appliances Market is valued at approximately USD 221 billion, reflecting a significant growth trend driven by consumer demand for energy-efficient and smart appliances, as well as rising disposable incomes and urbanization across the region.